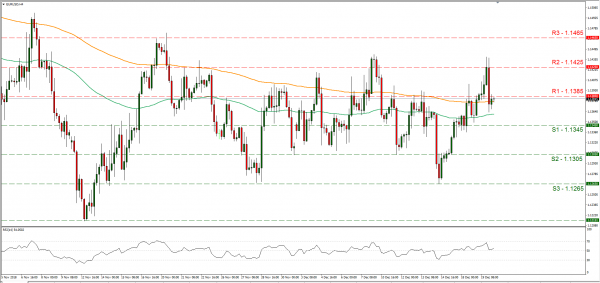

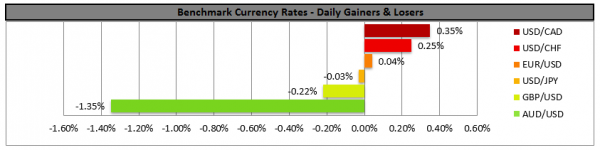

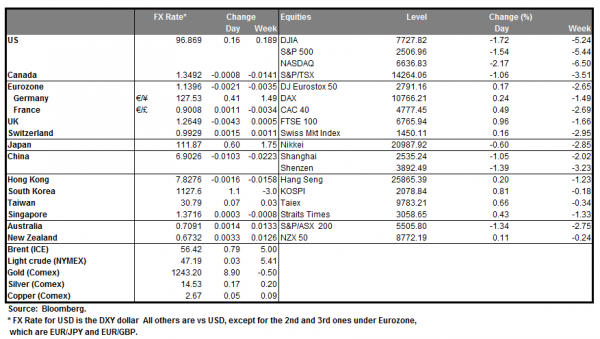

The FOMC hiked rates as was widely expected yesterday, raising interest rates by 25 basis points from 2.25% to 2.50%. Analysts point out that the markets were surprised by the Fed’s commitment to keep the core of its prior rate hike path, despite rising uncertainty. It should be noted that as the markets may have expected a more dovish outcome from the meeting, the bank surprised them as there were only slight changes in the statement along with lower growth and inflation forecasts. Also please note that the bank now sees two more rate hikes in 2019, as per the new dot-plot, instead the previous three, however the market remains skeptical as it seems currently to be pricing-in no to one rate hike in 2019. The strengthening of the USD during the time of the decision may not be as convincing and we would like to allow for some time for the dust to settle down in order to see the full effect of the decision. Despite EUR/USD rising and clearly breaking the 1.1385 (R1) and the 1.1425 (R2) resistance level, the release of the FOMC interest rate decision caused a drop in the pair’s price action surrendering any gains made and stabilising somewhat below the 1.1385 (R1) resistance line during the Asian session. Should the bulls take over once again today we could see it breaking the 1.1385 (R1) resistance line and aim for the 1.1426 (R2) resistance hurdle. Should the bears take over, we could see it dropping even further and breaking the 1.1345 (S1) support line.

BoE Interest rate decision

Bank of England is to announce its own interest rate decision today (12:00, GMT) and is widely expected to remain on hold at +0.75%, with GBP OIS implying a probability of 99.24% for such a scenario. Should the bank remain on hold as expected, we could see the market’s attention turned to the accompanying statement. We see the case for Brexit uncertainty to weigh on the statement, however it should also be noted that yesterday’s deceleration of the inflation rate, as well as weak GDP growth rates could also have a dovish effect on the bank’s decision. On the bright side, the UK economy seems to be enjoying a rather tight labour market, however that might prove insufficient for a more hawkish view by the bank. Should the bank remain on hold and dovish elements prevail in the accompanying statement, we could see the bearish sentiment for the pound increasing. Cable maintained a sideways movement, testing and finally breaking the 1.2630 (R1) support line (now turned to resistance). Should BoE’s interest rate decision enhance the bearish sentiment for the pound, we could see the pair breaking the 1.2555 (S1) support line and aim for lower grounds. Should on the other hand, the market favor the pair’s long positions, we could see it breaking the 1.2630 (R1) resistance line and aim for the 1.2700 (R2) resistance level.

In today’s other economic highlights:

During the European session today, we get from Sweden Riksbank’s interest rate decision which is expected to remain on hold and should the bank sound hawkish, we could see the SEK getting some support. From the UK, we get the retail sales growth rates for November and from the Czech Republic CNB’s interest rate decision, which is also expected to remain on hold after four consecutive rate hikes. In the American session, we get from the US the Philly Fed Manufacturing Index for December and from Canada the wholesale sales growth rate for October. Also please be advised that the volatility surrounding the FOMC’s interest rate decision yesterday, affected gold prices, causing them to drop after the announcement of the decision. Should you be interested on more fundamental news regarding the precious metal, please refer to our Gold Weekly outlook, due out later today.

EUR/USD H4

Support: 1.1345 (S1), 1.1305 (S2), 1.1265 (S3)

Resistance: 1.1385 (R1), 1.1425 (R2), 1.1465 (R3)

GBP/USD H4

Support: 1.2555 (S1), 1.2485 (S2), 1.2415 (S3)

Resistance: 1.2630 (R1), 1.2700 (R2), 1.2795 (R3)