Sterling is trading generally firm today as the EU and UK finally agreed on the withdrawal agreement. It will now have to go through Prime Minister Theresa May’s Cabinet today. That shouldn’t be too much a problem despite some open objection from Brexiteers. The main hurdle lies in the parliament which is now still uncertain. And that could be a reason for the Pound uncommitted strength.. Nevertheless, it’s trading as the second strongest next to New Zealand Dollar, followed by Australian Dollar. On the other hand, Canadian Dollar and Yen are the weakest ones. WTI crude oil’s free fall continues today and breached 55 to as low as 54.84. Yen could be weighed down slightly by GDP data. Dollar is the third weakest so far.

Technically, there isn’t much new development so far. USD/CHF and USD/JPY have both clearly lost upside momentum for further rise remain in favor. Similarly, USD/CAD’s rally is still in progress despite losing upside momentum. GBP/USD is seen as staying in consolidation pattern from 1.2661. Even if there is more upside in the pair, strong resistance will likely be see around 1.33, if it’s able to reach that level.

In other markets, DOW closed down -0.40% at 25286.49 overnight. S&P 500 dropped -0.15%. NASDAQ was flat at 7200.87. US treasury yields dropped quite notably. 10 year yield closed down -0.041 at 3.145. 30 year yield dropped -0.020 to 3.367. Near term consolidations in yields are extending. in Asia, Nikkei closed up 0.16% at 21846.48. But Hong Kong HSI, China Shanghai SSE and Singapore Strait Times are in red, down -0.57%, -0.88% and -0.58% at the time of writing. 10 year JGB yield is down -0.0053 at 0.11. It’s another factor pressuring Yen.

UK and EU agreed Brexit texts, May to hold Cabinet meeting today

The UK and EU have finally agreed on the texts of the Brexit withdrawal agreement after intensive work this week. UK Prime Minister Theresa May’s office confirmed and said “Cabinet will meet at 2:00pm tomorrow to consider the draft agreement the negotiating teams have reached in Brussels, and to decide on next steps.” And, “Cabinet ministers have been invited to read documentation ahead of that meeting”. Approval by the Cabinet will just make the deadline for holding a special EU summit by the end of November for the issue.

It’s reported that the agree will adopt a UK-wide customs backstop aimed preventing a hard Irish border. It’s so far unsure how much support May could get from her Cabinet. Boris Johnson and Jacob Rees-Mogg have already voiced objection to the draft agreement immediately. Johnson said the plan was “utterly unacceptable to anyone who believes in democracy” and he would vote against it. Rees-Mogg warned that UK would become a “vassal state” with Northern Ireland “being ruled from Dublin”. And Mogg added “It is a failure of the government’s negotiating position and a failure to deliver on Brexit”.

On the other hand, it’s reported that five senior ministers Dominic Raab, Jeremy Hunt, Sajid Javid, Michael Gove and Geoffrey Cox will back the Brexit deal.

Italy defies EU demand, kept deficit target and growth forecasts unchanged in 2019 budget

Italy refused to meet European Commission’s demand on revising its budget. Instead, the coalition government said that 2019 budget deficit target will be maintained at 2.4% of GDP. Growth forecast was also kept unchanged at 1.5%. The government statement noted that “we have the conviction that this is the budget needed for the country to get going again.” Nevertheless,the government pledged to beef up asset sales and monitor spending closely.

The European Commission have rejected Italy’s draft budget plan and requested re submission by November 13, yesterday. European Commission President Jean-Claude Juncker warned earlier this week that “the Italians are moving away not just from what they have promised us but also away from the minimum requirements of the stability pact.”

EU Malmstrom: If US auto tariffs were to happen, that would not be on EU

The US Commerce Department has submitted the draft recommendations regarding Section 232 national security tariffs on autos to the White House this week. The recommendations were discussed at a regular weekly meeting of Trump’s top trade officials yesterday. So far, no immediate action is taken by Trump.

At the same time, EU Trade Commissioner Cecilia Malmstrom will meet US Trade Representative Robert Lighthizer on Wednesday to carry on trade negotiations. Ahead of that, she said “We assume that if that (U.S. auto tariffs) were to happen, that would not be for the European Union,”. She referred to the agreement between Trump and European Commission President Jean-Claude Juncker that auto tariffs won’t apply to the EU when negotiations are still on going. Malmstrom also reiterated that the scope of the EU-US trade deal will be “limited” to industrial goods. She emphasized “be very clear, it will not include agriculture.”

Juncker said earlier this week that “we had achieved that there will not be a new trade conflict over the summer months until the end of the year, particularly with regard to car tariffs.”

Japan GDP contracted -0.3% qoq, exports contracted at fastest pace in over three years

Japan GDP contracted -0.3% qoq in Q3, matched expectation. Annualized rate showed -1.2% contraction, worse than expectation of -1.0%. GDP deflator dropped -0.3%, lowest than expectation of -0.2%. One detail to note is that exports contracted -1.8% qoq, fastest decline in over three years. It seems that the contraction in Q3 cannot be explained only by natural disasters. But the steep contraction in exports argued that US related trade tensions was also weighing on the economy of Japan. Though, it will take another quarter or two to really gauge the impact from protectionism.

Japan Economy Toshimitsu Motegi sounded confident and optimistic though. He said that “Japan’s economy is expected to recover driven mainly by domestic demand. Though he also warned that “we need to be vigilant to the impact of overseas uncertainties, financial market volatility and how trade problems affect the global economy.”

Also from Japan, tertiary industry index dropped -1.1% mom in September versus expectation of -0.4% mom. Industrial production dropped -0.4% mom versus expectation of -1.1% mom.

Looking ahead

The economic is rather busy today. Eurozone and Germany will release Q3 GDP. UK will release CPI and PPI. Later in the data US will also release CPI.

GBP/USD Daily Outlook

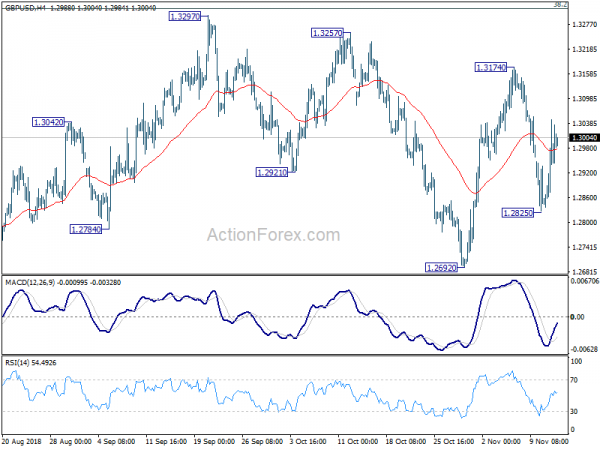

Daily Pivots: (S1) 1.2857; (P) 1.2952; (R1) 1.3063; More…

GBP/USD’s rebound from 1.2825 extends further but stays below 1.3174 resistance. Intraday bias remains neutral and outlook is unchanged. Price actions from 1.2661 are viewed as a consolidation pattern, that could be extending. In case of stronger rise, strong resistance should be seen at 1.3316 fibonacci level to limit upside to bring down trend resumption eventually. On the downside, below 1.2825 will resume the fall from 1.3174 to 1.2661/92 key support zone. Decisive break there will resume larger down trend from 1.4376.

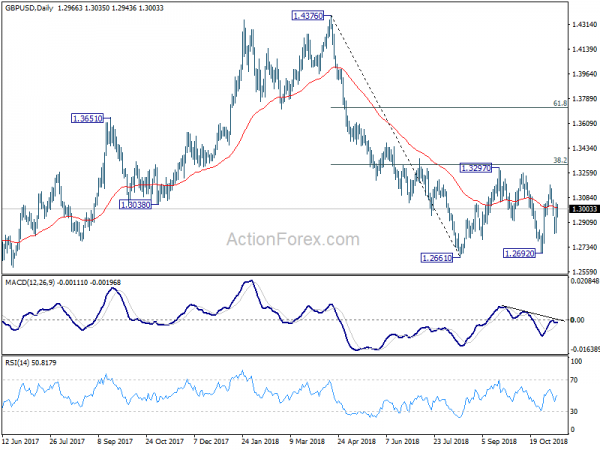

In the bigger picture, whole medium term rebound from 1.1946 (2016 low) should have completed at 1.4376 already, after rejection from 55 month EMA. The structure and momentum of the fall from 1.4376 argues that it’s resuming long term down trend. And this will be the preferred case as long as 38.2% retracement of 1.4376 to 1.2661 at 1.3316 holds. However, firm break of 1.3316 would bring stronger rebound to 61.8% retracement at 1.3721. And, the eventual depth of the fall from 1.4376, and the chance of hitting 1.1946 low, will depend on the strength of the interim corrective rebound from 1.2661.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | AUD | Westpac Consumer Confidence Nov | 2.80% | 1.00% | ||

| 23:50 | JPY | GDP Q/Q Q3 P | -0.30% | -0.30% | 0.70% | |

| 23:50 | JPY | GDP Deflator Y/Y Q3 P | -0.30% | -0.20% | 0.10% | 0.00% |

| 0:30 | AUD | Wage Price Index Q/Q Q3 | 0.60% | 0.60% | 0.60% | 0.50% |

| 2:00 | CNY | Retail Sales Y/Y Oct | 8.60% | 9.20% | 9.20% | |

| 2:00 | CNY | Industrial Production Y/Y Oct | 5.90% | 5.80% | 5.80% | |

| 2:00 | CNY | Fixed Assets Ex Rural YTD Y/Y Oct | 5.70% | 5.50% | 5.40% | |

| 4:30 | JPY | Tertiary Industry Index M/M Sep | -1.10% | -0.40% | 0.50% | 0.40% |

| 4:30 | JPY | Industrial Production M/M Sep F | -0.40% | -1.10% | -1.10% | |

| 7:00 | EUR | German GDP Q/Q Q3 P | -0.30% | 0.50% | ||

| 9:30 | GBP | CPI M/M Oct | 0.20% | 0.10% | ||

| 9:30 | GBP | CPI Y/Y Oct | 2.50% | 2.40% | ||

| 9:30 | GBP | Core CPI Y/Y Oct | 2.00% | 1.90% | ||

| 9:30 | GBP | RPI M/M Oct | 0.20% | 0.00% | ||

| 9:30 | GBP | RPI Y/Y Oct | 3.40% | 3.30% | ||

| 9:30 | GBP | PPI Input M/M Oct | 0.60% | 1.30% | ||

| 9:30 | GBP | PPI Input Y/Y Oct | 9.60% | 10.30% | ||

| 9:30 | GBP | PPI Output M/M Oct | 0.20% | 0.40% | ||

| 9:30 | GBP | PPI Output Y/Y Oct | 3.10% | 3.10% | ||

| 9:30 | GBP | PPI Output Core M/M Oct | 0.20% | 0.10% | ||

| 9:30 | GBP | PPI Output Core Y/Y Oct | 2.40% | 2.40% | ||

| 9:30 | GBP | House Price Index Y/Y Sep | 3.30% | 3.20% | ||

| 10:00 | EUR | Eurozone Industrial Production M/M Sep | -0.40% | 1.00% | ||

| 10:00 | EUR | Eurozone GDP Q/Q Q3 P | 0.20% | 0.20% | ||

| 13:30 | USD | CPI M/M Oct | 0.20% | 0.10% | ||

| 13:30 | USD | CPI Y/Y Oct | 2.50% | 2.30% | ||

| 13:30 | USD | CPI Core M/M Oct | 0.20% | 0.10% | ||

| 13:30 | USD | CPI Core Y/Y Oct | 2.20% | 2.20% |