“Currency Crash” occupies a lot of headline in Asian session today after Yen spikes higher during the “thin” period of the markets while Aussie was squeezed lower. We’re talking about:

- USD/JPY hit as low as 104.69 comparing to yesterday’s high at 109.72.

- EUR/JPY hit as low as 118.62 comparing to yesterday’s high at 125.85.

- GBP/JPY hit as low as 131.51 comparing to yesterday’s high at 139.92

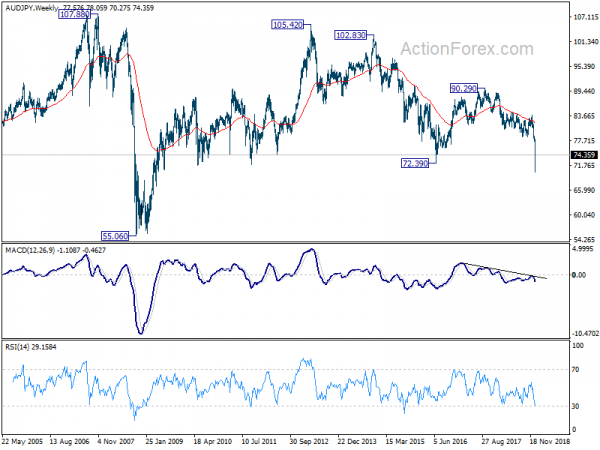

- And most seriously, AUD/JPY hit as low as 70.27 comparing to yesterday’s high at 77.34

Many key technical levels in yen crosses were breached with AUD/JPY breaching 72.39 (2016 low) and hit lowest since 2009. While Yen crosses pared back some much of the exaggerated moves, the trends remains bearish in them despite the recoveries.

The main fundamental trigger of the crash is believed to be Apple’s cutting of its sales forecasts amid China slowdown. It’s the tech giant’s first cut in revenue outlook in almost two decades. CEO Time Cook said the company expects around USD 84B in Q4, sharply lower from prior estimate of USD 89B to USD 93B. Cook also warned that in a statement to investor that “while we anticipated some challenges in key emerging markets, we did not foresee the magnitude of the economic deceleration, particularly in Greater China.”

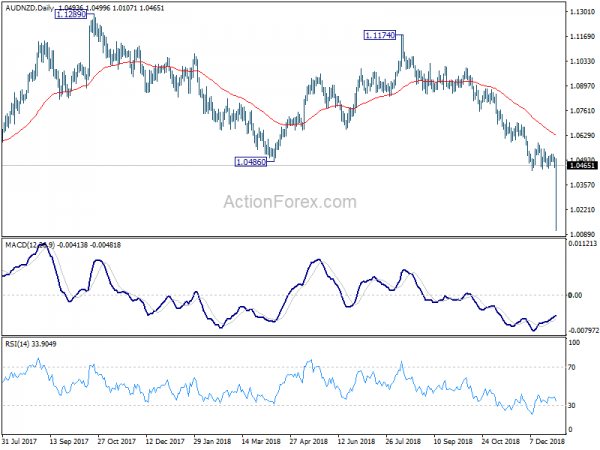

The crash in Yen crosses is described by some as “flash”. The exaggeration is seen as result of AUD/JPY liquidity vacuum as market dislocation at a short period of thin market. Aussie should at least be part of the problem as AUD/USD also breached 2016 low at 0.6826. And most apparently, even AUD/NZD spiked to as low as 1.0107 and is now back in Wednesday’s range.

As for now and today, Yen remains the strongest one, followed by Swiss Franc and then Euro. Aussie is weakest followed by Sterling and then Kiwi.