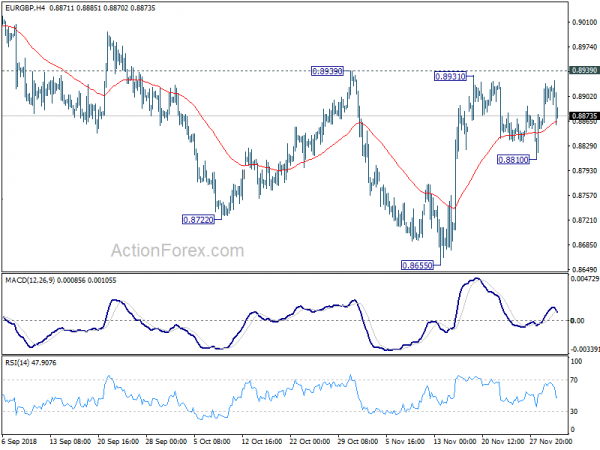

Despite dipping to 0.8810 last week, EUR/GBP quickly recovered. But there was no follow through buying through 0.8939 resistance. Initial bias is neutral this week first. On the upside, firm break of 0.8939 resistance will confirm completion of the fall from 0.9098 and turn outlook bullish for this resistance. On the downside, below 0.8810 will turn bias to the downside for 0.8655 low instead.

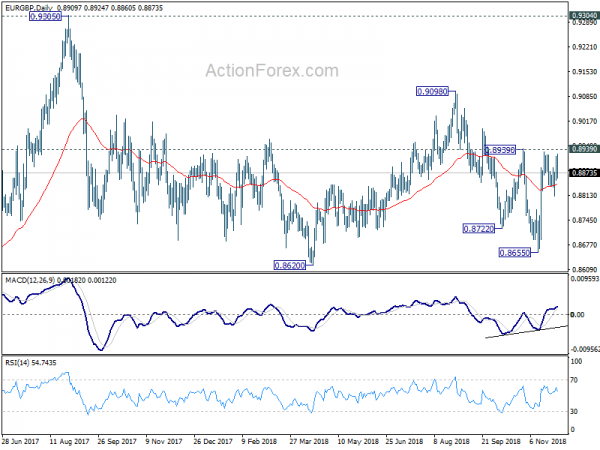

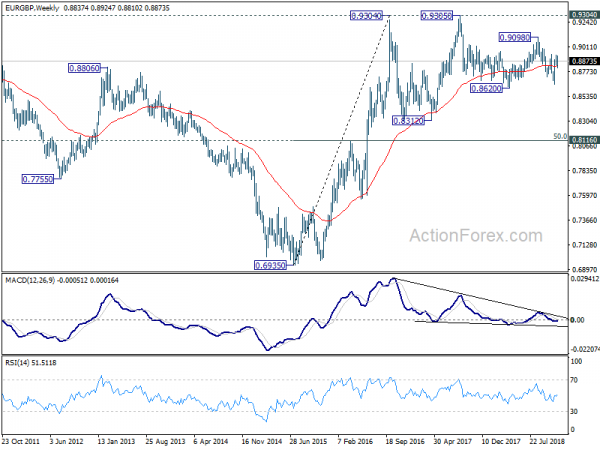

In the bigger picture, EUR/GBP is seen as staying in long term range pattern started at 0.9304 (2016 high). Sustained break of 0.8939 resistance will confirm that it’s in a medium term rising leg for 0.9098 and above. And for now, in case of another fall, downside will likely be contained by 0.8620/55 support zone to bring rebound.

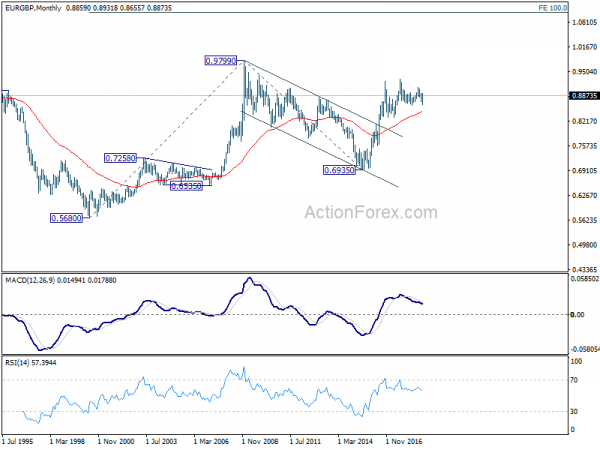

In the long term picture, we’re holding on to the view that rise from 0.6935 (2015 low) is resuming the up trend from 0.5680 (2000 low). Hence, after the consolidation from 0.9304 completes, we’d expect another medium term up trend through 0.9799 to 100% projection of 0.5680 to 0.9799 from 0.6935 at 1.1054.