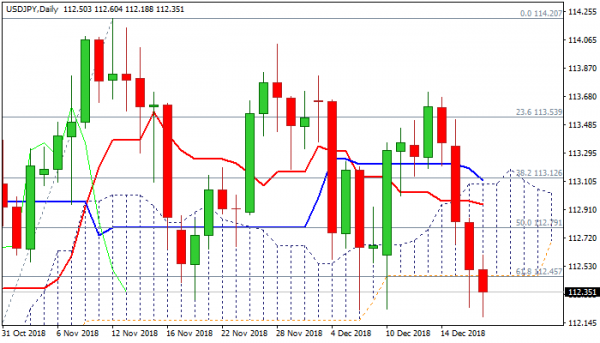

The pair holds in red for the fourth straight day and returns below daily cloud after bears failed to close below key supports at 112.46/40 (daily cloud base / Fibo 61.8% of 111.37/114.20 / 100SMA) on Tuesday, despite spike to 112.24.

Strong support from double-bottom at 112.23 (06/10 Dec lows) contained Tuesday’s dip, but was cracked on today’s spike to 112.18, signaling that bears remain firmly in play.

Eventual close below 112.46 Fibo support which so far resisted several attacks, would generate strong bearish signal for test of another pivot at 112.04 (Fibo 76.4% of 111.37/114.20).

Bearish daily studies support scenario, but oversold slow stochastic suggests that bears may show further hesitation at key support levels.

Markets look for fresh signals on FOMC decision, due later today. Wide expectations that the Fed will hike in Dec, as promised, but would signal significant slowdown in rate hikes in 2019, on growing fears of global growth slowdown.

Another scenario of Fed staying on hold today, is also in play, as the central bank is under strong pressure from US President Trump, who strongly opposes any further increase in interest rates, however, the Fed may act to show their independence.

Scenario of dovish hike or no hike at all would further pressure the dollar, while bears could be sidelined if Fed opts for hike and makes hawkish shift in their statement.

Res: 112.46, 112.60, 112.95, 113.08

Sup: 112.18, 112.04, 111.77, 111.37