The financial markets are rather steady in Asia today. Nikkei and and Singapore Strait Times are having notably rebounds. But China and Hong Kong stock markets are mixed. In the currency markets, Yen is the generally weaker one, followed by Sterling. Canadian Dollar and Swiss Franc are the stronger ones. But major pairs and crosses are bounded in Friday’s range, indicating low volatility. Traders are apparently turning more cautious ahead of FOMC rate decision and economic projections to be released later this week.

Technically, Friday’s selloff in Euro and Swiss Franc were a bit disappointing. EUR/USD recovered just ahead of 1.1267 support, keeping in consolidation in established range. EUR/JPY was also held above “equivalent” support at 127.61. USD/CHF was also held well below 1.0008 resistance. These levels will continue to be watched today. Also, EUR/GBP is held in tight range between 0.8931/9098. We’re favoring an upside break through 0.9098 for now. But a break of 0.8931 will indicate near term reversal in EUR/GBP.

In other markets, Nikkei closed up 0.62% at 21506.88. Singapore Strait Times is rising 1.12%. But Hong Kong HSI is just up 0.04% and China Shanghai SSE is down -0.03%. Japanese 10 year JGB yield is down -0.0008 at 0.034. Gold’s rebound last steady last week and is now back at 1237. WTI crude oil continues to consolidate in tight range above 50 handle.

UK PM May to urged not to “break faith” with British people with another Brexit referendum

According to pre-released text, UK Prime Minister Theresa May will urged parliament today not to “break faith” with the British people with another referendum. She will also warned that “Another vote which would do irreparable damage to the integrity of our politics, because it would say to millions who trusted in democracy, that our democracy does not deliver. Another vote which would likely leave us no further forward than the last”

Separately, Trade Minister said in a BBC show that “it is very clear that the EU understand what the problem is. And it’s a question now, without unpicking the whole of the withdrawal agreement, can we find a mechanism of operating the backstop in a way that actually removes those anxieties”. He added that “It will happen over Christmas, it’s not going to happen this week, it’s not going to be quick, it will happen some time in the New Year.”

Irish Foreign Minister Simon Coveney told RTE television that “If there is an entirely new proposal coming from the UK, I think undoubtedly it would need a lot more time to be considered on the EU side and that would probably involve an extension of Article 50 or pulling Article 50 for the moment.”

Italy coalition government agreed on numbers and contents of 2019 revised budget

In Italy, leaders of the coalition government sounded optimistic that they would eventually avoid disciplinary actions by the EU over its 2019 budget. Leader of the League Matteo Salvini said, after meeting with 5-Star Movement head Luigi Di Maio and Prime Minister Giuseppe Conte, “We have found an agreement on further fiscal reductions that probably will be appreciated by the EU.”

Salvini’s spokeswoman also said that there is “total agreement between Conte, Salvini and Di Maio on the numbers and contents of the proposal to send to Brussels,” regarding 2019 budget plan. And she denied there were tensions within the coalition government and rumors that Prime Minister Giuseppe Conte had threatened to quit.

Separately, Di Maio also said the talks with the commission “will allow us to avoid an infraction procedure”.

Fed rate hike and new economic projections as main focus

Looking ahead, three central banks will meet this week, including Fed, BoJ and BoE. BoJ and BoE are both expected to stand pat and are unlikely to reveal anything special. FOMC is widely expected to raise federal funds rate by 25bps to 2.25-2.50% this week. The main focus are both the new economic projections and chair Jerome Powell’s press conference. Powell’s comment that interest rates are now “just below” neutral prompted some selling pressure on the Dollar. But thanks to risk aversion, the greenback regained much ground and is trading as one of the strongest for the month along with Yen and Swiss Franc. Powell now has a chance to clarify what he exactly means.

In the September economic projections, the median longer run federal funds rate was estimated to be 3.0%, with central tendency at 2.8-3.0%. The range of estimate was naturally larger at 2.5-3.5%. Revision to this will be crucial on how far fed would hike to. Also, median projection for federal funds rates for 2019 was at 3.1%, with central tendency at 2.9-3.4%. Based on the projections, Fed would have two more rate hikes next year, with prospect of a third. The chance was dimmed by recent developments in the economy while investors were getting less convinced of such rate path. This will be another piece of market moving figure.

Addition to Fed, there are also some other events to watch, including German Ifo, UK CPI and retail sales,Canada CPI and retail sales, Australia employment and RBA minutes etc. Here are some highlights for the week:

- Monday: Eurozone CPI final, trade balance; UK CBI industrial orders; Canada foreign securities transactions; US Empire State manufacturing, NAHB housing index

- Tuesday: New Zealand ANZ business confidence; RBA minutes; German Ifo business climate; Canada manufacturing sales; US housing starts and building permits

- Wednesday Japan trade balance; Germany PPI; UK CPI, PPI, CBI realized sales; Canada CPI; US current account, existing home sales, FOMC rate decision

- Thursday: New Zealand GDP; Australian employment; BoJ rate decision, japan all industries index; Swiss trade balance; Eurozone current account; UK retail sales, BoE rate decision; Canada wholesale sales; US Philly Fed manufacturing , jobless claims

- Friday: Japan national CPI core; Germany Gfk consumer sentiment; UK Gfk consumer sentiment, Q3 GDP final, current account, public sector net borrowing; Canada retail sales, GDP; US durable goods, Q3 GDP final, personal income and spending

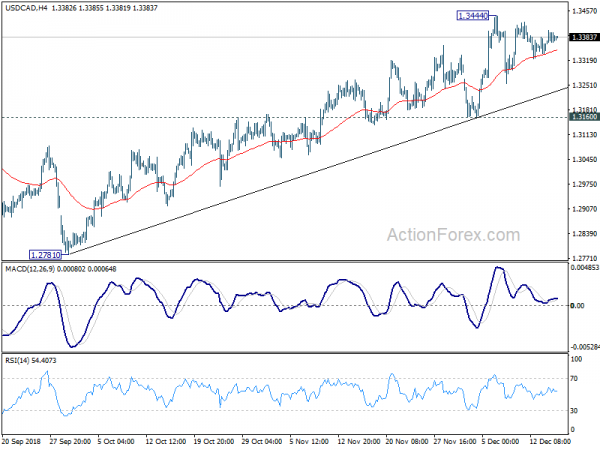

USD/CAD Daily Outlook

Daily Pivots: (S1) 1.3355; (P) 1.3378; (R1) 1.3411; More…

Intraday bias in USD/CAD remains neutral as consolidation from 1.3444 is still in progress. Near term outlook remains bullish as long as 1.3160 support holds, and further rally is expected. On the upside, break of 1.3444 will extend the larger up trend from 1.2061 for 1.3685 fibonacci level next. However, break of 1.3160 will indicate near term reversal and bring deeper decline.

In the bigger picture, up trend from 1.2061 (2017 low) is still in progress and should target to 61.8% retracement of 1.4689 (2016 high) to 1.2061 at 1.3685. However, such rise is not clearly impulsive yet. And it could be the second leg of the long term corrective pattern that started at 1.4689. Hence, even in case of further rally, we’d be cautious on loss of momentum and topping above 1.3685. Nevertheless, in any case, outlook will stay bullish as long as channel support (now at 1.2969) holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:01 | GBP | Rightmove House Prices M/M Dec | -1.50% | -1.70% | ||

| 10:00 | EUR | Eurozone Trade Balance (EUR) Oct | 14.2B | 13.4B | ||

| 10:00 | EUR | Eurozone CPI M/M Nov | 0.20% | 0.20% | ||

| 10:00 | EUR | Eurozone CPI Y/Y Nov F | 2.00% | 2.00% | ||

| 10:00 | EUR | Eurozone CPI Core Y/Y Nov F | 1.00% | 1.00% | ||

| 13:30 | CAD | International Securities Transactions (CAD) Oct | 6.20B | 7.70B | ||

| 13:30 | USD | Empire State Manufacturing Dec | 20.1 | 23.3 | ||

| 15:00 | USD | NAHB Housing Market Index Dec | 61 | 60 | ||

| 21:00 | USD | Net Long-term TIC Flows Oct | 30.8B |