The Canadian dollar has slid about 4% since the beginning of October on the back of the sell-off in crude oil – Canada’s biggest export earner. The currency’s weakness comes despite a mostly solid run of economic indicators out of Canada in recent months, which has allowed the Bank of Canada to pursue a monetary tightening path. Investors will therefore be watching Friday’s third quarter GDP release, due at 13:30 GMT, for clues as to how soon the next BoC rate hike can be delivered.

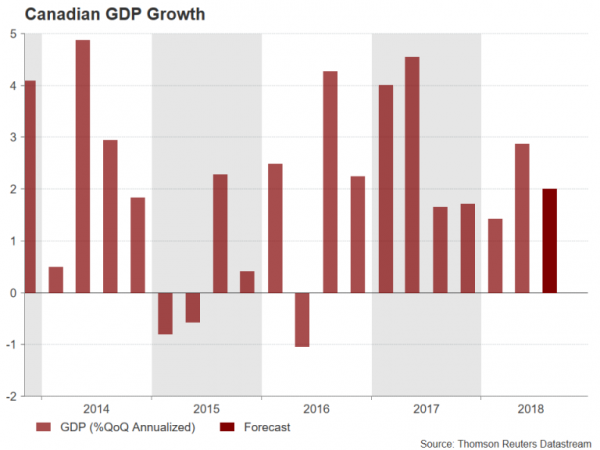

Canada’s economy grew by an annualized 2.9% during the second quarter, picking up some steam after three straight quarters of below 2% growth. The strong growth rebound that accompanied the recovery in oil prices that began in 2016 appears to have moderated and GDP growth in the third quarter is expected to have eased again to an annualized rate of 2.0%. However, the BoC has signalled it will continue to raise interest rates as the economy is operating close to full capacity and sees the risks to inflation being to the upside.

The Bank of Canada’s next meeting is on December 5 and most market participants are not expecting any change to the overnight rate, currently at 1.75%. According to overnight index swaps, the next rate hike is not priced in until the March 2019 meeting. But the odds for an earlier move could start to rise if the GDP numbers come in above consensus forecasts and incoming data after that, particularly inflation, is on the strong side.

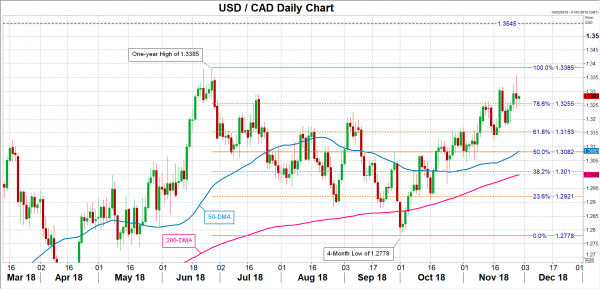

The loonie could enjoy a significant upside correction from rate hike expectations shifting forward as the Canadian currency had been looking a little oversold against the greenback after its recent losses. Dollar/loonie broke above the 1.33 level for the first time since June this week, hitting a 5-month peak. Stronger-than-expected GDP data could pull the pair below immediate support around 1.3255, which is the 78.6% Fibonacci retracement of the downleg from 1.3385 to 1.2778. Below this level, the next major support could come from the 1.3150 region, which is near the 61.8% Fibonacci level, while further down, steeper declines could pause at the 50% Fibonacci at 1.3082.

However, if the GDP numbers point to lacklustre growth, dollar/loonie could be set for additional gains, which could potentially be exasperated if this was to coincide with a further sell-off in oil. Dollar/loonie would eye the July top of 1.3385 in the event of disappointing data. Above this high, the area around 1.3545 is likely to come into focus as this was a frequently tested level in the past. A break higher would bring the 1.36 handle into range, which acted as resistance back in December 2016.

With the Bank of Canada maintaining a hawkish bias at its last policy meeting in October, a surprise early rate hike in December or January cannot be ruled out, especially given that the central bank has a history of catching the markets off guard. One of the things the BoC will be paying attention to in the GDP report is the employee compensation component for any signs of wage pressures. Like in most other advanced economies, wage growth in Canada has been muted since the financial crisis. Any indication that wage pressures are building could prompt the BoC to hike rates before March.

However, possibly offsetting accelerating wage growth are projections of lower oil production, which could hurt economic growth in the fourth quarter. Pipeline bottlenecks have led Canadian producers to restrict output in recent months to alleviate the problem. But the capacity constraints aren’t likely to be resolved anytime soon, while the recent plunge in oil prices is only adding to local producers’ woes.

Depending on how inflationary pressures and oil production evolve in the coming months, BoC Governor, Stephen Poloz, will probably keep markets guessing as to the timing of the next rate hike.