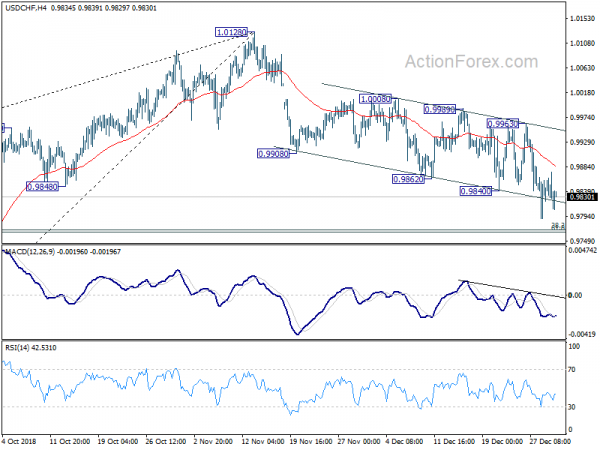

Daily Pivots: (S1) 0.9807; (P) 0.9825; (R1) 0.9841; More…

USD/CHF’s decline from 1.0128 is still in progress for cluster support at 0.9765/8 (61.8% retracement of 0.9541 to 1.0128 at 0.9765, 38.2% retracement of 0.9186 to 1.0128 at 0.9768). We’ll look for bottoming signal again there but break of 0.9963 resistance is needed to confirm near term reversal. Otherwise, further decline will remain in favor even in case of recovery. Also, decisive break of 0.9765/8 will pave the way back to 0.9541 support.

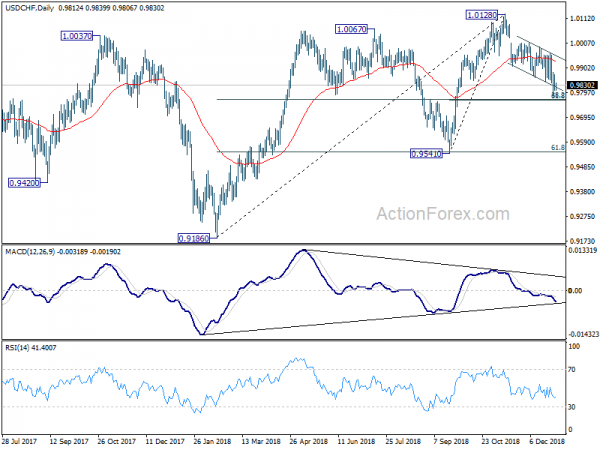

In the bigger picture, the deeper than expected fall form 1.0128 argues that medium term rally from 0.9186 might have completed at 1.0128 already, on bearish divergence condition in daily and weekly MACD. Break of 0.9541 key support will confirm this bearish case. More importantly, the corrective three wave structure will in turn argue that long term corrective pattern from 1.0342 (2016 high) is extending. In that case, 0.9186 will be the next target.