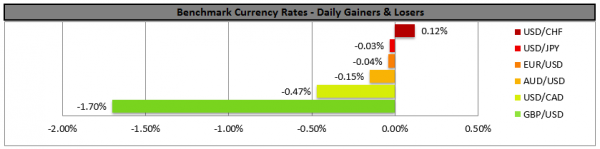

The pound had a heavy drop against a number of currencies yesterday, as two senior ministers resigned, plunging the government into crisis. As a result, cable suffered one of its steepest drops in one day marking a 1.7% dive, the widest for more than a year. Amidst resignations, a possible leadership contest in the Tory party, fears of the Brexit deal collapsing, investors seem to have priced out also the possibility for the BoE hiking next year. UK’s PM Theresa May vowed to continue in a statement after the resignations were made known and supported the Brexit deal as she did previously in parliament. Analysts point out, that the possible outcomes now range from the current deal, to hard Brexit, a general elections, as well as a new referendum. Volatility is expected to continue for the pound, as further Brexit headlines could continue to reel in.

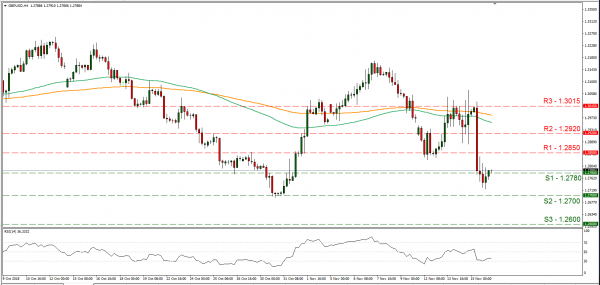

Cable dropped heavily yesterday, freefalling from 1.3015 (R3) and breaking consecutively the 1.2920 (R2) and the 1.2850 (R1) support lines (now turned to resistance). It continued to drop by testing the 1.2780 (S1) support line and for a brief period breaking it, only to correct later on. The pair seems to have stabilised for now, however volatility could occur towards both directions, depending on the headlines about Brexit today. Should the bulls be in control of the pair’s direction we may see it breaking the 1.2850 (R1) resistance line and aim for the 1.2920 (R2) resistance hurdle. Should the bears take over once again, we could see cable breaking the 1.2780 (S1) support line and aim for the 1.2700(R2) support level.

Oil prices remain stable after record inventories injection

Oil prices remained rather stable yesterday, despite the EIA showing a record injection in the crude oil inventories of 10.27 million barrels. The injection is considered as the widest in 2018, and was accompanied by a record production of US crude oil of 11.7 million bpd, last week. It should be noted though that the news could have been overshadowed by reports stating that OPEC may intent to cut production substantially. Overall the market seems to be in a wait and see position, maintaining the current level of pricing. Analysts point out though, that crude oil may be oversold and could bounce from current levels, as OPEC+ dials back production in December. Oil prices could be at a turning point right now and as analysts point out, the current level of oil prices may be presenting an opportunity for buyers to enter the market.

WTI prices remained rather stable yesterday, above the 56.15 (S1) support line. Technically, despite the stability in the price action of WTI in the past two days, we would require the commodity to break the downward trendline incepted since the 3rd of October in order to lift our bearish bias. Should black gold’s price action, find fresh buying orders along its path, we could see it breaking the 58.30 (R1) resistance line and aim for the 60.00 (R2) resistance hurdle. Should on the other hand, WTI come under the selling interest of the market, we could see it dropping and breaking the 56.15 (S1) support line and aim for the 54.15 (S2) support area.

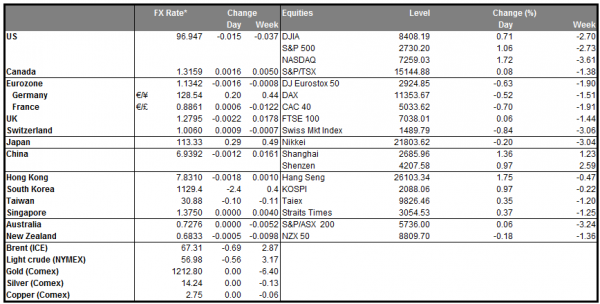

In today’s other economic highlights:

In today’s European session we get Eurozone’s final HICP rate for October. In the American session, Canada’s manufacturing sales growth rate for September, the US industrial production growth for October and the Baker Hughes oil rig count figure are to be released. As for speakers, ECB president Mario Draghi, German BuBa president Jens Weidmann and Chicago Fed President Charles Evans speak.

GBP/USD H4

Support: 1.2780 (S1), 1.2700 (S2), 1.2600 (S3)

Resistance: 1.2850 (R1), 1.2920 (R2), 1.3015 (R3)

WTI 4H

Support: 56.15 (S1), 54.15 (S2), 52.10 (S3)

Resistance: 58.30 (R1), 60.00 (R2), 61.73 (R3)