- Risk sentiment in dire straits; US stocks close at fresh lows, yen shines

- Dollar drops as Fed rate-hike expectations fade even further

- Kiwi buoyant after New Zealand’s business sentiment recovers

S&P 500 closes at 14-month low as fear dominates greed

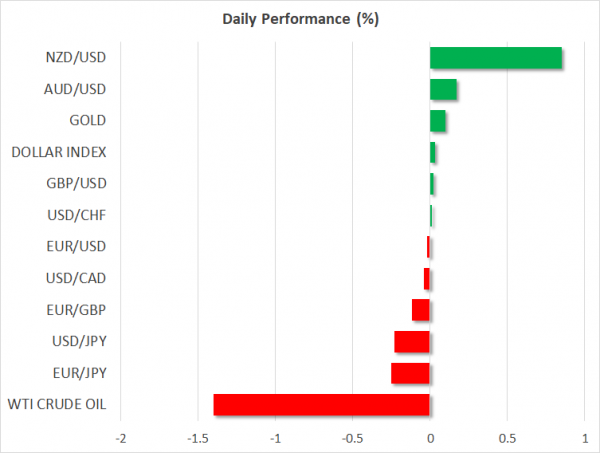

Risk sentiment remained sour to start the week, in the absence of any clear catalyst, other than a flurry of headlines suggesting a US government shutdown may be on the cards this holiday season. The benchmark S&P 500 index fell by 2% to close at a 14-month low, WTI oil broke below its recent troughs, while the Japanese yen outshined all the major currencies as investors de-risked. Meanwhile, the Russell 2000 index of US small caps entered a bear market, down 20% from its highs.

Market sell-offs in December have a special twist to them, as the selling can be amplified by calendar effects. Since most funds report their performance as a yearly figure, many of them place greater emphasis on preserving any year-to-date profits via liquidating positions and limiting their exposure, as opposed to trying to expand them.

Dollar falls as investors bet market sell-off will stay the Fed’s hand

Amidst this turmoil, markets are betting on an even softer Fed rate path. The probability for a hike tomorrow has declined to 63%, while 2019 rate expectations have also faded further as investors increasingly doubt whether the central bank will dare appear hawkish and exacerbate the havoc. Assuming a hike is delivered tomorrow, Fed funds futures suggest a meagre 30% chance for just one more next year. In this context, one wonders how much worse the selling in stocks would have been if rate expectations didn’t fade and effectively provide a cushion for risky assets.

As for the dollar, it posted hefty losses as fading rate hike bets coupled with worries over a government shutdown outweighed safe-haven demand for the reserve currency. All eyes remain on the Fed’s decision tomorrow. Given just how dovish market pricing has become, the odds for a hawkish surprise have risen materially. Investors may have gotten ahead of themselves in pricing out such a substantial degree of Fed tightening so quickly, particularly considering that US economic data outside of housing remain quite healthy.

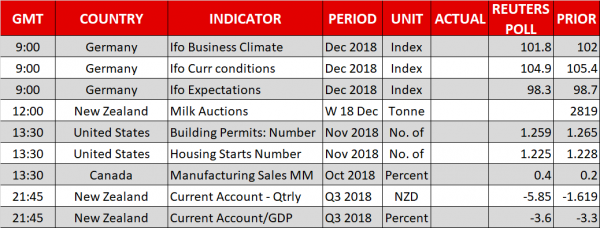

In this respect, US building permits and housing starts for November due later today may attract attention, as weakness in recent housing indicators has been at the spearhead of speculation that the US economy is slowing down.

Kiwi propelled higher by recovering business sentiment

The kiwi dollar is outperforming on Tuesday, following the monthly ANZ business sentiment survey. Although still in negative territory, the index rose from its lows, calming some nerves that a sustained deterioration in business expectations would become self-fulfilling and lead to a slump in investment. Hence, good news for the RBNZ, though clearly not good enough to fuel speculation for any policy move anytime soon. Today, kiwi traders will keep their sights on the twice-monthly milk auction, though the nation’s current account data for Q3 may also attract attention.

Day ahead: Germany’s Ifo survey and Brexit developments

Besides the US housing figures, Germany’s Ifo survey gauging business expectations is also due; it could shed some light on how Europe’s largest economy fared heading into year-end.

In the UK, the Brexit saga continues as opposition leader Jeremy Corbyn indicated he will trigger a “no confidence” vote in PM May; not on the entire government. Although this would have minimal implications, it serves as a reminder political uncertainty remains elevated.

As for the speakers, ECB Vice President de Guindos (0815 GMT), as well as Governing Council members Rehn (0900 GMT) and Makuch (1200 GMT) will all deliver remarks.