Here are the latest developments in global markets:

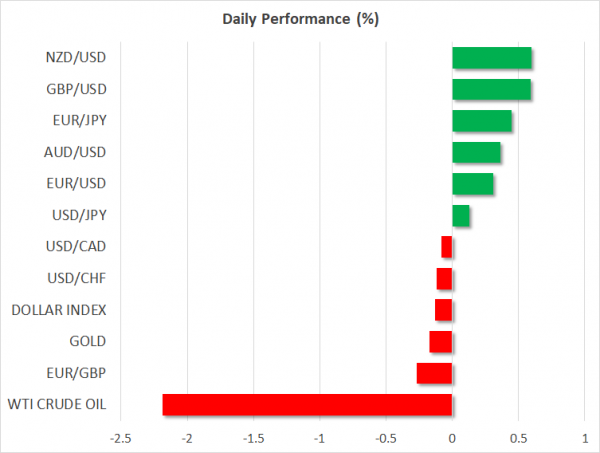

- FOREX: Three-month average earnings including bonuses grew by 3.0% y/y in September in the UK, while the ex-bonus measure jumped by 3.2% y/y versus 3.1% expected. The pound, though, saw little upside as the unemployment rate inched up by 0.1 percentage points to 4.1%, while more importantly the Brexit pessimism remained elevated despite the British Cabinet Secretary saying that a divorce agreement is in a “touching distance”. Pound/dollar was flirting with the 1.29 key level (+0.40%) after dropping as low as 1.2825 on Monday. Pound/yen recorded a stronger rebound, jumping by 0.64% as interest for the safe-haven yen somewhat slowed down following encouraging trade headlines; sources supported that the US Treasury Secretary, Steven Mnuchin and the Chinese Vice Premier Liu He have started discussions to de-escalate trade tensions between the nations. This comes a few weeks ahead of a crucial meeting between Trump and the Chinese leader during the G20 gathering in Argentina. Turning to Eurozone, the Italian government is expected to submit a revised form of its budget plan today and while analysts think that Rome will stick to its deficit targets it would be interesting to see how Italy will achieve it. Euro/dollar was standing slightly higher at 1.1248 (+0.27%), while euro/pound was down at 0.8703 (-0.31%). Dollar/yen managed to break marginally above the 114.00 level despite US Treasury yields opening with a gap down today. The dollar index flattened around 97.53, near 1 ½-year highs. In antipodean markets, the risk-sensitive aussie/dollar and kiwi/dollar benefitted from trade optimism, crawling up by 0.36% and 0.52% respectively. Dollar/loonie paused around 1.3231 after reaching four-month highs at 1.3249 on Monday.

- STOCKS: European stocks rebounded on Tuesday after closing lower in the previous day as the slump in the technology sector triggered by Apple’s weaker forecasts recovered with hopes the US and China could resume trade negotiations. Gains in telecoms were also supportive. The pan-European STOXX 600 and the bleu-chip Euro STOXX 50 climbed by 0.56% and 0.66% respectively at 1000 GMT. The German DAX 30 rose by 0.66%, the French CAC 40 increased by 0.42% and the UK’s FTSE 100 improved by 0.46%. The Italian FTSE MIB rose by 0.33%. In Asia markets closed mixed, with Japanese equities losing around 2.0% and Chinese stocks winning around 1.0%. In the US, futures tracking the S&P 500, Dow Jones and Nasdaq 100 are flashing green, pointing to a positive open after starting the week with sharp selling.

- COMMODITIES: Oil prices extended substantially lower after Trump’s OPEC tweet yesterday messaged that oil prices should remain lower, a day after Saudi Arabia said that OPEC and its allies are looking for a supply cut next year. WTI crude and Brent plunged by more than 2.0%, with the former sinking to $67/barrel, the lowest since April, and the latter diving to $58.51/barrel, a price never seen since February. In precious metals, the strength in the dollar pushed gold to a one-month low of $1,196.5/ounce (-0.35%).

Day Ahead: Italy’s budget and Brexit in spotlight; overnight Japan, Australia and China will publish economic data

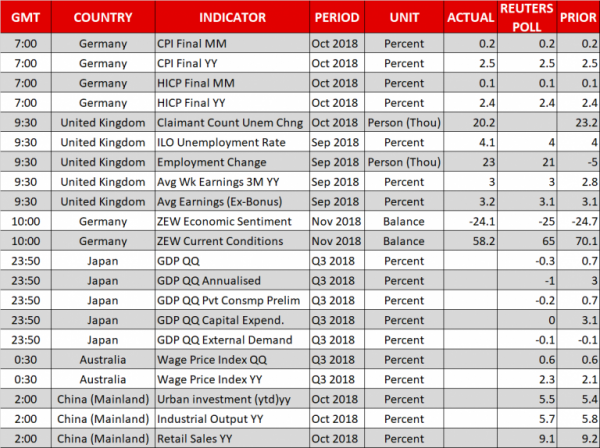

The economic calendar will turn quiet in terms of data releases in the remainder of the day, however, the Brexit problem and the Italian budget story might keep investors on the toes in coming sessions. Overnight, Japan will release GDP growth figures, Australia will issue wage growth data and China will publish retail sales, industrial output, and urban investment.

In the Eurozone, any news on Italy’s budget could drive the euro during the day. Today is the deadline for the Italian government to adjust its fiscal demands after the EU commission rejected Rome’s proposed spending plans and asked for revision. The EU legislator body published its own projections for the Italian economy based on the policies Rome wants to put forward, concluding that Italy’s own growth forecasts are optimistic and that its deficit could be in fact 2.9% of GDP in 2019, instead of 2.4% the Italian government is insisting. While forecasts are for Italy to stand pat on its 2019 spending plans, sources support that the government could reduce its growth estimates for next year to persuade Brussels that deficit will not run above 2.4% of GDP in 2019.

Brexit will remain in the center stage as well as investors try to figure out whether negotiations are on a good path. Earlier in the day, David Lidington, the British Cabinet Office Minister, encouraged that a Brexit deal is “almost within touching distance” and could be concluded within 48 hours. Particularly, asked if a deal is possible in the next 24-48 hours, he said “still possible but not at all definite.”

In terms of data releases, preliminary Japanese GDP growth data for Q3 will come into view during the Asian morning on Wednesday (2350 GMT, Tuesday). Forecasts are for the Japanese economy to have posted a negative reading of 0.3% q/q, after growing by 0.7% in Q2, while on an annualized basis, the gauge is said to have declined by 1.0% compared to a strong 3.0% expansion seen previously – the highest since August 2017. Capital expenditures and consumption GDP components will be closely watched as well. In the wake of an upbeat GDP report, the yen could attract buying interest and vice versa.

In Australia, the wage price index for Q3 is expected to come higher at 2.3% y/y, from 2.1% in Q2 and the aussie is highly anticipated to cheer on the data if those surprise to the upside. Around 0200 GMT, the currency could see further volatility as China, Australia’s major export partner is scheduled to report on retail sales industrial output, and urban investment, all for October.

Chinese industrial output growth is expected to tick lower to 5.7% y/y versus 5.8% in the preceding month, while urban investment is estimated to inch up to 5.5% y/y from 5.4% before. Moreover, retail sales growth is expected to decline marginally to 9.1% y/y from 9.2% previously.

As of today’s, public appearances, Fed Board Governor Lael Brainard (permanent FOMC voting member) and Minneapolis Fed President Neel Kashkari will be speaking at 1500 GMT. Later at 1920 GMT, comments from Philadelphia Fed President Patrick Harker (non-voter in 2018) will be also in focus. Meanwhile in the Eurozone, ECB Vice President Luis de Guindos will be giving remarks at 1900 GMT at the Euro Finance Week event organized by Deutsche Bundesbank in Frankfurt, Germany.