With central bank meetings and the US midterm elections out of the way, economic data will return to the forefront next week. Monthly stats on inflation, industrial output, employment and retail sales will dominate the calendar, while GDP numbers out of Japan will be watched for a possible contraction in Q3. Italian politics will also be on investors’ radar over the coming week as the country has until November 13 to submit a redraft of its budget or risk EU fines. OPEC could be making the headlines too as major producers meet on November 11 to discuss possible cuts to crude oil output.

Aussie eyes Australian and Chinese data to maintain upside momentum

The Australian dollar rallied to 6-week highs this week as easing trade tensions, relief from the US midterms and an upbeat RBA lifted the currency. But the aussie could be at risk of a downside correction should next week’s figures disappoint. First up on the watchlist is the NAB business confidence gauge on Tuesday, which will be followed by the Westpac’s consumer sentiment index on Wednesday. However, the more important release on Wednesday will be the quarterly wage price index, plus some Chinese indicators.

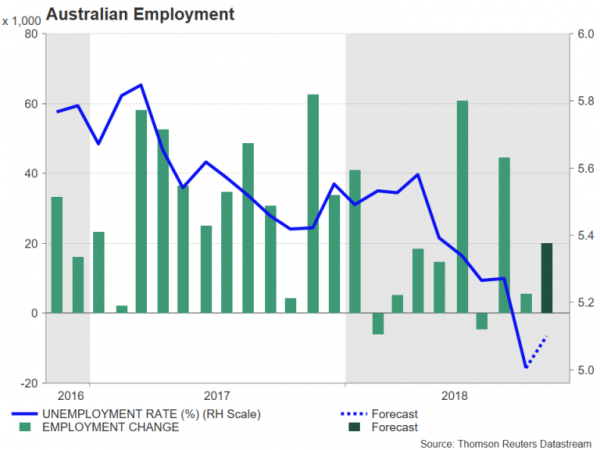

Australian wage growth is forecast to have accelerated slightly in the third quarter, from 2.1% to 2.3% year-on-year. If confirmed, it would support the RBA’s view that wage pressures should start to gather pace as unemployment declines. The latest look on the jobs market will arrive on Friday but before then, investors will be able to sift through China’s monthly reads on industrial output, fixed-asset investment and retail sales.

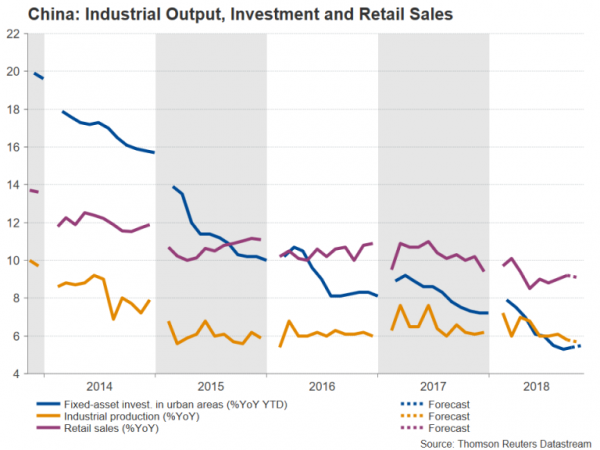

Industrial output growth is expected to slow further in October to 5.7% y/y, after hitting a 2½-year low of 5.8% in the prior month. Investment in urban areas is forecast to quicken marginally from 5.4% to 5.5% y/y in the year-to-date in October. Meanwhile, retail sales growth, which has been on an uptrend after hitting a 15-year low in May, is predicted to ease slightly to 9.1% y/y in October. A worse-than-expected slowdown in these key barometers would be negative for risk sentiment and the aussie, which often acts as a liquid proxy for the Chinese economy due to Australia’s dependence on exports to China.

Lastly for the aussie, employment numbers will be the highlight on Thursday. The Australian economy is forecast to have added 20k jobs in October, picking up from a gain of 5.6k in September. The unemployment rate is expected tick higher, though, to 5.1%, due to an anticipated rise in the participation rate.

Japan’s economy to contract again in Q3

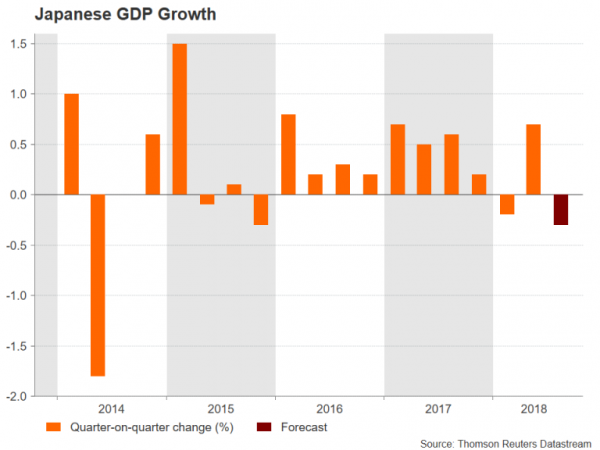

November hasn’t been a very good month for the yen so far (to the likely relief of policymakers). The recent efforts by the US and China to restart a trade dialogue, a dovish Bank of Japan, and drama-less midterm elections have taken the shine off the safe-haven Japanese currency. The yen could face additional selling pressure next week if the GDP figures, due Wednesday, show a negative print. After bouncing back from the first quarter dip by a descent 0.7% quarter-on-quarter rate in the second quarter, Japan’s economy is projected to have shrunk again in the latest quarter. GDP is seen to have declined by 0.3% q/q in the three months to September. A worse reading would further push back the foreseen timing of the BoJ’s exit from its massive stimulus program, as well as add to the deteriorating outlook for world growth in 2019.

Euro unlikely to find much direction from Eurozone indicators

The euro got a helping hand from a softer US dollar earlier this week to briefly recover back above the $1.14 handle. An upward revision to the Eurozone’s final composite PMI for October and some better-than-expected industry data out of Germany also bolstered the single currency. However, next week’s releases could struggle to inject more positive sentiment as it may be too early to anticipate convincing signs of a turnaround in Eurozone growth momentum, not too mention the ongoing standoff between Italy and the EU that’s still weighing on the currency. The European Commission has given Italy until November 13 to submit revised budget proposals, but the coalition government appears unwilling to budge, risking a much more contentious confrontation with the EU.

Tuesday’s German ZEW business survey will probably provide further evidence of the subdued picture. The ZEW economic sentiment index is forecast to fall further in November from -24.7 to -25.0, which would make it a 6-year low. On Wednesday, Eurostat will publish its second estimate of GDP growth for the euro area in the third quarter. Eurozone growth is expected to remain unrevised at 0.2% q/q in Q3, confirming the slowdown from the prior 0.4% rate. Industrial production figures for September are also out on Wednesday, while on Friday, the final estimates of Eurozone inflation for October are due.

Plenty of UK data but pound to remain hostage to Brexit headlines

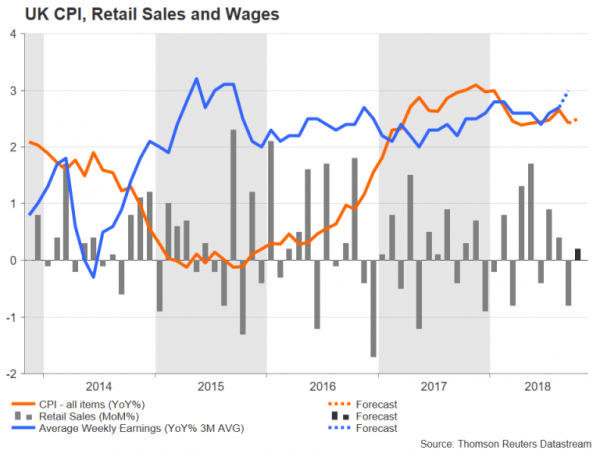

It will be a busy calendar for the UK next week as employment, inflation and retail sales figures are out on Tuesday, Wednesday and Thursday, respectively. The UK labour market is expected to stay near full employment, with the unemployment rate holding at 4% in the three months to September. Total average weekly earnings are forecast to pick up to a three-year high of 3.0% y/y during the period, potentially boosting real incomes.

On Wednesday, the focus will turn to the latest CPI figures. The annual rate of inflation unexpectedly eased to 2.4% in September. It is projected to edge up to 2.5% in October. Core inflation is also expected to head higher, rising to 2.0% y/y.

Finally, retail sales will be monitored closely to assess the strength of consumer spending during October, given that consumption accounts for around two thirds of UK GDP. Retail sales are forecast to have increased by 0.2% month-on-month in October, rebounding only partially from September’s 0.8% drop, and by 2.7% annually.

As British and EU negotiators close in on a Brexit deal, sterling will likely remain ultra-sensitive to any news reports pointing to an agreement or to talks breaking down, with the data probably proving to be of secondary importance once again. The pound rallied to a 3-week high of $1.3174 this week but could struggle to stretch those gains in the absence of fresh positive developments on the Brexit front, even if the data surprise to the upside.

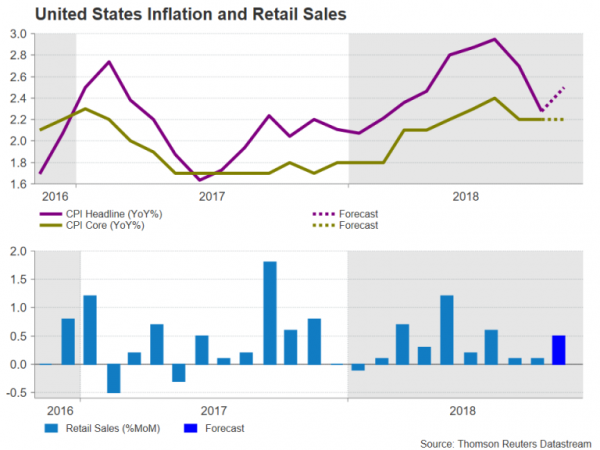

US to also publish inflation and retail sales numbers

It’s looking like a somewhat less exciting time for dollar traders over the next seven days, as markets move past the US midterm elections and the FOMC meeting with not much changed regarding the near-term outlook. There should be enough US economic releases, however, to fill the void, starting with inflation figures on Wednesday.

The 12-month rate of CPI is forecast to inch up by 0.2 percentage points to 2.5% in October, but the core rate is expected to stay unchanged at 2.2%. Import prices for October on Thursday will provide another price gauge for investors, while November manufacturing surveys – the New York Fed’s Empire State manufacturing index and the Philly Fed manufacturing index – will also be eyed. A bigger attraction on Thursday, though, will be retail sales numbers, which are likely to have the biggest impact on the dollar. October retail sales are forecast to point to a solid start to the fourth quarter, increasing by 0.5% m/m, which would be an improvement on the previous 0.1% rate. On Friday, the main release to watch will be industrial production figures for October.

Aside from the data, central bankers will also be hitting the headlines next week as Fed officials return to the public arena after this week’s policy meeting. The highlight will be Fed Chairman Jerome Powell’s appearance on Wednesday, who will participate in a panel discussion at a Dallas Fed event.