Dollar is mildly softer in Asian session as traders turn cautious ahead of FOMC rate decision. But it should be noted that, except versus less, and to a lesser extent Swiss Franc, Dollar isn’t that weak. EUR/USD, GBP/USD and AUD/USD are bounded in consolidation in familiar range. USD/CAD has indeed extended recent rally, thanks to free fall in oil prices. The wild card in the new FOMC economic projections. Dollar could have a breakout from ranges whether there are changes in the projections or not.

Staying in the currency markets, Canadian Dollar is the weakest one for the week as WTI crude oil dived to as low as 46.07 on down trend resumption. Dollar is the second weakest for the week but is held above last week’s against all. Australian Dollar is the third weakest, also staying in prior week’s range. On other hand, Yen is notably strong as it’s now above last week’s high against Euro, Swiss Franc and Canadian.

In other markets, US treasury yields had another day of sharp decline overnight. 5-year yield closed down -0.037 at 2.656. 10-year yield dropped -0.032 to 2.825. 30-yer yield dropped -0.035 to 3.079. Yield curve is now inverted from 1-year (2.651) to 2-year (2.646) and 3-year (2.631). US stocks recovered mildly after Monday’s free fall. DOW rose 0.35%, S&P 500 rose 0.01%, NASDAQ rose 0.45%. In Asia, Nikkei is currently down -0.55%, Hong Kong HSI up 0.16%, China Shanghai SSE down -0.25%, Singapore Strait Times up 0.47%.

FOMC previews and recap of September projections

Despite all the political pressure, Fed is widely expected to raise federal funds rate by 25bps to 2.25-2.50% today. The meeting bears much more importance then just the rate hike, as investors would be eager to know Fed’s rate path in 2019, which has become pretty unsure recently. The statement, voting, and economic projections could all play a part in shaping market expectations.

In the November statement, Fed concluded by saying that “In determining the timing and size of future adjustments to the target range for the federal funds rate, the Committee will assess realized and expected economic conditions relative to its maximum employment objective and its symmetric 2 percent inflation objective. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments.”

That is, Fed based its decision on a wide range of meaningful data rather than just a few pieces of them. While Chair Jerome Powell might put more emphasis on data dependency, the statement itself is clear and comprehensive enough that doesn’t warrant a change.

On economic projections, the most important part is federal funds rate projections. As a recap, back in September, the longer run federal funds rate was estimated to be at 3.0%, with central tendency at 2.8-3.0% and 2.5-3.5%. Despite financial market volatility and signs of peaking growth momentum, it still a consensus among fed policies to lift rate to neutral. And if we take the central tendency as consensus, there should be at least one to two more rate hikes onwards.

But timing is the question. For 2019, the median federal funds rate projection was at 3.1%, with central tendency at 2.9-3.4%. That means, members leaned towards two to three more hikes in 2019, if economic conditions favored. At the same time, that would mean interest rate would go pass neutral a little.

While we won’t expect many changes to the projections, we won’t be surprised to see some. And changes or not, Dollar would be volatile on the figures.

Suggested readings on FOMC:

- Fed Likely Hikes Rate in December, Future Path More Dovish

- USD/JPY: Will The Fed Deliver A Present Or A Lump Of Coal For Buck Bulls?

- Will the Fed be Less Dovish than Markets Expect?

- FOMC Preview: What Do We Expect?

- What To Expect From The Last Fed Meeting In 2018?

UK to start no-deal Brexit preparation in full

UK Prime Minister Theresa May’s spokesman said yesterday that the Cabinet agreed that the government should start no-deal Brexit preparation “in full”. He noted “we have now reached the point where we need to ramp up these preparations”. And, “we will now set in motion the remaining elements of our no-deal plans”.

Additionally, “Cabinet also agreed to recommend businesses now also ensure they are similarly prepared, enacting their own no-deal plans as they judge necessary”.

Asian business sentiment stays low on trade war concerns

The Thomson Reuters/INSEAD Asian Business Sentiment Index rose to 63 in Q4, up from 58 in Q3 which was a near three year low. While readings above 50 still indicates a positive outlook, the result is still one of the lowest readings in years.

Antonio Fatas from INSEAD noted in the release that “this confirms the reading of the previous quarter: there is more uncertainty, there are increasing concerns about growth,” And, “this doesn’t mean there is going to be a crisis over the next quarters, but if there is one, this is an indication that it wouldn’t be a large surprise to some.”

Global trade war is, by some distance, the biggest perceived risks to business outlook. China slowdown and higher interest rates followed and then Brexit. The report also noted that, “the dispute between the world’s two biggest economies, threatens businesses throughout the region due to global value chains.”

On the data front

Australia Westpac leading index dropped -0.1% mom in November. Japan trade deficit widened to JPY -0.49% in November.

UK inflation data will be the main focus in European session, with CPI, RPI, PPI and house price index featured. Germany will also release PPI.

Canadian CPI will be a focus in US session too. US will release existing home sales, crude oil inventories and the highly anticipated FOMC rate decision and press conference.

EUR/USD Daily Outlook

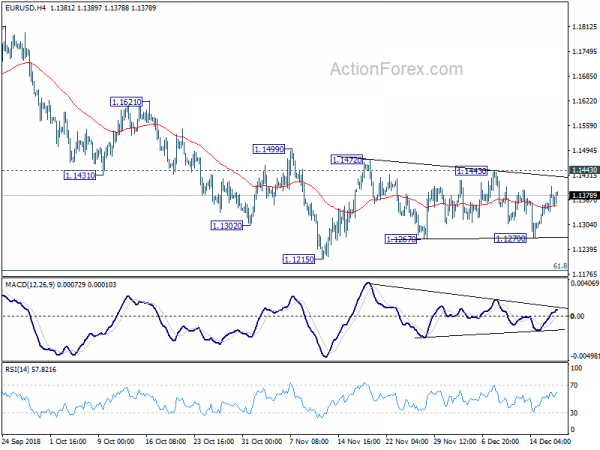

Daily Pivots: (S1) 1.1334; (P) 1.1368; (R1) 1.1400; More…..

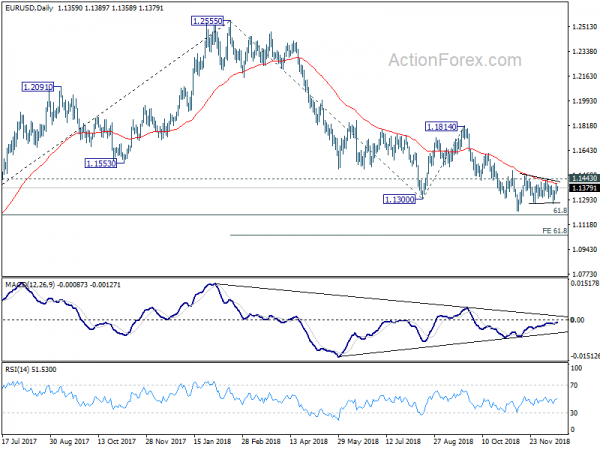

While the rebound from 1.1270 was strong, EUR/USD is still bounded in range of 1.1270/1443. Intraday bias remains neutral at this point. As long as 1.1443 resistance holds, we’d favor a downside breakout. On the downside, break of 1.1270 will argue that larger fall is resumption should target 1.1251 low next. Decisive break there will confirm this bearish case. EUR/USD should drop through 1.1186 fibonacci level to 61.8% projection of 1.2555 to 1.1300 from 1.1814 at 1.1038 next. However, firm break of 1.1443 resistance will indicate near term reversal and turn focus back to 1.1814 resistance.

In the bigger picture, as long as 1.1814 resistance holds, down trend down trend from 1.2555 medium term top is still in progress and should target 61.8% retracement of 1.0339 (2017 low) to 1.2555 at 1.1186 next. Sustained break there will pave the way to retest 1.0339. However, break of 1.1814 will confirm completion of such down trend and turn medium term outlook bullish.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | AUD | Westpac Leading Index M/M Nov | -0.10% | 0.10% | ||

| 23:50 | JPY | Trade Balance (JPY) Nov | -0.49T | -0.31T | -0.30T | -0.29T |

| 7:00 | EUR | German PPI M/M Nov | -0.10% | 0.30% | ||

| 7:00 | EUR | German PPI Y/Y Nov | 3.20% | 3.30% | ||

| 9:30 | GBP | CPI M/M Nov | 0.20% | 0.10% | ||

| 9:30 | GBP | CPI Y/Y Nov | 2.30% | 2.40% | ||

| 9:30 | GBP | Core CPI Y/Y Nov | 1.90% | 1.90% | ||

| 9:30 | GBP | RPI M/M Nov | 0.10% | 0.10% | ||

| 9:30 | GBP | RPI Y/Y Nov | 3.30% | 3.30% | ||

| 9:30 | GBP | PPI Input M/M Nov | 0.60% | 0.80% | ||

| 9:30 | GBP | PPI Input Y/Y Nov | 9.60% | 10.00% | ||

| 9:30 | GBP | PPI Output M/M Nov | -0.10% | 0.30% | ||

| 9:30 | GBP | PPI Output Y/Y Nov | 3.10% | 3.30% | ||

| 9:30 | GBP | PPI Output Core M/M Nov | 0.30% | |||

| 9:30 | GBP | PPI Output Core Y/Y Nov | 2.40% | |||

| 9:30 | GBP | House Price Index Y/Y Oct | 3.30% | 3.50% | ||

| 13:30 | USD | Current Account Balance (CAD) Q3 | -125B | -101B | ||

| 13:30 | CAD | CPI M/M Nov | -0.10% | 0.30% | ||

| 13:30 | CAD | CPI Y/Y Nov | 2.20% | 2.40% | ||

| 13:30 | CAD | CPI Core – Common Y/Y Nov | 1.90% | 1.90% | ||

| 13:30 | CAD | CPI Core – Median Y/Y Nov | 2.00% | 2.00% | ||

| 13:30 | CAD | CPI Core – Trim Y/Y Nov | 2.10% | 2.10% | ||

| 15:00 | USD | Existing Home Sales Nov | 5.20M | 5.22M | ||

| 15:30 | USD | Crude Oil Inventories | -1.2M | |||

| 19:00 | USD | FOMC Rate Decision (Lower Bound) | 2.25% | 2.25% | ||

| 19:00 | USD | FOMC Rate Decision (Upper Bound) | 2.50% | 2.50% | ||

| 19:30 | USD | FOMC Press Conference |