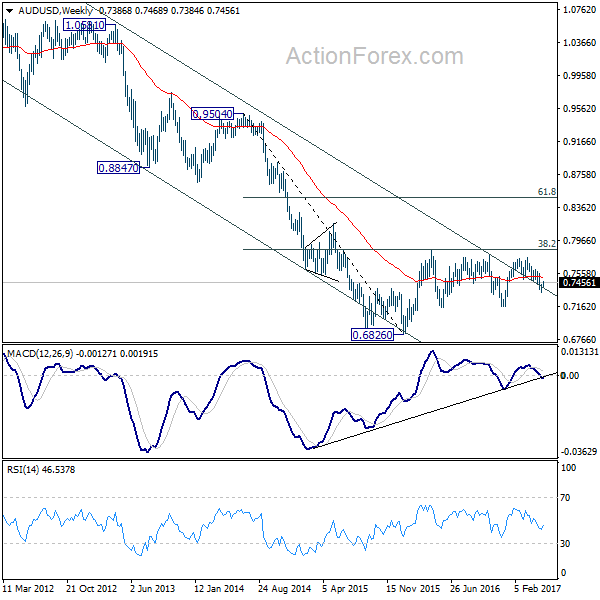

AUD/USD’s consolidation from 0.7328 continued last week and outlook is unchanged. Further recovery could be seen this week. But upside should be limited below 0.7555 resistance to bring fall resumption. Below 0.7388 minor support will turn bias to the downside. Break of 0.7328 will extend the decline from 0.7748 to 0.7144/7158 support zone. However, firm break of 0.7555 will argue that fall from 0.7748 is completed and turn bias back to the upside.

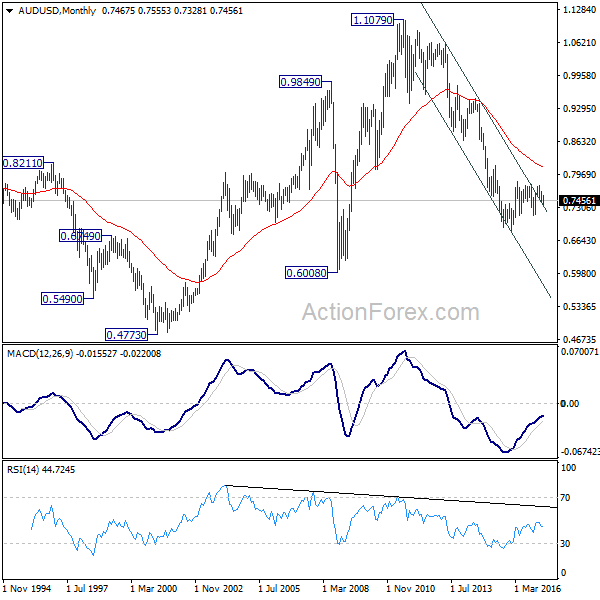

In the bigger picture, we’re still treating price actions from 0.6826 low as a corrective pattern. And, as long as 38.2% retracement of 0.9504 to 0.6826 at 0.7849 holds, long term down trend from 1.1079 is expected to resume sooner or later. Break of 0.6826 low will target 0.6008 key support level. However, firm break of 0.7849 will indicate that rise from 0.6826 is developing into a medium term rebound, rather than a sideway pattern. In such case, stronger rise should be seen to 55 month EMA (now at 0.8115) and above.

In the longer term picture, while the down trend from 1.1079 might extend lower, we’re not anticipating a break of 0.6008 (2008 low) yet. We’ll look for bottoming above there to reverse the medium term trend.