The price of crude oil gained sharply in overnight trading as Saudi Arabia announced plans to reduce supplies. This is in line with the statement released in December after the meeting of OPEC member countries in Austria. Saudi wants the price of crude to be about $80. Another minor issue bullish for crude oil is the political instability in Gabon, which is OPEC’s smallest member. This week, a group of armed officers attempted a coup, which failed. Investors are also bullish on crude because of the ongoing negotiations between the United States and China. Another reason is that the US stocks declined by more than 6.2 million barrels in the past week.

Yesterday, optimism for a China-US trade deal fueled a stock rally that saw the Dow gain more than 250 points. This was a continuation of a rally that started last week. Meanwhile, in Asia, stocks rose sharply with the Shanghai, Nikkei, and Hang Seng gaining by 40, 250, and 650 points respectively. In Australia and New Zealand, the main indices rose by 50 and 4 points respectively while US and European futures point to a higher open. Bloomberg reported that Trump was hopeful that a deal will be reached so that it can boost the stock prices.

The biggest economic news today will be the Bank of Canada’s monetary policy meeting. This will be the first major monetary policy decision this year. The bank is expected to leave interest rates unchanged at 1.75%. Still, traders will want to hear what the bank plans this year. This comes as the Canadian dollar continues to strengthen against the USD. Other big news expected today will be the Fed’s minutes, which will give traders insights about the bank’s thinking.

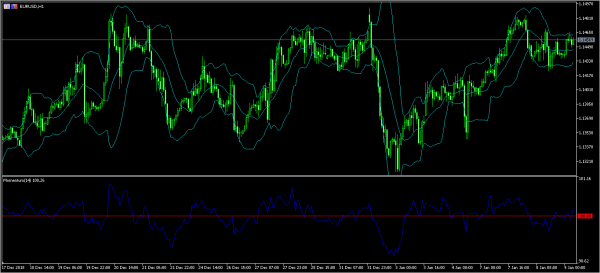

EUR/USD

The EUR/USD is in consolidation mode as traders wait for the Fed minutes and the inflation numbers from the US. The pair is trading at 1.1455, which is higher than the year’s low of 1.1307 but lower than the weekly high of 1.1485. On the hourly chart, the price is close to the upper line of the Bollinger Bands while the momentum indicator is above the 100 level. A breakout for the pair could happen in either direction today.

XBR/USD

This year, crude oil has been an excellent performer, with Brent price rising from $50 to almost $60. On the hourly chart, the price of crude oil is above the 21-day and 42-day EMA while the Parabolic SAR points to more increases. The RSI, continues to remain below the overbought level of 70 as the MACD continues to rise. There is a likelihood that the price will continue moving up as the market sentiment remains bullish.

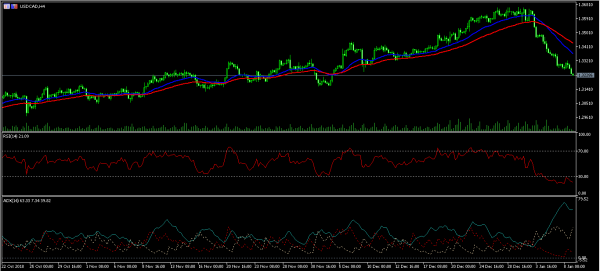

USD/CAD

The USD/CAD has been declining as the Canadian dollar continues its strength. The USD/CAD pair is now trading along the 1.3228 level, which is below the major moving averages as shown below. The RSI remains below the oversold level of 30 while the average directional index increased sharply. With no major support in sight, the pair will likely continue falling though this could change depending on the statement by BOC.