‘Technically, it’s important for the dollar to get back to 115, which is a nice figure to target, but I think a lot of investors are probably playing from the long position and it’s difficult to get a new wave of buyers to give it that extra kick.’ – State Street Global Markets (based on Reuters)

Pair’s Outlook

The overall picture did not change on Monday, as the USD/JPY pair keeps consolidating between 111.50 and 115.00. The Buck has sufficient space to edge higher again, even though the 20-day SMA and the weekly PP form resistance quite close to today’s opening price. A failure to climb over this resistance cluster is likely to result in a relatively serious decline, with the tough demand area circa 111.70 limiting any possible losses. On the other hand, a successful breach of the nearest resistance would allow the 115.00 area to be retested again, making another step towards reaching the two-year down-trend.

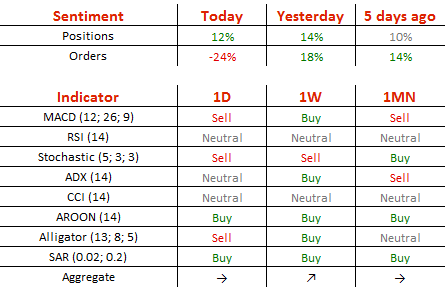

Traders’ Sentiment

There are no 56% of traders who are bulls, compared to 57% on Monday. The share of purchase orders declined dramatically in the last 24 hours, having fallen from 59 to 38%.