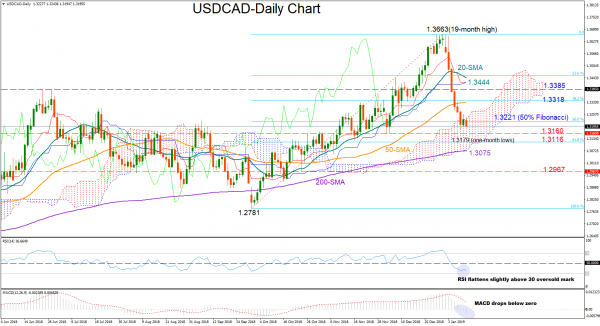

USDCAD erased half of its October-December rally, dropping to a one-month low of 1.3179 on Wednesday before turning neutral.

According to the RSI the pair is not far away from oversold territory at the moment, as the indicator lies slightly above 30, a sign that a rebound could possibly emerge in the short term. Yet, with the MACD entering the negative zone and the blue Kijun-sen line set to cross above the red Tenkan-sen, any gains could appear limited. The bearish shift in the 20-day simple moving average (MA) also provides some negative signals.

Should the bears distance the price further below the 50% Fibonacci of the upleg from 1.2781 to 1.3631, immediate support could be found between the 1.3160 barrier and the 61.8% Fibonacci of 1.3116. Under that region, a stronger sell-off could take place probably towards 1.2967 but only if the price successfully clears out the 200-day MA currently at 1.3075.

In the alterative scenario, in case the price jumps back above the 50% Fibonacci of 1.3221, investors would be interested to see whether bullish pressure is enough to overcome the 50-day MA and the 38.2% Fibonacci at 1.3318. Slightly higher, July’s peak of 1.3385 could be next in target, while if more gains come into the market, buyers would be eagerly waiting for a break above the 20-day MA at 1.3444.

Turning to the three-month period picture, the bullish outlook has somewhat faded after the market’s recent freefall. Yet, as long as the 50-day MA holds above the 200-day MA, the risk is positive.