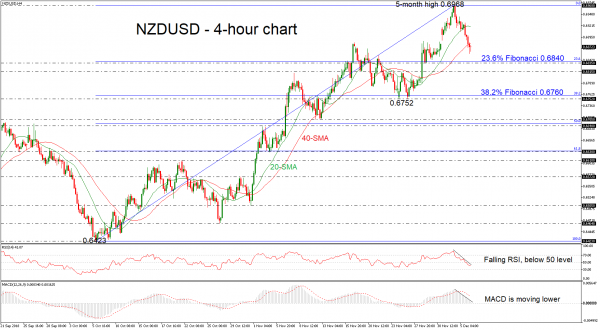

NZDUSD has been underperforming in the past days, drifting lower from the five-month high of 0.6968 and below the 20- and 40-simple moving averages in the 4-hour chart. In the short term, technical indicarors point to more weakness, with the RSI dropping to bearish territory below 50 and the MACD losing further ground below the trigger line.

In case of further declines, immediate support could come from the 23.6% Fibonacci retracement level of the upward move from 0.6423 to 0.6968, around 0.6840. If the sellers manage to push below that hurdle, that could mark a drop towards the 0.6815 region, identified by the highs on November 26. More downside could send prices even lower until the 38.2% Fibonacci of 0.6760.

If the bulls take control, the price could hit the five-month peak of 0.6968. A potential upside violation of this region could open the door for the 0.7050 resistance, taken from the highs on June 13.

Overall, the market’s outlook appears bullish following the considerable rebound on the 0.6423 trough.