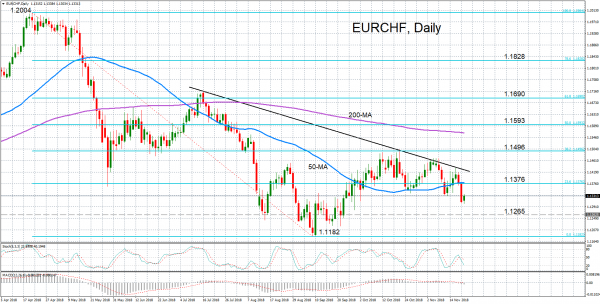

EURCHF has slipped back below its 50-day moving average (MA), touching a two-month low of 1.1303 earlier today. The near-term bias is looking bearish again with the MACD histogram returning to negative territory and falling below its signal line, while the stochastics are declining sharply.

Further declines would likely drive the pair towards the nearest support around 1.1265 – a previous congestion zone. Failure to hold above this support would risk a breach of September’s 13-month low of 1.1182. If broken, this would bring into focus the psychological 1.11 handle.

To the upside, immediate resistance could be met at the 23.6% Fibonacci retracement of the downleg from 1.2004 to 1.1182, at 1.1376. This is also where the 50-day MA is converging, suggesting the area could prove a difficult barrier to overcome. Higher up, further resistance could come from the descending trend line, which has been capping advances since July.

A break above the descending trendline would shift the short-term bearish picture to a more positive one and place EURCHF in a stronger position to re-challenge 38.2% Fibonacci at just below the 1.15 level. The 38.2% Fibonacci halted the pair’s rebound back in October. A successful attempt to cross above it could mark the start of a more bullish picture in the medium term.