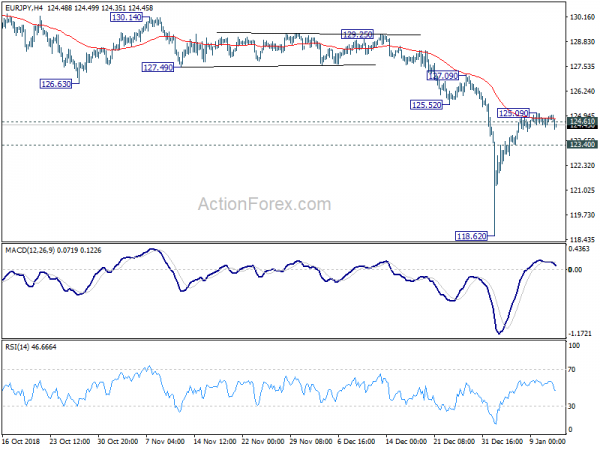

EUR/JPY edged higher to 125.09 last week but failed to sustain above 124.61 resistance, as well as 4 hour 55 EMA. With 4 hour MACD staying below signal line, initial bias remains neutral this week first. We’d still expect upside to be limited around 124.61 resistance to complete the rebound from 118.62. On the downside, break of 123.40 minor support will turn bias back to the downside for retesting 118.62 low first. However, sustained break of 124.61 will extend the rebound to 127.09 resistance next.

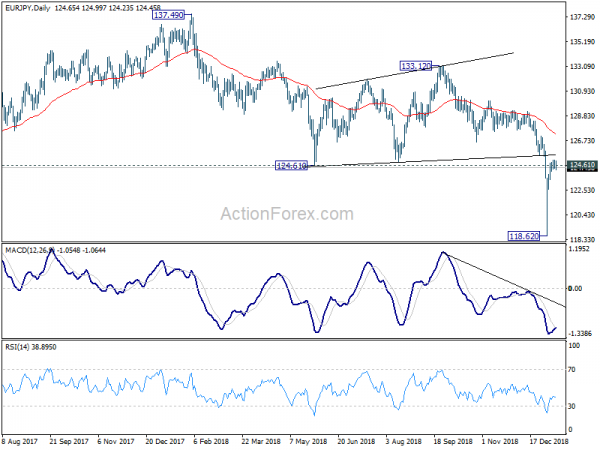

In the bigger picture, medium term rebound from 109.03 (2016 low) has completed at 137.49 already, with corrective structure. Fall from 137.39 is seen as a medium term fall, resuming the decline from 149.76 (2014 high). Such decline should break through 109.03 low next. This will remain the preferred case as long as 124.61 support turned resistance holds. Sustained break of 124.61 will mix up the outlook and we’ll reassess on the final structure of the rebound from 118.62.

In the long term picture, EUR/JPY is staying in long term sideway pattern, established since 2000. Fall from 137.49 is seen as a falling leg inside the pattern. It could extend through 109.03 to resume the decline from 149.76 But in that case, we’d expect strong support around 94.11 (2012 low) to bring reversal.