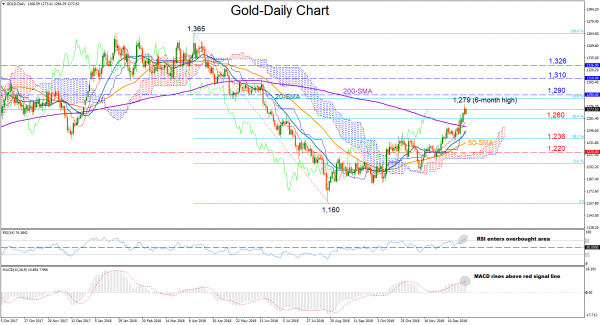

Gold jumped above the 200-day simple moving average (MA) last week for the first time since May and continued to rally until touching a six-month high of 1,279 yesterday. With the RSI breaking above the 70 overbought barrier after a long time, downside corrections are not unlikely in the short-term. The positive momentum in the MACD though, which fluctuates comfortably above its red signal line, suggests that the precious yellow metal will likely maintain its gains, at least in the short term.

On the upside, the bulls will likely retry to pierce the 1,279 top, with scope to reach a more restrictive area around 1,290. Even higher, the bottom of the five-month consolidation seen at the beginning of the year at 1,310 may provide resistance. If breached, attention would shift towards the noisy 1,326 region.

On the other hand, a leg lower may find support at the 50% Fibonacci of the long downleg from 1,365 to 1,160, at 1,260. Should this fail to hold, subsequent declines could open the door for the 38.2% Fibonacci of 1,236. Slightly lower, 1,220 could be another level to watch.

Turning to the medium-term picture, the bullish profile is expected to hold as long as the market keeps trading well above the Ichimoku cloud. Moreover, it’s worth noting that the 50-day MA continues to rise towards the slipping 200-day MA, increasing the chances for a brighter positive outlook.

Overall, gold is still bullish both in the short and the medium-term picture.