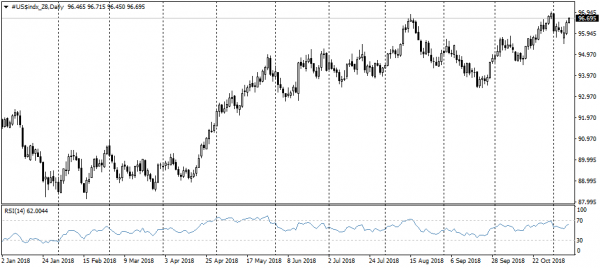

The US dollar has turned to growth this week following its previous decline in uncertainty. First of all, the risks of unpleasant surprises due to the elections are now gone and the results were close to predictions. Often, subsequent to elections, the currency and stock market of the country experiences some upswing, which was also evident this time, since key American indices added more than 2%.

Despite a small decline immediately after the announcement of the election results, the U.S. dollar has turned to growth, adding 1.2% to the Wednesday lows.

The growth wave of the dollar on Thursday supported the Fed. Keeping the policy unchanged, the U.S. Central Bank called the economy “strong” and highlighted the need to maintain its course to gradual rates hiking. Regarding the comments relating to the decision, there was only one cautions moment, about slowing business investments. Such approach has caused yield growth for short-term government bonds that support demand for a dollar as a more yielded currency.

The increase in the dollar due to higher interest rates usually has a negative impact on the demand for developing country currencies and commodities. This week we saw a decrease there, despite the growing demand for risks at American exchanges

It won’t be surprising to witness the development of this trend soon, as the events with the greatest potential risks for the dollar (Employment report, Elections, FOMC decision) are already behind.

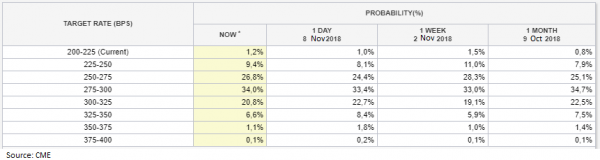

At the same time, it is worth mentioning that over the past month the markets have become less believing that the Fed will produce more than three increases in rates next year. Latest data from CME’s FedWatch tool indicate that investors are considering a 27.8% chance to see more than three hikes, against 31.5% a month earlier.

Empowering of this trend could undermine the dollar belief over the long-term perspective.