Dollar’s selloff continues today as markets are in deep concerned with US President Donald Trump’s political turmoil. The situation worsens after a report that Trump has intervened in FBI investigation on national security adviser Michael Flynn. House Oversight Committee chair Jason Chaffetz, a Republican, requested FBI to hand over all records of correspondence between form FBI director James Comey and Trump, by May 24. Chaffetz tweeted that "@GOPoversight is going to get the Comey memo, if it exists. I need to see it sooner rather than later. I have my subpoena pen ready." Meanwhile, Russian President Vladimir Putin offered to provide US Congress with a record of Trump’s meeting with Russian officials, just after firing Comey. It’s reported that Trump passed highly sensitive classified information to Russia at the meeting.

The dollar index dives through 98.54 support this week, partly also due to strength in Euro. Downside acceleration now put 50% retracement of 91.91 to 103.82 at 97.86 at risk. And a firm break there will pave the way to 61.8% retracement at 96.43. At this point, we’re still treating the decline from 103.82 as a correction. Hence, while it’s going deeper than expected, we’d expect support from 95.88 to contain downside and bring near term reversal.

European Council Tusk and European Commission Juncker talked on Brexit

European Council President Donald Tusk said today, referring to UK, that "the relationship between the EU and a non-member state cannot offer the same benefits as EU membership." And, a free trade agreement "even if it is ambitious and wide-ranging cannot mean participation in the single market or its parts." Also, "UK must be aware that any free trade agreement will have to ensure a level playing field and encompass safeguards against unfair competitive advantages through inter alia tax, social, environmental and regulatory measures and practices."

European Commission President Jean-Claude Juncker said three are three priorities for the first phase of Brexit negotiations. First and "foremost" both sides have to deal with the situation of more than four milling people. Those include 3.2m EU nationals living in UK and 1.2m Britons living in EU. Secondly, "all financial commitments given by the EU will be honoured by the UK". Thirdly,avoiding a hard border between Northern Ireland and the Republic of Ireland is one the the three priorities.

German DFM Spahn urged ECB exit

In Eurozone, German Deputy Finance Minister Jens Spahn urged ECB to exit from the ultra loose monetary policy soon. Spahn warned in a conference at the German foreign ministry that "unless monetary policy starts normalizing soon, negative side-effects will become more damaging." And, "regarding the euro zone, the ECB should be ready to exit the unconventional monetary policy not too late." However, there are also talks that ECB policy makers are likely still unconvinced by the inflation outlook even through headline CPI was at 1.9% in April. The key on ECB outlook will lie on the new staff economic projections to be released at the June ECB meeting.

BoJ Kuroda told PM Abe stimulus still needed

BoJ Governor Haruhiko Kuroda said he told Prime Minister Shinzo Abe that "Japan’s economy is steadily recovering and will continue to grow above its potential." Kuroda also expressed his confidence that price will rise. Nonetheless as inflation is still far from the 2% target, he told Abe that "we will continue with out monetary easing program. it’s generally expected that Kuroda will be given another five year term as BoJ Governor next year, after the current term ends.

On the data front…

Canada manufacturing shipments rose 1.0% mom in March, above expectation of 0.4% mom. Eurozone CPI was confirmed at 1.9% yoy in April, while core CPI was at 1.2% yoy. From UK, claimant counts rose 19.4k in April. Unemployment rate dropped to 4.6% in March. Average weekly earnings rose 2.4% 3moy in March. New Zealand PPI inputs rose 0.8% qoq in Q1, above expectation of 0.7% qoq. PPI outputs rose 1.4% qoq, above expectation of 1.1% qoq. Australia wage cost index rose 0.5% in qoq, meeting consensus. Westpac consumer sentiment dropped -1.1%. Japan machine orders rose 1.4% mom in March.

EUR/USD Mid-Day Outlook

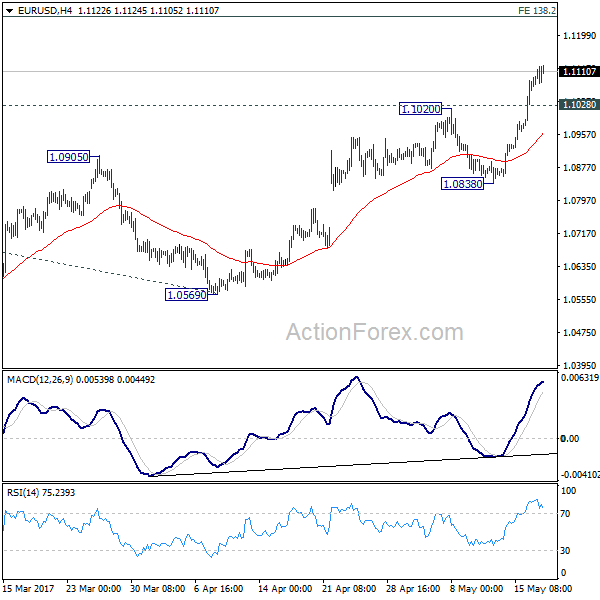

Daily Pivots: (S1) 1.1003; (P) 1.1050 (R1) 1.1128; More….

Intraday bias in EUR/USD remains on the upside as current rally continues. The pair would target 138.2% projection of 1.0339 to 1.0828 from 1.0569 at 1.1245, which is close to 1.1298 key resistance. For now, rise from 1.0339 is still viewed as a corrective move. Hence we’d expect strong resistance below 1.1245/98 to limit upside and bring reversal. On the downside, below 1.1028 minor support will turn bias neutral and bring consolidation. But break of 1.0838 support is needed to indicate short term topping. Otherwise, further rise will remain in favor.

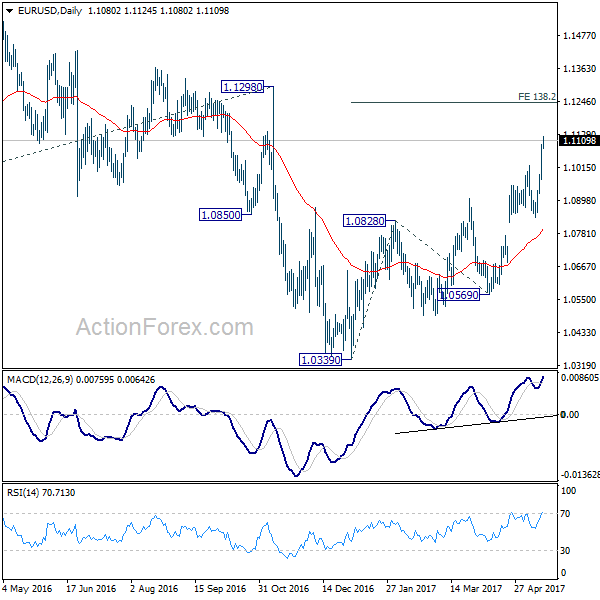

In the bigger picture, as long as 1.1298 key resistance holds, whole down trend from 1.6039 (2008 high) is still expected to continue. Break of 1.0339 low will send EUR/USD through parity to 61.8% projection of 1.3993 to 1.0461 from 1.1298 at 0.9115. However, considering bullish convergence condition in weekly MACD, break of 1.1298 will indicate long term reversal.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | PPI Inputs Q/Q Q1 | 0.80% | 0.70% | 1.00% | |

| 22:45 | NZD | PPI Outputs Q/Q Q1 | 1.40% | 1.10% | 1.50% | |

| 23:50 | JPY | Machine Orders M/M Mar | 1.40% | 2.50% | 1.50% | |

| 00:30 | AUD | Westpac Consumer Confidence May | -1.10% | -0.70% | ||

| 01:30 | AUD | Wage Cost Index Q/Q Q1 | 0.50% | 0.50% | 0.50% | |

| 04:30 | JPY | Industrial Production M/M Mar F | -1.90% | -2.10% | -2.10% | |

| 08:30 | GBP | Jobless Claims Change Apr | 19.4K | 25.5K | 33.5K | |

| 08:30 | GBP | Claimant Count Rate Apr | 2.30% | 2.20% | ||

| 08:30 | GBP | Average Weekly Earnings 3M/Y Mar | 2.40% | 2.40% | 2.30% | |

| 08:30 | GBP | ILO Unemployment Rate 3M Mar | 4.60% | 4.70% | 4.70% | |

| 09:00 | EUR | Eurozone CPI M/M Apr | 0.40% | 0.40% | 0.80% | |

| 09:00 | EUR | Eurozone CPI Y/Y Apr F | 1.90% | 1.90% | 1.90% | |

| 09:00 | EUR | Eurozone CPI – Core Y/Y Apr F | 1.20% | 1.20% | 1.20% | |

| 12:30 | CAD | Manufacturing Shipments M/M Mar | 1.00% | 0.40% | -0.20% | -0.60% |

| 14:30 | USD | Crude Oil Inventories | -2.5M | -5.2M |