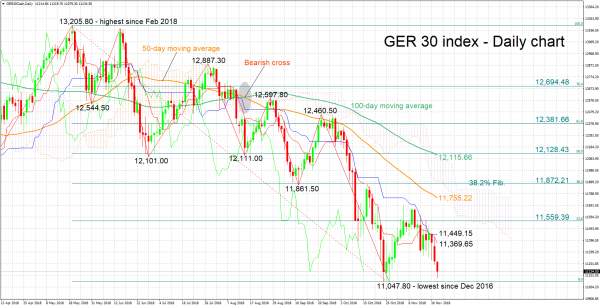

The Germany 30 index is declining for the third straight day and is currently trading not far above its lowest since December 2016 of 11,047.80 hit in late October.

The Tenkan- and Kijun-sen lines are negatively aligned in support of a bearish bias in the short term.

Additional declines may find support around the near two-year nadir of 11,047.80; the area around this also encapsulates the 11,000 mark that may be of psychological significance. Below, the zone around 10,800 that halted advances numerous times in 2016 could act as support. Even lower, the region around 10,500 which was congested in 2016 may be of importance.

On the upside, resistance could occur around the current levels of the Tenkan- and Kijun-sen lines at 11,369.65 and 11,449.15 respectively. Further above, a barrier may be found around 11,559.39, the 23.6% Fibonacci retracement level of the downleg from 13,205.80 to 11,047.80. More bullish movement would bring the current level of the 50-day moving average line at 11,755.22 within scope.

The medium-term picture is clearly bearish: the index is in a downtrend, recording lower highs and lower lows. Additionally, price action is taking place below the 50- and 100-day MAs, as well as below the Ichimoku cloud.

Overall, both the short- and medium-term outlooks appear negative at the moment. For perspective, the index is down by 16.5% in 2018.