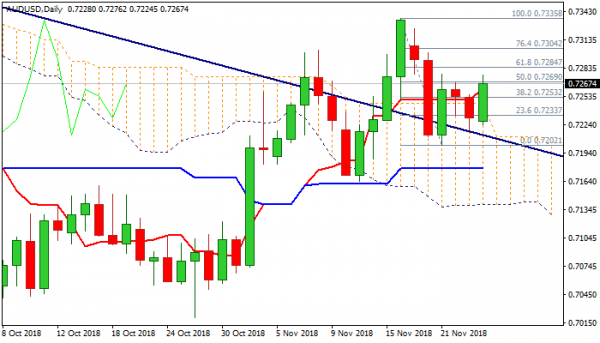

The Australian dollar rallied on Monday and recovered all losses from last Thu/Fri, to retest cracked Fibo barrier at 0.7269 (50% of 0.7335/0.7202 bear-leg. Ability to hold above thick daily cloud would keep hopes for further recovery, with improving daily techs as MA’s turn to bullish setup on today’s rally and momentum turned sideways just above the midline, after being in steady descend during past sessions. Close above 0.7269 pivot would generate fresh bullish signal and keep immediate focus shifted up. Bulls would then need break above Fibo barriers at 0.7284/0.7304 (61.8% and 76.4% of 0.7335/0.7202) to confirm continuation. The downside would remain vulnerable on another failure to close above 0.7269 pivot, with increased downside risk towards rising 20SMA (0.7226) and cloud top (0.7211) if today’s action ends below broken 100SMA (0.7245). Focus turns towards upcoming G20 meeting at the end of the week, where the top event will be meeting between US President Trump and Chinese President Xi. Two presidents are expected to talk about persisting trade problem, after the US announced the raise its current 10% tariff on Chinese goods to 25%. If tariff hike will be postponed after talks this would open way for further negotiations and would ease concerns about global war. Such scenario would improve market sentiment and likely further support Aussie dollar.

Res: 0.7269, 0.7284, 0.7304, 0.7335

Sup: 0.7257, 0.7245, 0.7226, 0.7211