Canadian and US Dollar are the strongest ones in a rather quiet day. WTI crude oil stays firm above 49 but there is no buying to push it through 50 handle yet. But that’s enough to keep the Loonie buoyed ahead of BoC rate decision tomorrow. Dollar is supported by rebound in treasury yields as 10-year yield is now back above 2.7 handle. On the other hand, New Zealand Dollar and Euro are the weakest ones for today.

US-China trade negotiations are extending into overnight in Beijing today. Markets will be eager to hear some positive comments as the meeting completes. Meanwhile, eyes will also be on Trump’s planned speech regarding border wall and government shutdown. But that will come late at around 9pm EST.

In other markets, DOW futures are pointing to another day of higher open. In Europe, FTSE is currently up 1.04%, DAX is up 1.24%, CAC is up 1.62%. German 10 year yield is up 0.0141 at 0.238. Earlier in Asia, Nikkei gained 0.82%, Hong Kong HSI rose 0.1%, Singapore Strait Times rose 0.65%. But China Shanghai SSE dropped -0.26%. Japan 10-year JGB yield attempted to turn positive but closed at -0.003, up 0.0115.

UK confirmed arranging Brexit parliament vote on Jan 15, subject to approval

UK Prime Minister Theresa May’s spokesman James Slack confirmed today that a vote is scheduled in the parliament on Tuesday, January 15 on the Brexit agreement. He told reporter that “Subject to parliament approving a business motion, the debate will be opened tomorrow … The prime minister said that she would close the debate next Tuesday, which is January 15, when the vote will take place,”

Also he added that May is not trying to delay Brexit by extending Article 50 withdrawal notice. And, the idea may have been discussed by EU officials but not by British officials.

UK Barclay denied discussing Article 50 extension on Brexit

UK Brexit Minister Stephen Barclay denied the Daily Telegraph report that they’re discussing the possibility of withdrawal request with EU. He told BBC radio that “I’ve had no discussions with the European Union in terms of extension.”

When he’s explicitly asked if he could deny the report, Barclay said “Yes, because I can be very clear that the government’s policy is to leave on March 29, the prime minister has made that clear on numerous occasions to parliament.”

Separately, Irish Prime Minister Leo Varadkar pledged to try to give UK the reassurances needed for getting the Brexit agreement through the parliament. Varadkar said “We don’t want to trap the UK into anything – we want to get on to the talks about the future relationship right away,” And, “I think it’s those kind of assurances we are happy to give.”

Eurozone economic sentiment dropped, weakened in all five largest economies

Eurozone economic confidence (ESI) dropped “markedly” by 2.2 to 107.3 in December, below expectation of 108.9. Eurostats noted that “the deterioration of euro-area sentiment resulted from lower confidence in industry, services, construction and among consumers, while confidence improved slightly in retail trade.”

Also, the ESI weakened in all five largest economies, including Spain (−3.0), France (−2.0), Germany (−1.9) and Italy (−1.4) and, marginally so, in the Netherlands (−0.3).

Industrial confidence dropped to 1.1, down from 3.4 and missed expectation of 3.1. Services confidence dropped to 12.0, down from 13.4, and missed expectation of 12.3. Consumer confidence was finalized at -6.2.

Eurozone business climate dropped to 0.82, down from1.09 and missed expectation of 0.99.

Elsewhere, German industrial production dropped -1.9% mom in November versus expectation of 0.3% rise. Swiss unemployment rate was unchanged at 2.4% in December. Japan consumer confidence dropped -0.2 to 42.7 in December. Australia trade surplus narrowed slightly to AUD 1.93B in November, and missed expectation of AUD 2.18B.

GBP/USD Mid-Day Outlook

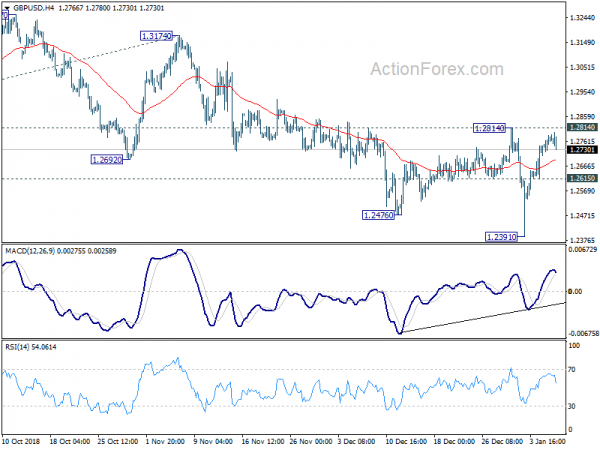

Daily Pivots: (S1) 1.2726; (P) 1.2756; (R1) 1.2806; More….

Intraday bias in GBP/USD is turned neutral as it retreats notably after failing to take out 1.2814 resistance. Near term outlook stays bearish for now. On the downside, below 1.2615 minor support will turn bias to the downside for retesting 1.2391 first. Break will extend the down trend from 1.4376 and target 61.8% projection of 1.4376 to 1.2661 from 1.3174 at 1.2114 next. However, firm break of 1.2814 resistance will be an early sign of trend reversal and bring stronger rebound back to 1.3174 resistance next.

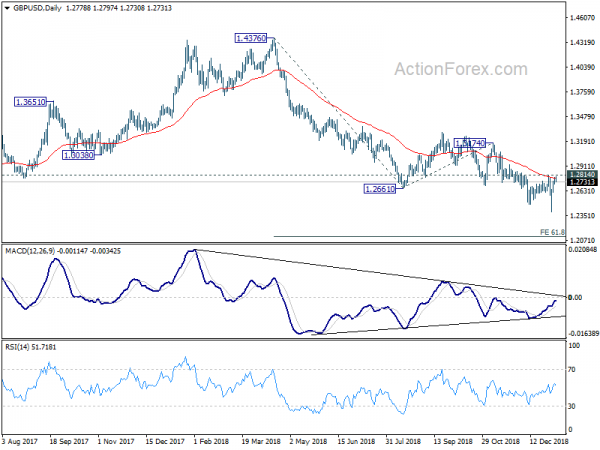

In the bigger picture, whole medium term rebound from 1.1946 (2016 low) should have completed at 1.4376 already, after rejection from 55 month EMA. The structure and momentum of the fall from 1.4376 argues that it’s resuming long term down trend from 2.1161 (2007 high). And this will now remain the preferred case as long as 1.3174 structural resistance holds. GBP/USD should target a test on 1.1946 first. Decisive break there will confirm our bearish view.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:30 | AUD | Trade Balance (AUD) Nov | 1.93B | 2.18B | 2.32B | 2.01B |

| 05:00 | JPY | Consumer Confidence Dec | 42.7 | 42.8 | 42.9 | |

| 06:45 | CHF | Unemployment Rate Dec | 2.40% | 2.40% | 2.40% | |

| 07:00 | EUR | German Industrial Production M/M Nov | -1.90% | 0.30% | -0.50% | |

| 10:00 | EUR | Eurozone Business Climate Indicator Dec | 0.82 | 0.99 | 1.09 | |

| 10:00 | EUR | Eurozone Economic Confidence Dec | 107.3 | 108.9 | 109.5 | |

| 10:00 | EUR | Eurozone Industrial Confidence Dec | 1.1 | 3.1 | 3.4 | |

| 10:00 | EUR | Eurozone Services Confidence Dec | 12 | 12.3 | 13.3 | 13.4 |

| 10:00 | EUR | Eurozone Consumer Confidence Dec F | -6.2 | -6.2 | -6.2 | |

| 11:00 | USD | NFIB Small Business Optimism Dec | 104.4 | 103.6 | 104.8 | |

| 13:30 | CAD | International Merchandise Trade (CAD) Nov | -2.1B | -1.9B | -1.2B | -0.9B |