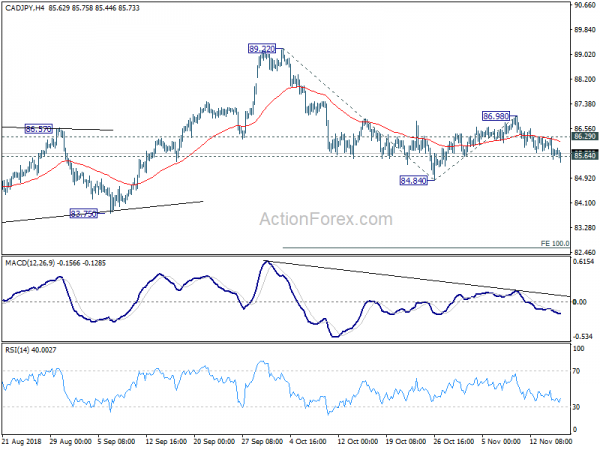

** Quick update: The position is stopped out with 66 pips loss within hours after this post. Following up on our position trading strategy mentioned in the weekly report, we’ve entered CAD/JPY short on break of 85.64 support. The development is actually quite disappointing as, despite WTI oil’s free fall to below 55, CAD remains relatively resilient. Though, Yen is starting to pick up some strength for rebound, with USD/JPY in risk of near term reversal.

Near term outlook in CAD/JPY remains unchanged that corrective rise from 84.84 should have completed at 86.98 already. So, we’d hold on to CAD/JPY and lower the stop from 87.00 to 86.30 (slightly above 86.29 minor resistance). A break of 86.29 will suggests that the corrective rise from 84.84 is going to extend with another rise and 86.98 will likely be breached. So, if we’re wrong in our view, there is no point in holding on to the stop at 87.00.

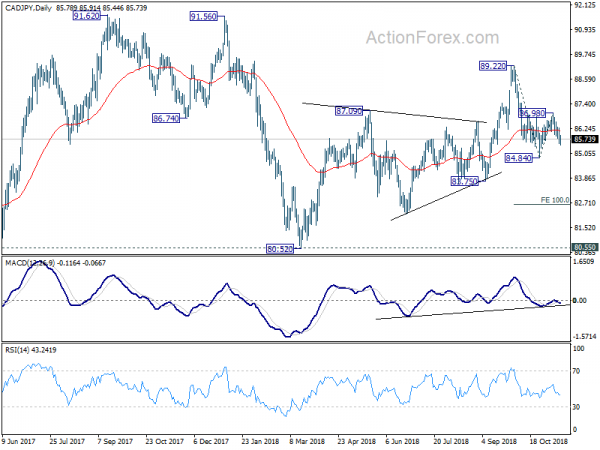

The overall larger outlook is unchanged that rise from 80.52 (March low) is a corrective three wave move that has completed at 89.22. Fall from 89.22 is, in a more bearish case, resuming the down trend from 91.62 (2017 high) through 80.52/55 support. Or in a less bearish case, fall fro 89.22 is a falling leg in the medium term range pattern. In either case, deeper decline is in favor to have a test on 80.52 low.