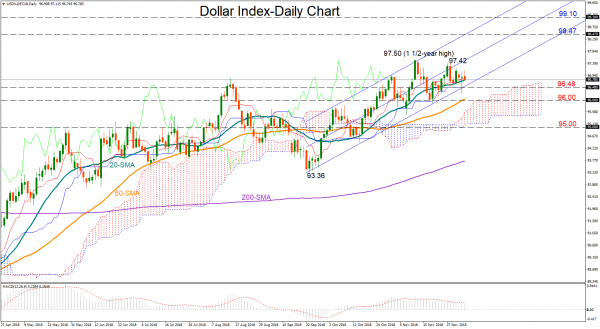

The dollar index has been moving sideways after unlocking 1 ½-year highs at 97.50 within the ascending channel. In the short term, consolidation will likely continue as the red Tenka-sen line looks to be steadying again above the blue Kijun-sen line which is also flat, while the MACD has slipped below its red signal line, though marginally.

On the upside, the index could retest the previous highs of 97.42 and 97.50 which are not far away from the middle bound of the bullish channel. A decisive close above the region could bring further buying interest into the market, pushing the price towards the upper line of the channel seen around 98.40. If that proves a weak obstacle too, resistance could run up to 99.10, with the outlook turning even more positive.

In case the index heads down, the lower bound of the channel seen at 96.48 could offer nearby support. An extension below that line and therefore out of the channel, would probably trigger further declines towards the 96.00 round level which halted downside movements in previous weeks. This is also where the 50-day simple moving average(SMA) is currently standing, adding some improvement to the level. A stronger wall, however, could be found around the 95.00 barrier, where any violation would confirm that the bullish phase has come to an end.

In the medium-term timeframe, the price is trending upwards, painting a positive picture. Given that the 50-day SMA continues to gain ground far above the 200-day SMA, the bullish sentiment might improve even further.

Summarizing, the dollar index is neutral in short term and bullish in medium term.