After a year that saw the S&P 500’s bull run become the longest in history and then abruptly end, giving way to a steep correction, investors are increasingly nervous that 2019 may be an even more challenging period as the US economic cycle appears to be nearing its final stages. Global central banks are withdrawing stimulus at a time when growth is moderating to more normal levels and geopolitical risks linger. Hence, volatility is set to remain elevated, and while stock markets may still be able to eke out some late-cycle gains, caution among participants is definitely on the rise.

Slowdown looming

Although very few pundits are calling for an outright recession in 2019, almost everyone agrees that some ‘cracks’ are starting to show in the global economy, and growth will most likely slow to a more normal pace going forward. In the US, such softness is evident in the housing market, which due to its sensitivity to interest rate hikes vis-a-vis rising mortgage rates is typically considered the “canary in the coal mine”, in the sense that it leads the broader economy in weakening. Europe may be in a more critical stage as growth is already bleeding momentum, while Japan’s economy contracted in the most recently-reported quarter. Likewise, China signalled it will ease both monetary and fiscal policy further in the coming months amid decelerating growth.

Global indices suffer heavy losses

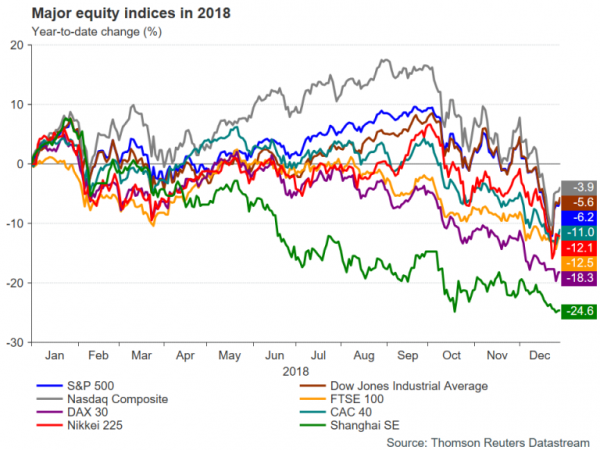

The bleaker outlook for global growth cannot be good news for share prices as it can only translate to a drop in corporate earnings growth. After an outstanding year for corporate America that saw a record number of companies in the S&P 500 index beating their earnings forecasts, the 9-year bull market may be coming to an end, with the benchmark now officially in correction territory, having fallen more than 10% from its record high. The Dow Jones and the Nasdaq Composite are also more than 10% below their all-time highs, with the tech-heavy Nasdaq being the closest to entering a bear market (losses exceed 20%) as it has fallen almost 18% from its record level scaled in October.

For the year as a whole though, the three main indices were down only moderately, falling between 4% and 6%, and losses in other parts of the world were more pronounced, particularly in China. A slowing Chinese economy, brought about by deleveraging reforms and worsened by the trade war with the US, dragged the Shanghai Composite and the CSI 300 indices down by around 25% in 2018. Japan’s Nikkei 225 index lost about 12% as exports struggled amid global trade tensions, while major European bourses were down by between 11% and 18% on disappointing economic performance and political uncertainty.

Early tests for traders at start of 2019

As 2019 gets underway, there is little for investors to get excited about as the risks for equities are seemingly to the downside. The US economy is losing steam as the effects of the 2018 fiscal stimulus fade, China is slowing faster than anticipated as higher US tariffs start to bite, the odds of a disorderly Brexit remain uncomfortably high less than three months before the UK departs from the EU, and a pick up in Eurozone growth is still looking elusive.

The first big test for the markets could come as early as mid-January when the UK Parliament will get to vote on Theresa May’s hugely unpopular Brexit deal. Mrs. May needs to secure further assurances by EU leaders that the UK would not get trapped inside the customs union should the Irish backstop ever be initiated in order to stand a good chance of winning the vote. If lawmakers vote down the deal, hopes for a smooth Brexit would dissipate and market turmoil could ensue.

The next danger for investors will be the March 1 deadline for the US and China to make meaningful progress in the negotiations for a new trade accord. Failure for the two sides to reach some sort of a preliminary agreement could trigger a new wave of stocks sell-off.

US stocks cheaper, but cheap enough?

However, while new headwinds and negative developments would almost certainly lead to global equities extending their losses into 2019, the rout is unlikely to be as deep as the worst-case predictions and a recovery could come far more quickly than what analysts would expect.

The main reason for that is that stock valuations are already looking much more attractive than they did only a couple of months ago. The S&P 500 is currently trading at 14.3 times its one-year forward earnings. That’s below its one-year historical level of 17.75 and less than the 5-year average of 15.7. The Dow Jones and the Nasdaq Composite are also trading below their 12-month historical price/earnings ratios.

It’s worth pointing out though that those valuations would start to look not so cheap if the outlook for corporate earnings started to deteriorate beyond what has been priced into the markets and stocks would need to fall further to remain attractive.

Will Fed come to the rescue?

Another factor that could limit the downside scope for stocks is if the Federal Reserve steps in to counter a steep downturn with rate cuts. The Fed has so far not appeared overly concerned by the growing market pessimism and turmoil and plans to raise rates two more times in 2019. Markets are not convinced by the Fed’s hawkishness and do not think the US central bank will be able to hike at all this year. Should policymakers signal an end to the rate hike cycle and message their willingness to respond to the tightening financial conditions by possibly cutting rates, stocks would receive a major boost and could be set for a sustained upside reversal.

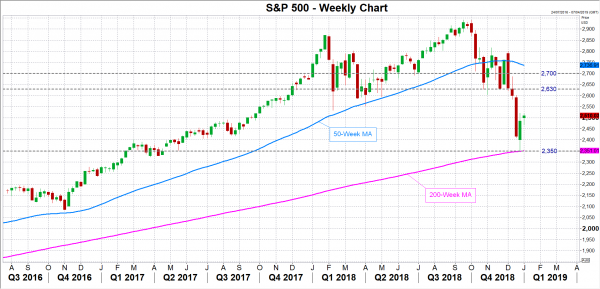

A key level to watch for the S&P 500 that could determine whether the index is bottoming out or if it’s headed for further losses is the 200-week moving average around 2,350. A breach of this support could signal the start of a bear market. However, if this support holds, the index could move sideways until some of the uncertainties surrounding the growth outlook, trade frictions and Brexit have been lifted.

Fears of recession overdone?

It is wildly possible of course that none of the risks worrying traders materialize, or even if they do, they are successfully contained by policymakers and the fallouts do not live up to the worst-case scenarios. The single-most positive development that could alter the outlook for 2019 is an end to the trade spat between the US and China, or at the least, some concrete steps in achieving that.

But even if the US and other major economies are hit with some strong headwinds, investors may be underestimating the underlying fundamentals of the global economy and the negative impact to growth may not prove to be so great. After all, you could argue that the US and Europe are only returning to trend growth after a spell of above-average growth and that rising employment levels should sustain healthy domestic demand, preventing a deeper downturn.

An eventual realisation of this by the markets could lead to a gradual recovery in stocks as investors adjust their earnings forecasts. The S&P 500 could initially rebound towards the recently congested area of 2,630 before attempting a break above the 2,700 level.

Risk of overtightening

There is a danger, however, that in the absence of significant downside risks, the Fed and others such as the ECB would stick to their current policy path of raising borrowing costs in 2019. This means any rebound in equities would likely have limited room to run as investors could once again find themselves on edge as fears that central banks are tightening too fast would return to the fore.

At the moment, markets are not expecting the Fed to raise rates at all this year. Should traders start to price in a rate rise again, this could derail any stock market recovery (or deepen the rout if there is no turnaround) if renewed Fed hawkishness is not supported by a notable improvement in the global growth momentum.