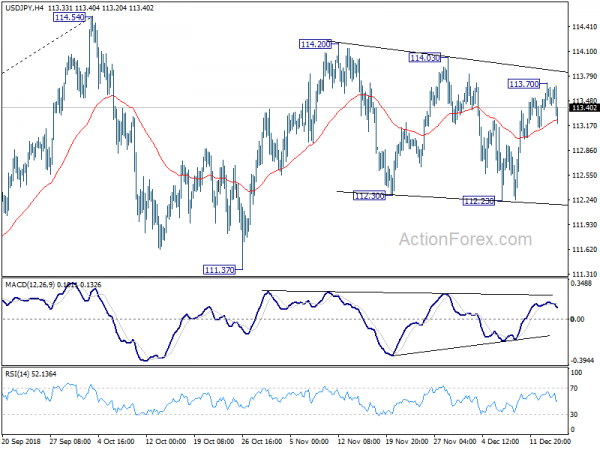

USD/JPY rebounded to 113.70 last week but retreated notably since then. Initial bias is neutral this week first. On the upside, above 113.70 will target 114.20 resistance first. Break there will resume the rise from 111.37 and target 114.73 key resistance next. However, break of 112.23 support will extend the corrective pattern from 114.54 with another decline. Overall, price actions 114.54 are seen as a consolidative pattern. In case of deeper fall, downside should be contained by 38.2% retracement of 104.62 to 114.54 at 110.75 to bring rebound. Larger rise from 104.62 is expected to resume later.

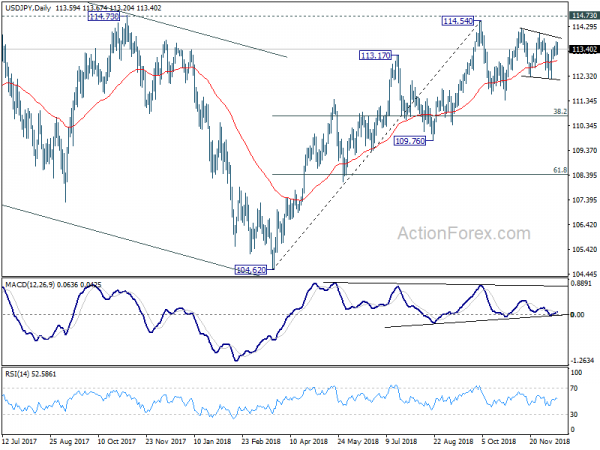

In the bigger picture, corrective fall from 118.65 (2016 high) should have completed with three waves down to 104.62. Decisive break of 114.73 resistance will likely resume whole rally from 98.97 (2016 low) to 100% projection of 98.97 to 118.65 from 104.62 at 124.30, which is reasonably close to 125.85 (2015 high). This will stay as the preferred case as long as 109.76 support holds. However, decisive break of 109.76 will dampen this bullish view and turns outlook mixed again.

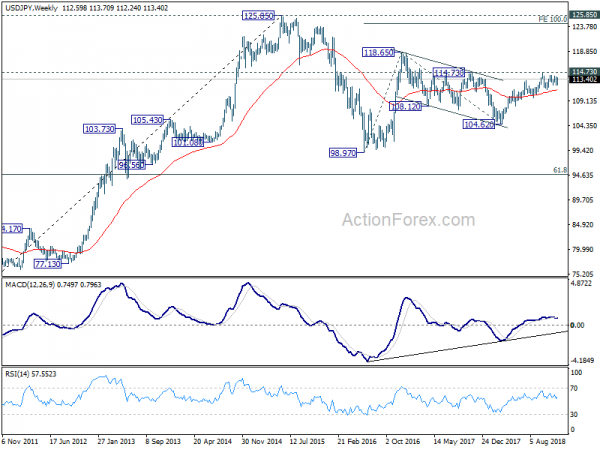

In the long term picture, the rise from 75.56 (2011 low) long term bottom to 125.85 top is viewed as an impulsive move, no change in this view. Price actions from 125.85 are seen as a corrective move which could still extend. In case of deeper fall, downside should be contained by 61.8% retracement of 75.56 to 125.85 at 94.77. Up trend from 75.56 is expected to resume at a later stage for above 135.20/147.68 resistance zone.