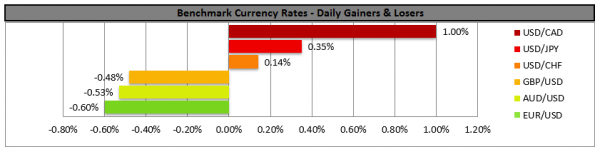

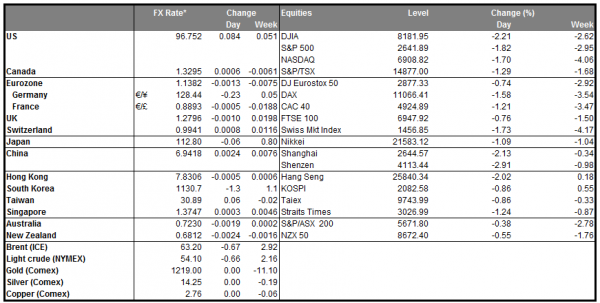

The USD strengthened against a number of its counterparts yesterday, as its safe haven qualities gathered support. Yesterday’s stock market rout, turned investors towards the greenback, as risk aversion rose on escalating worries about global growth and further tensions in the US-Sino relationships. It should be mentioned that the US administration yesterday, said that China has to alter its unfair practices, mounting further pressure according to media. Please note that the expected rate hike by the Fed in December, may currently be providing a positive short term bias for the USD as well. The strengthening of the USD was more obvious against the CAD, as the commodity currency weakened, probably due to falling oil prices, as Canada is a major oil producer. Volatility could continue for the USD, just before the Thanksgiving holiday.

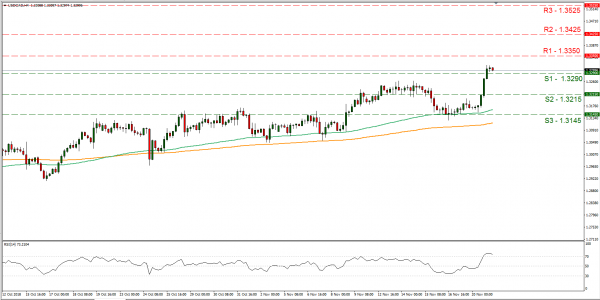

USD/CAD rallied yesterday, breaking consecutively the 1.3215 (S2) and the 1.3290 (S1) resistance levels (now turned to support). We could see the pair stabilising today, as it seems to have taken a breather during the Asian session, however the direction still remains uncertain. The main risk factors to watch out for could include today’s financial releases, oil prices and investor’s sentiment towards the USD as described above. Please note, that the pair’s RSI in the 4 hour chart has surpassed the reading of 70, implying a rather overcrowded long position. Should the pair find fresh buying orders along its path we could see it breaking the 1.3350 (R1) resistance line and aim for the 1.3425 (R2) resistance level. On the other hand, should the pair come under the selling interest of the market, we could see it breaking the 1.3290 (S1) support line and aim for the 1.3215 (S2) support level.

EUR weakens as the Italian effect takes place once again

The EUR traded with a bearish bias against the USD, as wider confidence in the common currency retreated yesterday. Worries grew among investors about the EUR, as the Italian bank shares hit a two year low and the spread between German and Italian bond yields widened, according to analysts. We see the case for the single currency to remain under pressure as the possibility of further tensions between Rome and Brussels continues and Eurozone’s preliminary PMI’s for November are to be released on Friday. We could see volatility continuing to dominate EUR pairs however with a bearish bias this time.

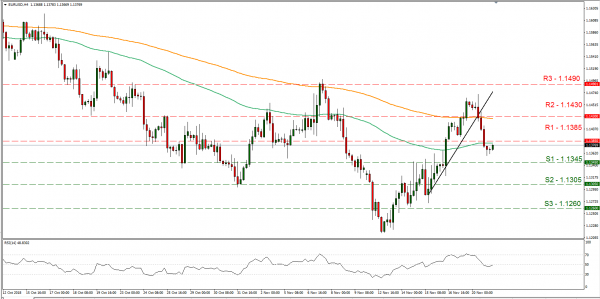

EUR/USD dropped yesterday breaking the upward trendline incepted since the 15th of November and the 1.1430 (R2) as well as the 1.1385 (R1) support lines (now turned to resistance). As the pair broke the prementioned upward trendline, we lift our bullish bias and the pair’s stabilization during the Asian session today, could enable the pair to open a new leg. Should the bulls dictate the pair’s direction, we could see the pair breaking the 1.1385 (R1) resistance line and aim for the 1.1430 (R2) resistance hurdle. Should the bears continue to reign over the pair, we could see it breaking the 1.1345 (S1) support line and aim for the 1.1305 (S2) support barrier.

In today’s other economic highlights:

During the American session today we get from Canada the Wholesale sales growth rate for September, the US Durable goods orders growth rates for October, the number of existing US home sales for October, the final release of the Michigan Consumer Sentiment indicator for November and the EIA Crude Oil inventories figure. Please be advised that the API crude oil inventories figure showed an unexpected drawdown which provided some support for oil prices, however should you be interested in more fundamentals and technical analysis for oil please refer to our weekly oil outlook due out later today .

USD/CAD H4

Support: 1.3290 (S1), 1.3215 (S2), 1.3145 (S3)

Resistance: 1.3350 (R1), 1.3425 (R2), 1.3525 (R3)

EUR/USD H4

Support: 1.1345 (S1), 1.1305 (S2), 1.1260 (S3)

Resistance: 1.1385 (R1), 1.1430 (R2), 1.1490 (R3)