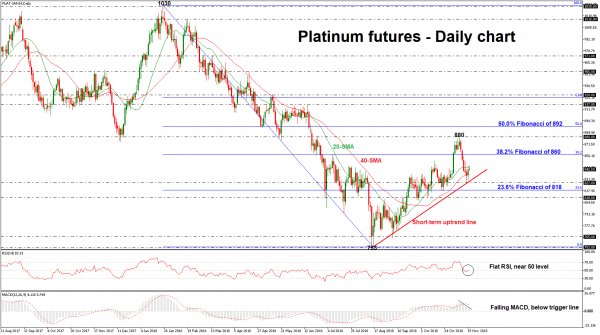

Platinum futures delivered on January 2019 are moving higher over the last three months, following the bounce off the 753 support level. The price seems to be in a bullish correction mode as it surpassed the first significant level of Fibonacci barriers, the 23.6% level, taken from the downleg from 1030 to 753, near 818.

From the technical point of view, the RSI indicator looks neutral near the 50 level, while the MACD oscillator holds below the trigger line but remains above the zero line.

Should the white gold manage to strengthen its positive momentum, the next resistance could come around the 38.2% Fibonacci mark of 860. A break above this level would drive the commodity until the latest high of 880 before challenging the 50.0 %Fibonacci of 892.

However, if prices violate the short-term bullish trend line and the 827 support to the downside the next barrier is coming from the 23.6% Fibonacci of 818. The next key support to watch slightly lower is the 810 level, taken from the bottom on October 8. A drop below this barrier could signal a resumption of the long-term downtrend that’s been developing since January 28.

Overall, the short-term structure indicates a bullish correction as the price hovers above the rising diagonal line, however, the technical indicators are pointing for further losses in the very near term.