- Famous dot plot indicates two rates hike next year at the FOMC policy meeting

- Bank of England to hold rates steady amid Brexit drama

- EU and Italy find a common ground on budget plan

Fed not so dovish as expected

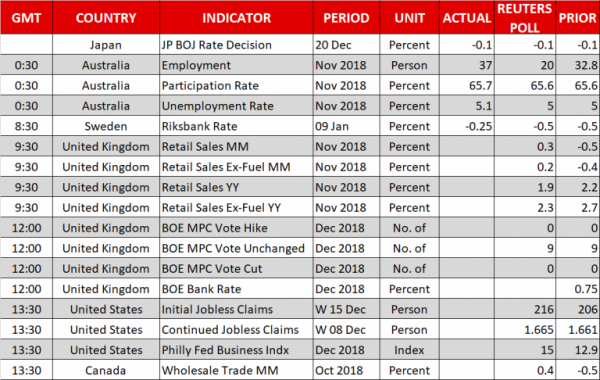

Shares in the US and Asia tumbled after the Federal Open Market Committee raised interest rates by a quarter point to 2.25-2.5% in a widely expected decision and hinted further tightening next year despite the hazards in global economic conditions. The central bank little changed its projections for 2019 as well, downgrading growth to 2.3% and inflation to 1.9%, but investors, who were anticipating the worst from the Fed – from no hike to just one versus three displayed by the September’s dot plot – were surprised to hear that policymakers are still aiming for two rate hikes in 2019, with the Fed chief Jerome Powell saying at his press conference that the US economy performed satisfactorily this year and hence policy no longer needed to be accommodative.

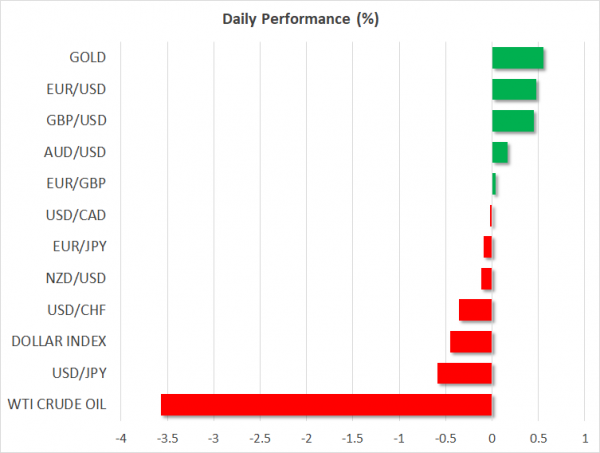

Markets though did not seem much convinced about whether the Fed could keep course on its agenda, driving dollar/yen down by 0.52% on Thursday near two-month lows, while the safe-haven gold was gaining 0.36% in the day after hitting five-month highs on Wednesday. A sign that investors could turn more vulnerable to upcoming data releases which could potentially affect rate hike prospects. Headlines that People’s Bank of China lunched a new tool on Wednesday to boost lending to small and private companies amid a slowing economy and trade restrictions from Washington weighed on sentiment as well.

Unlike the Fed, the Bank of Japan which held its policy meeting a few hours later, kept borrowing costs unchanged and reiterated that current stimulus will be maintained for an extended period of time.

Bank of England next to decide on rates

The Bank of England will be next in line to decide on monetary policy on Thursday at 1200 GMT but analysts are certain that policymakers will judge wiser to stand pat on rates as far as Brexit remains unsolved. While the UK Prime Minister, Theresa May, has survived a leadership challenge last week, she still needs to achieve assurances from the EU over her Brexit deal and win the support of ministers in the homeland before the exit date in March. Yet with both sides preparing strategy plans for a no-deal Brexit it seems that the EU is not willing to soften its stance by allowing changes in the withdrawal bill agreed with the UK PM even If the majority of British lawmakers are against it.

On Wednesday, May announced that the delayed Brexit vote in the Parliament will be rescheduled in the week ending January 14.

Meanwhile in FX markets, cable is trading higher by 0.34% so far in the day, benefitting on the back of a weaker dollar. While the BoE meeting is not expected to affect much the pound as no press conference or a new quarterly inflation report are scheduled to be delivered today, a more cautious outlook in the rate statement may pressure the currency. Yet retail sales numbers out of the UK at 0930 GMT could spur some volatility to the market.

Italy avoids EU sanctions

On Wednesday, the Italian Prime Minister, Giuseppe Conte, revealed that the government reached a compromise with the EU to reduce the deficit target to 2.04% of GDP in 2019 from 2.4% proposed previously, without dramatic changes in key budget components. Although the agreement is not the ideal one according to the European Commission, it protects Italy from disciplinary procedures. Yet the European Commission’s Vice President Valdis Dombrovskis argued that the composition of the spending plan is still a concern and could result in higher costs in coming years once implemented.

The euro was among the best performers today, changing hands higher by 0.47% against the greenback.

Other highlights

The loonie hit 20-month lows yesterday versus the dollar and remained around that troughs on Thursday as the sharp sell-off in oil markets continued, with WTI crude and the London-based Brent diving by more than 2.5% on Thursday on oversupply concerns and as stock markets melted again. Moreover, the headline CPI figure for the month of November eased to the lowest in 10 months on a yearly basis, while the core measures also appeared weaker, suggesting that the Bank of Canada might not be in hurry to pick up rates.