Markets remain rather quiet today as most of the major markets are still on holiday. Though activity could back with the US later today. For now, Australian and New Zealand Dollar are the strongest ones for today so far while yen and Swiss Franc are the weakest.

That’s probably be due to easing risk aversion as US futures point to slightly higher open. But it should be noted that a higher open doesn’t necessary mean a sustainable rebound in stocks. It could also be setting up the markets for another deep fall. Let’s see.

For now AUD/JPY is the top mover for today. But that’s just a corrective recovery. AUD/JPY is indeed the worst performer for the month on risk aversion. It’s down -5.96% for the month, quite a distance from second top mover NZD/JPY.

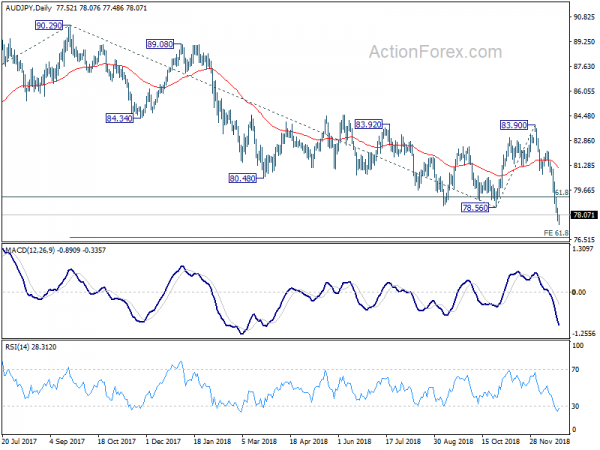

AUD/JPY’s strong break of 78.56 support last week confirmed resumption of the down trend from 90.29 high.

More importantly, AUD/JPY failed to sustain above falling 55 week EMA on last rebound attempt. Weekly MACD was also held below zero. It’s also now broken 61.8% retracement of 72.39 to 90.29 decisively. These are also bearish signals. And fall from 90.29 could indeed be resuming larger down trend from 105.42 (2013 high). AUD/JPY should now target 61.8% projection of 90.29 to 78.56 from 83.90 at 76.65 first. Firm break there will add more credence to this long term bearish case.