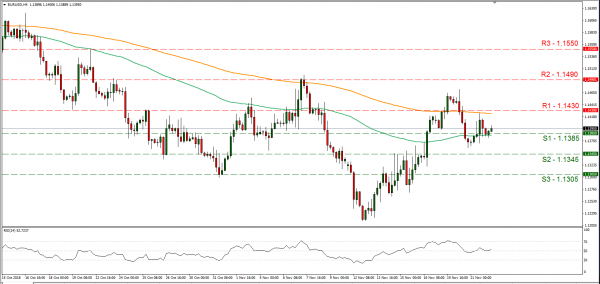

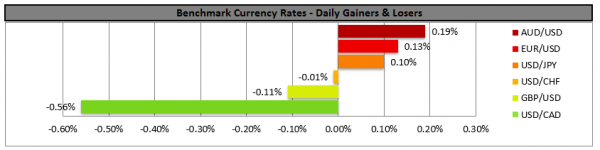

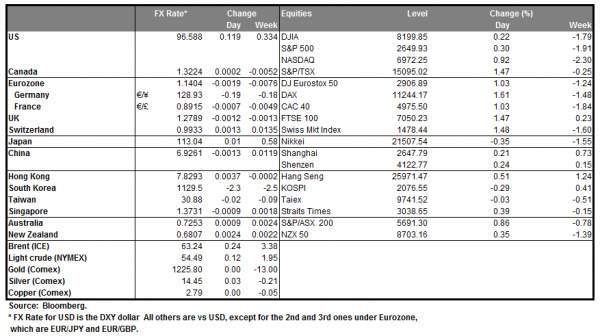

The EUR strengthened despite Brussels taking the first step towards disciplining Italy about it’s budget deficit. The European Commission stated yesterday that Italy was in breach of EU fiscal rules and should face EU action to reduce its deficit. Before the EU Commission’s decision, hopes started to appear for a possible solution as Italian Prime Minister Conte expressed worries about the government bond and committed to reforms. Also Italy’s Deputy Prime Minister Salvini, stated that he may be open to review the budget, however later retracted as he said that he was not open to discussion about the 2.4% deficit, according to media. Analysts point out that the market remains hopeful about the issue, as both sides have incentives to reach a compromise. Overall, we could see the issue lingering on and volatility could rise again for the common currency. EUR/USD spiked during the European session yesterday, breaking the 1.1385 (S1) resistance line (now turned to support), however corrected lower later on, teasing the prementioned support line. We could see the pair trading in a sideways movement, however the financial releases later today, as well as the Italian budget issue could affect the pair’s direction. Should the bulls dictate the pair’s direction we could see it breaking the 1.1430 (R1) resistance line and aim for the 1.1490 (R2) resistance barrier. On the other hand should the bears take over, we could see the pair breaking the 1.1385 (S1) support line and aim for the 1.1345 (S2) support hurdle.

Theresa May meets Juncker ahead of EU summit

UK’s PM Theresa May met with EU Commission’s President Juncker in an effort to secure a draft document regarding UK’s post Brexit ties with the EU ahead of the EU summit. The EU leaders are to meet on Sunday in order to ratify the draft agreement about UK’s withdrawal from the bloc and outline its future relationship with the UK. Main issues could include Spanish objections regarding Gibraltar, as well as fishing rights disputes from northern member states. Germany’s Chancellor Merkel stated that she remains optimistic about a possible solution until Sunday, however didn’t know how, as per media. In the inner political front, the DUP seems to be hardening its no-stance, while the Theresa May threatened with a possible no-Brexit in case her plan does not pass. A last minute attempt to renegotiate the deal seems as a remote scenario, however volatility could continue for the pound as headlines reel in. Cable, kept a sideways movement yesterday, however with some bearish tendencies as it continuously tested the 1.2780 (S1) support line. In the absence of any financial releases for both sides, we could see the pair be highly sensitive to any further Brexit headlines. Should the pair be under selling interest, we could see cable breaking the 1.2780 (S1) support line and aim for the 1.2700 (S2) support zone. Should on the other hand, the market favor the pair’s long positions, we could see cable breaking the 1.2850 (R1) resistance line and aim for higher grounds.

In today’s other economic highlights:

In the European session we could some volatility for EUR pairs as ECB will release the account of its last monetary policy meeting, while during the American session today, we get the preliminary release of Eurozone’s consumer confidence indicator for November. As for speakers, BOC Council member Wilkins, ECB’s Mersch and BoE’s Saunders speak.

EUR/USD H4

Support: 1.1385 (S1), 1.1345 (S2), 1.1305 (S3)

Resistance: 1.1430 (R1), 1.1490 (R2), 1.1550 (R3)

GBP/USD H4

Support: 1.2780 (S1), 1.2700 (S2), 1.2600 (S3)

Resistance: 1.2850 (R1), 1.2920 (R2), 1.3015 (R3)