Riding on the strong rally in the US on Friday, Asian opened the week generally higher. While major Asian indices maintain gains, there is no follow through buying seen. There seems to be enough risks to keep investors’ hands tied, including the result of the vice ministerial level US-China trade negotiations, which starts in Beijing this week. On the other side of the planet, parliamentary debate on Brexit agreement will resume this week and there is no sign of breakthrough yet. And across the Atlantic, partial US government shutdown is in its third week, with no end in sight.

In the currency markets, Yen is trading as the strongest one for today but gain is limited. Euro and Australian Dollar follow as second and third strongest. Dollar is the weakest one, under broad based pressure. Fed Chair Jerome Powell said Fed will be patient to see how the economy evolves. More important, Powell said Fed is “always prepared to shift the stance of policy”. Fed funds futures are pricing in nearly no chance of a rate hike in first half of 2019, and around 25% of a rate cut by December. Canadian Dollar and Sterling follow as second and third weakest.

In Asia, Nikkei is currently up 2.73% and Singapore Strait Times is up 1.27%. But Hong Kong HSI is up 0.67% only. China Shanghai SSE is up 0.44%. Japan 10 year JGB year stays negative at -0.011.

Trump threatens radical move over border wall, but offers concession too

The partial US government shutdown is now in its third week without any resolution in sight. Trump repeated his threat of a radical move to get funding for his border wall, but at the same time offered concession over the weekend. He warned on Sunday “I may declare a national emergency dependent on what’s going to happen over the next few days.” He also added, “The barrier, or the wall, can be of steel instead of concrete, if that helps people. It may be better.”

Later Trump also tweeted that Vice President Mike Pence had a “productive meeting with the Schumer/Pelosi representatives”. And, .”We are now planning a Steel Barrier rather than concrete. It is both stronger & less obtrusive.”

But so far, the Democrats showed little interest in the “concession.”

UK PM May repeated her warnings over no-deal Brexit

UK Prime Minister Theresa May repeated her warning that voting down her Brexit agreement in the parliament will put the UK into “uncharted territory”. And she added, “I don’t think anybody can say exactly what will happen in terms of the reaction that we’ll see in Parliament.”

She also reiterated that the Irish backstop “is not intended to be used in the first place, and if it is, it’s only temporary”. And, “ensuring that we actually get the future relationship in place to replace the backstop if it’s used is actually a crucial element of this.”

May also reiterated her opposition to a second referendum as that would “divide our country” and require a delay to Brexit.

Separately, a cross party group of Conservative and Labour MPs are seeking to amend the government’s Finance Bill to ensure the “no deal” provisions in it can only be implemented if Parliament votes to allow it.

Debate on the Brexit agreement will resume this Wednesday, with the vote due in the week beginning January 14.

IMF Lipton: World is not well prepared to deal with recession

IMF first deputy managing director David Lipton warned that “the next recession is somewhere over the horizon, and we are less prepared to deal with that than we should be”, and “less prepared than in the last” crisis in 2008.

And he urged that “given this, countries should be paying attention to keeping their economy on a level trajectory, building buffers and not fighting with each other.”

Lipton also noted that “China is clearly slowing down — we think China’s growth has to slow, but keeping it from slowing in a dangerous way is an important objective.”

Looking ahead

BoC rate decision will be the main event among central bank activities this week. For now, its seems most analysts lean towards the case of holding rate unchanged at 1.75%. But this is not a total consensus. There could be some surprises in rate decision, the statement and new economic projections. FOMC and ECB meeting accounts, however, will likely provide little news to the markets.

On the data front, main focuses will be on US ISM services and CPI, UK GDP and productions, Australia retail sales and trade balance.

Here are some highlights for the week:

- Monday: German factory orders; Swiss foreign currency reserves; Eurozone Sentix investor confidence, retail sales; Canada Ivey PMI; US ISM services

- Tuesday: Australia trade balance; Japan consumer confidence; Germany industrial production; Swiss retail sales; Canada trade balance; US trade balance

- Wednesday: Japan average cash earnings; Australia building approvals; Germany trade balance; Swiss CPI; Eurozone unemployment rate; FOMC minutes; BoC rate decision

- Thursday: China CPI and PPI; Japan leading indicators; ECB meeting accounts; Canada building permits, new housing price index; US jobless claims

- Friday: New Zealand building permits; Japan household spending, current account; Australia retails sales; UK GDP, trade balance, productions; US CPI

USD/JPY Daily Outlook

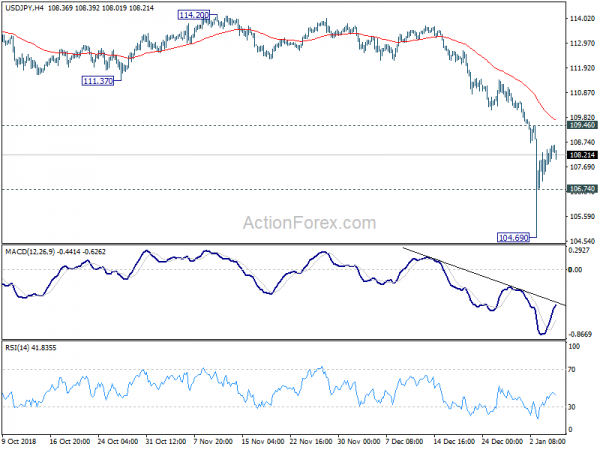

Daily Pivots: (S1) 107.82; (P) 108.21; (R1) 108.90; More..

USD/JPY retreats mildly today but intraday bias stays on the upside. Rebound from 104.69 might extend higher. But upside will likely be limited by 109.46 minor resistance. On the downside, below 106.74 minor support will turn bias to the downside for 104.62 low. Overall, larger downtrend from 118.65 (2016 high) is expected to resume finally through 104.62 after current consolidation from 104.69 completes.

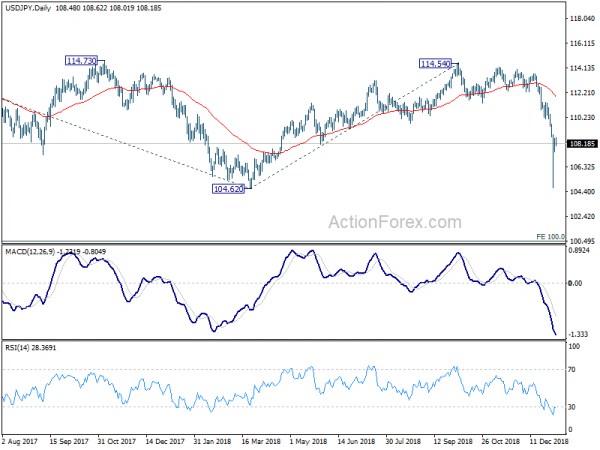

In the bigger picture, price actions from 125.85 (2015 high) are seen as a long term corrective pattern, no change in this view. Apparently, such corrective pattern is not completed yet. Fall from 114.54 is seen as part of the falling leg from 118.65 (2016 high). Break of 104.62 will target 100% projection of 118.65 to 104.62 from 114.54 at 100.51, which is close to 100 psychological level. But in that case, we’d expect strong support from 98.97 to contain downside to bring reversal. Also, this bearish case will remain the preferred one as long as 114.54 resistance holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:30 | AUD | AiG Performance of Manufacturing Index Dec | 49.5 | 51.3 | ||

| 23:50 | JPY | Monetary Base Y/Y Dec | 4.80% | 5.80% | 6.10% | |

| 7:00 | EUR | German Factory Orders M/M Nov | -0.20% | 0.30% | ||

| 8:00 | CHF | Foreign Currency Reserves (CHF) Dec | 749B | |||

| 9:30 | EUR | Eurozone Sentix Investor Confidence Jan | -2 | -0.3 | ||

| 10:00 | EUR | Eurozone Retail Sales M/M Nov | 0.20% | 0.30% | ||

| 15:00 | CAD | Ivey PMI Dec | 58.1 | 57.2 | ||

| 15:00 | USD | ISM Non-Manufacturing/Services Composite Dec | 59.4 | 60.7 |