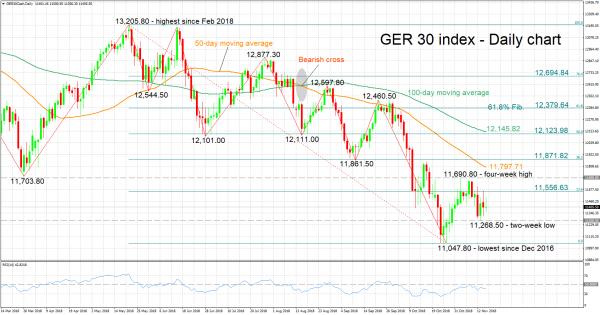

The Germany 30 index looks to have stabilized after recovering somewhat from its lowest since December 2016 of 11,047.80 hit in late October.

The RSI is in bearish territory below 50, though it’s been largely moving sideways in recent days, pointing to a mostly neutral short-term picture for the benchmark.

Index gains may meet initial resistance around 11,556.63, the 23.6% Fibonacci retracement level of the downleg from 13,205.80 to 11,047.80. Not far above lies early November’s four-week high of 11,690.80, with the area around it also encapsulating late March’s trough of 11,703.80. Steeper advances could stall around 11,871.82, the 38.2% Fibonacci mark. The region around this point includes the current level of the 50-day moving average line at 11,797.71 and a recent bottom at 11,861.50, something which perhaps increases its significance.

On the downside, a first line of support may come around 11,268.50, a two-week low touched on Tuesday. A downside violation would increasingly bring within scope the near two-year nadir of 11,047.80, with the zone around it also capturing the 11,000 handle that may be of psychological importance.

The medium-term outlook remains bearish, with the index being in a downtrend, recording lower highs and lower lows. Additionally, trading activity is taking place below the 50- and 100-day MAs, which maintain a negative slope.

Overall, the short-term bias looks predominantly neutral at the moment, and the medium-term picture continues to look negative.