Sterling continues to trade as the weakest one for today as negative Brexit news fly around. It’s reported that European Council President Donald Tusk has given UK Prime Minister Theresa May a deadline for an extra November summit. And enough progress has to be made by this Wednesday night. So far, there is little hope to achieve anything significant within that short time frame. In particular, May is losing more support from her own party on the Irish backstop exit. That is, it’s clear that May wouldn’t have enough for for the plan if UK cannot quit the backstop unilaterally.

Euro is following as the second weakest on Italy-EU budget showdown. Italy will resubmit a new or revised plan tomorrow. There could be disciplinary actions by the European Commission if they’re not satisfied with the plan. The development also drags down Swiss Franc. On the other hand, Canadian Dollar is the strongest one for today, partly because it’s digesting last week’s loss. And, it’s partly because Saudi Arabia announced to cut oil exports by 500k bpd starting December. Dollar and Yen follow as the next strongest.

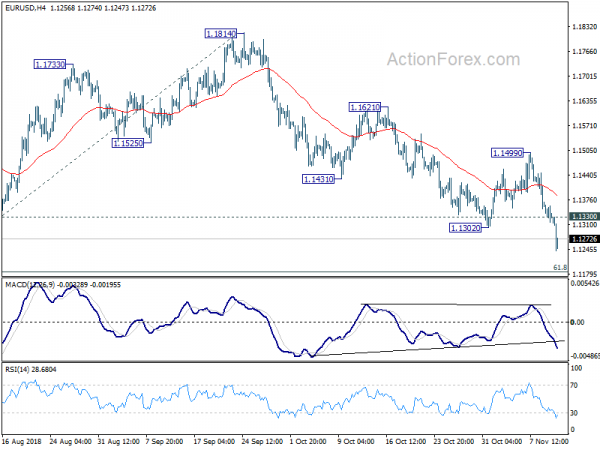

Technically, EUR/USD finally broke 1.1300 key support to resume medium term down trend from 1.2555. USD/CHF also broke 1.0094 resistance to resume recent rebound. GBP/USD’s break of 1.2951 earlier today is a sign of weakness too. Condition is now set for more rally in Dollar. And 0.7182 minor support in AUD/USD starts to look vulnerable.

In other markets, FTSE is trading down -0.18% at the time of writing. DAX is down -0.86% and CAC is down -0.25%. German 10 year yield is down -0.023 at 0.386, back below 0.4 handle. Italian 10 year yield is up 0.051 at 3.449. German-Italian spread is back above 300. Earlier today, Nikkei closed up 0.09%, Hong Kong HSI up 0.12%, China Shanghai SSE up 1.22%, Singapore Strait Times down -0.32%. 10 year JGB yield closed down -0.0071 at 0.118, which is a sign of market cautiousness.

BoE Broadbent warns sequence of Brexit events in the coming months could change economic outlook materially

BoE Deputy Governor Ben Broadbent reiterated in a CNBC interview that the central bank’s forecasts were “conditioned on an assumption that there will be a deal” on Brexit. In particular, there would be a “transition period agreed”. And to him, a Brexit deal is still “the most likely outcome”. However, he also emphasized that “the sequence of events over the next two to three months could change the outlook materially,”

On recent volatility in Pound exchange rate he noted “obviously, over time, every day there are headlines, positive, negative, which will send the currency in particular in one direction or the other.”

On the economy, He said that “even though GDP (gross domestic product) growth has been weaker than certainly pre-crisis rates, it’s been strong enough to allow the unemployment rate to fall further to reach 40-year lows and that in turn has been strong enough to push our wage growth which is momentarily higher since any time since the crisis,”

He added that “we’ve certainly seen stronger figures, not just in the official data but in many of the pay surveys, than we’ve seen for many years.” And, the MPC “always believed that the same old rules applied — that as the labor market tightened you would begin to see faster wage growth, and that’s indeed what we’ve seen.”

Italy Maio: Respecting EU budget limit is suicidal

Italy was requested by the European Commission to submit a new or revised draft budget plan (DBP) by November 13, tomorrow, after rejection. Ahead of that Deputy Prime Minister Luigi Di Maio continued with populist rhetoric and said respecting EU budget limit is suicidal. The Prime Minister’s office also denied that there would be cabinet meeting today. We’ll see what revised plan they’re going to re-submit to the European Commission tomorrow.

Nevertheless, it’s also reported that Economy Minister Giovanni Tria is considering to tweak the plan by lowering 2019 growth forecast. According to Italian coalition government’s own budget, 2019 GDP growth is projected at 1.5%. And, the budget deficit target is 2.4% of GDP. Tria has pledged last week to maintain the “pillars” of the budget. And clearly, the pillars don’t necessarily include growth forecast.

La Repubblica reported that Tria could cut the growth estimate to 1.0%. On the other hand, Il Messaggero said he could cut the forecast to 1.2%. According to European Commission’s own projections, Italy’s growth would be at 1.2% in 2019. Also Tria might also look at automatic mechanism to cut public expenses to keep deficit under the 2.4% cap.

ECB VP de Guindos: Some risks are building up in the financial system

ECB Vice President Luis de Guindos warned in a speech today that while the fundamentals for solid growth rates over the next two years are still in place, some risks are building up in the financial system. The first one is that current US expansion is “now significantly longer than historical norms”. A down turn in the US “could trigger a reassessment of riskier asset classes.”

Secondly, “tensions have grown in emerging market economies: due to strong US Dollar and increased trade frictions. Such developments may “undermine global growth prospects and ultimately lead to abrupt increases in risk premia”.

Thirdly, there were “re-emerging debt sustainability concerns” in Europe, both in public and private sector. And, “Italy is the most prominent case at the moment”. Meanwhile, “strong market reactions to political events have triggered renewed concerns about the sovereign-bank nexus in parts of Europe” But contagion has been “limited” so far.

Bank of France: Q4 GDP to grow 0.4%

Bank of France manufacturing business sentiment indicator dropped to 103 in October, down from 104. The slowdown was “essentially because of a sluggish automobile sector.”

Services business sentiment indicator was unchanged at 102. Construction business sentiment indicator rose to 106, up from 105. “Construction sector activity grew significantly, for both structural and finishing works.”

Bank of France said according to the monthly index of business activity, GDP should grow 0.4% in Q4.

China MOFCOM: US trade friction has limited impact, but 2019 more adverse and complex

The Chinese Ministry of Commerce released Fall 2018 “China Foreign Trade Situation Report” today. In a statement, MOFCOM noted that China’s foreign trade maintained a “stable and good trend” and in 2018 up to Q3. And, the current US-China trade friction has “limited impact” on China’s foreign trade.

MOFCOM also noted that current international demand is “relatively stable”. Domestic demand is “growing steadily”. And conditions exist for steady growth in foreign trade. Nonetheless, with higher base effect, Q4’s import and export growth could be dragged down.

Additionally, MOFCOM also said 2019 trade development will be “more adverse and complex”. It noted increasing downside risks in the world economy and protectionism. The report urged measures like reducing burden on bother import and export businesses, and real implementation of trade policies.

Japan PM Abe to boost infrastructure spending to ensure recovery continues

Japanese Prime Minister Shinzo Abe is pushing for more public infrastructure spending in the upcoming fiscal year. At the Council on Economic and Fiscal Policy (CEFP) meeting today, Abe requested his cabinets to draw out plans with focuses strengthening infrastructure to withstand earthquakes and frequent flooding.

Economy Minister Toshimitsu Motegi said after the CEFP that “the prime minister asked me to take firm measures to ensure that our economic recovery continues.” Motegi added that Abe also said “public works spending program expected at the end of this year should be compiled with this point in mind.”

A preliminary public works plan will be compiled by the end of this month and the final version would be ready by the end of the year.

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1311; (P) 1.1340; (R1) 1.1365; More….

EUR/USD’s accelerates to as low as 1.1240 so far. Break of 1.1300 key support confirms resumption of whole decline trend from 1.2555. Intraday bias stays on the downside for 1.1186 fibonacci level first. Break will target 61.8% projection of 1.2555 to 1.1300 from 1.1814 at 1.1038 next. On the upside, above 1.1330 minor resistance will turn intraday bias neutral first. But recovery should be limited below 1.1499 resistance to bring fall resumption.

In the bigger picture, down trend from 1.2555 medium term top has just resumed and should target 61.8% retracement of 1.0339 (2017 low) to 1.2555 at 1.1186 next. Sustained break there will pave the way to retest 1.0339. On the upside, break of 1.1814 resistance is now needed to confirm medium term bottoming. Otherwise, outlook will stay bearish in case of recovery.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Domestic CGPI Y/Y Oct | 2.90% | 2.80% | 3.00% | |

| 06:00 | JPY | Machine Tool Orders Y/Y Oct P | -1.10% | 2.90% |