World markets declined overnight after a daughter of Huawei’s founder and current CFO, Wanzhou Meng, was arrested in Canada for potential extradition to the US. While details of the arrest are yet unknown, Huawei is believed to have been used for espionage purposes in the past. US carriers have been banned from using its products and just last month, Australia banned its networking products too. After the arrest, the S&P VIX index, which measures the fear in the market, rose by 4% to 20.75.

The Australia dollar continued the declines started on Tuesday after the country released weak trade balance data. In October, the country’s trade balance was at A$2.316 billion, which was lower than the consensus estimate of A$3.1 billion. In September, the balance was at A$2.90 billion. The trade balance happened as exports increased by 1% while imports increased by 3%. This data came a day after the country released weaker-than-expected GDP numbers and two days after the RBA sounded hawkish about the economy. Later today, traders will listen to a statement by the RBA vice chair, Guy Debelle.

The price of crude oil was little moved in overnight trading ahead of the OPEC meeting in Vienna. This will be an important meeting because it comes at a time of numerous geopolitical tensions and when the price of oil is close to the yearly low. The US has also become the biggest oil producer. OPEC members account for more than 50% of all crude oil produced globally. Over the past few days, Saudi Arabia has convinced Russia that supply cuts are needed. However, the problem is on how to word the statement on reducing production without going against the US President, Donald Trump.

The USD was unchanged in overnight trading ahead of key employment data. Today, ADP will release its reading of the number of private sector payrolls in November. Traders expect the data to show an increase by 196K, which will be lower than October’s 227K. In the past, however, this number has differed greatly off the back of official government data that will be released tomorrow. In addition to this, traders will pay close attention to the jobless claims data, trade numbers, and the ISM non-manufacturing PMI.

EUR/USD

The EUR/USD pair was little moved overnight ahead of US jobs numbers. The pair is trading at 1.1345, which is unchanged from where it was yesterday. The consolidation in the pair was evident with the triangular pattern that has been forming. The current price is along the middle band of the Bollinger Band while the RSI and MACD are all in neutral positions on the four-hour chart below. This pattern will likely end today after the US jobs numbers.

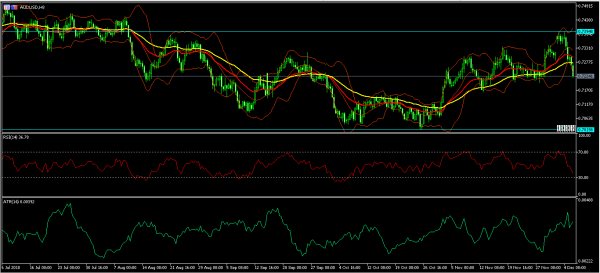

AUD/USD

The AUD/USD pair dropped sharply in overnight trading and reached an intraday low of 0.7220 after weak trade data. The pair’s price is now below the 25-day and 50-day EMA while the RSI has dropped from 70 to the current 36. The ATR, which measures volatility has increased to the highest level since September while the price is along the lower line of the Bollinger Band. Therefore, it is likely that the pair will continue the downward trend.

NZD/USD

After months of increase, the NZD/USD pair continued the downward trend started on Tuesday. In the past two days, the pair has dropped from a YTD high of 0.6970 to today’s intraday low of 0.6875. On the four-hour chart, the pair’s current price is along the 50-day EMA and lower than the 25-day EMA. The pair’s RSI has dropped from 72 on Tuesday to the current 38 and shows that there is a room for a further decline. There is a likelihood that the downward trend will continue today and the pair could test the important support of 0.6800.