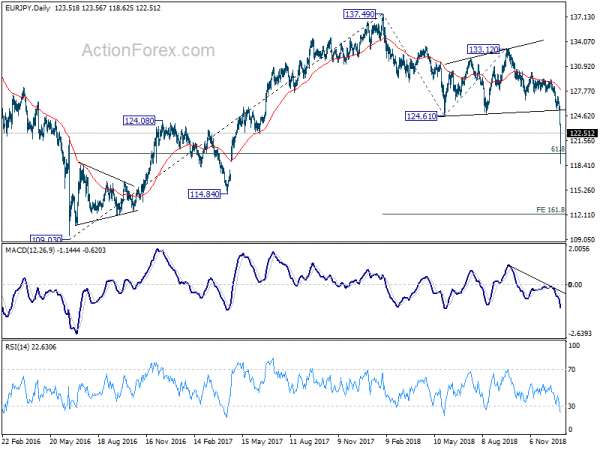

Here is a quick update to our EUR/JPY short trade (sold at 127.80, stop at 127.10, target at 120.00) as last updated here. The target of 120.00 was met as EUR/JPY spiked to 118.62 during the “Currency Flash Crash” in Asian session. We’ve exited with 780 pips profit.

Admittedly, there’s luck, quite a lot of, as the downward move today is rather exaggerated. But technically, the ideal case did happen as there was downside acceleration through 124.08 key support level. The bearish case played out well and it’s just a matter of time when the mentioned 61.8% retracement of 109.03 to 137.49 at 119.90 is met. For now, we’ll hold our hands off first as there will be heavy weight non-farm payrolls to be released tomorrow. We’ll post new strategy, if there would be any good one(s), in the upcoming weekly report.

Meanwhile, there are some reflections on the trade and related ideas we’ve posted in 2018:

- The strategy was first posted back on November 24 here. Back then, AUD/JPY was a better candidate for selling. But due to the uncertainty of Trump-Xi summit, we chose EUR/JPY over AUD/JPY. Looking back, AUD/JPY is still a much better choice, if not for that uncertainty.

- It took more than five weeks for the trade to play out and it’s rather boring in between. But patience usually pays.

- We’re using the relatively “longer” time frame as a way to demonstrate the strategy and analysis in “slow motion”. Thus, we’ve got time to explain our thinking process throughout. Yet the trade was live. And we hope our readers could get something out of the updates.

- With 780 pips profit pocked at the start of 2019, we now have some bullets to probe other opportunities.

- But finally, we’d emphasize that the strategies won’t suit everybody. Traders are advised to choose strategies that suit their temperament.