Here are the latest developments in global markets:

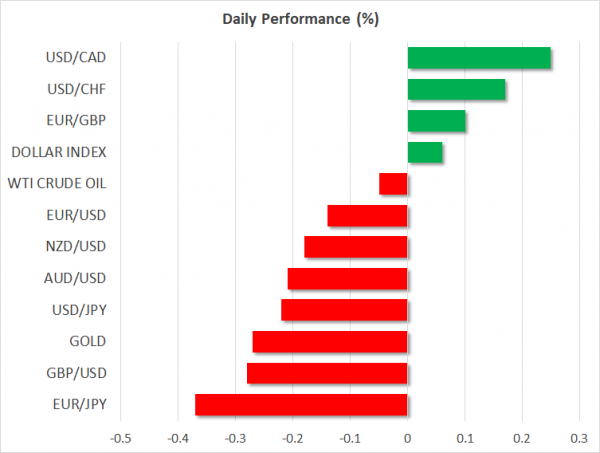

FOREX: The dollar is little changed against a basket of six major currencies on Friday (+0.06%), consolidating the gains it recorded in the previous session as the Fed signaled it remains on track to meet its rate-path projections. Meanwhile, the defensive yen is outperforming, as risk appetite seems to have soured once again. In Canada, the loonie continued to track oil prices lower, touching a fresh two-month low against the dollar.

STOCKS: Wall Street closed lower for the most part on Thursday, as the Fed maintained a relatively confident tone, keeping a December rate hike firmly on the table and providing no hints that trade or other risks will delay its normalization efforts. The result was US bond yields remaining at elevated levels, taking the wind out of the sails of equity investors. The Nasdaq Composite (-0.53%) and S&P 500 (-0.25%) both edged lower, though the Dow Jones managed to eke out a 0.04% gain. Futures tracking the Dow, S&P, and Nasdaq 100 are all pointing to a lower open today as well. Asia was a sea of red on Friday, with Japan’s Nikkei 225 (-1.05%) and Topix (-0.49%) posting moderate losses compared to the Hang Seng in Hong Kong (-2.41%). Similarly, all the major European indices were set to open lower today, futures suggest.

COMMODITIES: Oil continued its downfall amid lingering concerns the market may be shifting towards oversupply again, in light of the US waivers on Iranian sanctions and the soaring production domestically in the US. The demand side hasn’t been any brighter, with global growth slowing and US-China trade tensions adding another dimension to risks. The only bright spot that may stem the decline is that OPEC is flirting with cutting its output again, though speculation around this hasn’t caught much wind yet. In precious metals, gold is down by another 0.27% on Friday at $1,220 per ounce, extending losses from yesterday and looking set to record a sixth day of losses in a row. The near-term outlook is still neutral, though a break back below the $1,212 barrier and the 100-day moving average could turn it negative.

Major movers: Dollar extends gains as FOMC sticks to script

As widely anticipated, the Fed kept rates unchanged yesterday, with the statement accompanying the decision containing few changes from previously. The Committee acknowledged the unemployment rate has declined further and noted household spending continued to grow strongly, but also that business investment moderated somewhat. The absence of concrete policy updates probably enhanced the narrative that policymakers remain committed to raising rates again in December and another 3 times next year, in line with their “dot plot” projections – which are more hawkish than current market pricing. Accordingly, the dollar gained in the aftermath.

In other words, the fact that officials refrained from sounding a note of caution with respect to trade risks or the recent market volatility likely gave the bulls the “green light” to re-enter long-dollar positions. Overall, the message from the Fed was consistent; it remains dedicated to raising rates in a gradual manner amid a fiscally-turbocharged US economy, and the current risks are not enough to derail, or even delay, this normalization process. Euro/dollar fell notably to settle near 1.1340, from around 1.1400 ahead of the decision.

In the broader market, the heightened appetite for risk assets that was evident after the US midterms proved short-lived, with US stock indices closing mostly lower yesterday and markets in Asia flashing red today. Consequently, the defensive yen has attracted some inflows, and looks set to recover some of its latest losses. The catalyst may have been the “confident” tone by the Fed, which assisted in keeping longer-term US Treasury yields at elevated levels, likely reviving some jitters around rising interest rates.

Elsewhere, the loonie touched a two-month low versus the greenback earlier today. The Canadian currency has taken a beating alongside oil prices in recent weeks. News overnight that the widely-touted Keystone oil pipeline has been blocked by a US Federal court likely amplified the negative sentiment. It was expected to connect Canada and Texas, to eliminate transportation bottlenecks.

Day ahead: UK GDP in focus; US PPI and U of M survey also due

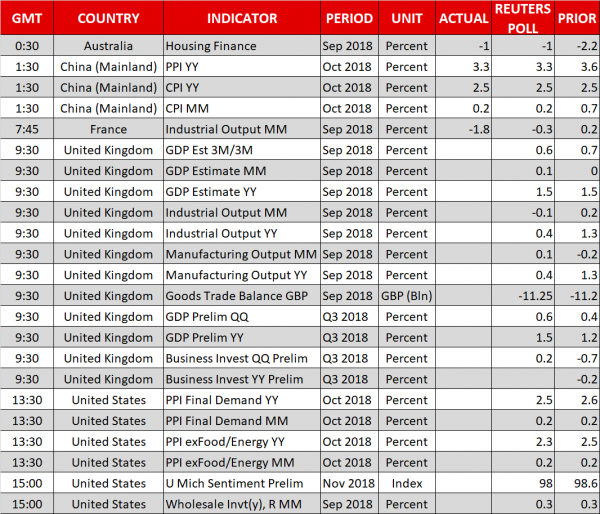

Friday’s calendar features quarterly GDP figures out of the UK, while the US will be on the receiving end of producer price data, as well as the University of Michigan’s (U of M) survey on consumer sentiment.

At 0930 GMT, preliminary UK GDP data for Q3 will be made public. The economy is forecast to have accelerated relative to Q2, growing by 0.6% q/q (vs 0.4% previously). The annual pace of growth is projected to stand at 1.5% (vs 1.2% in Q2). While Brexit developments have been acting as the primary driver of sterling pairs, the numbers are significant and deviations from expectations are likely to give some near-term direction to the pound.

Monthly GDP prints for September will also be released out of the nation at 0930 GMT, with the readings on Q3 business investments, September’s trade balance, and industrial & manufacturing output for the same month also slated for release at the same time. Manufacturing production is predicted to expand by 0.1% m/m, after contracting by 0.2% in August.

Out of the US, October factory inflation as gauged by the producer price index (PPI) will be hitting the markets at 1330 GMT. Both headline and core PPI – the latter excludes volatile food and energy items – are anticipated to slightly ease on a yearly basis relative to September. Traders may use these numbers to speculate on how next week’s (Wednesday) CPI data come out, though it should be stressed that the two measures – PPI and CPI – are far from perfectly correlated.

Also out of the world’s largest economy is the U of M’s preliminary survey gauging consumer morale during November. The relevant index is projected to weaken, though at 98.0 still remain at relatively elevated levels. The survey’s sub-indexes measuring inflation expectations have proved market-moving in the past and will thus also be attracting attention. The readings are due at 1500 GMT, alongside September’s wholesale inventory data.

Elsewhere, the EU’s warnings over Italy’s budget deficit are keeping investors’ eyes on a potential clash between Italian and EU officials. Such an outcome is expected to prove euro-negative, at least in the short term.

The ECB’s Coeure will be talking at 1000 GMT, with Bank of England chief economist Haldane making a public appearance at 1830 GMT. Numerous Fed policymakers are also on the agenda, specifically Williams (permanent FOMC voting member – 1330 GMT), Harker (non-voter – 1345 GMT) and Quarles (permanent voter – 1405 GMT).

In energy markets, Baker Hughes data on active oil rigs in the US are due at 1800 GMT.

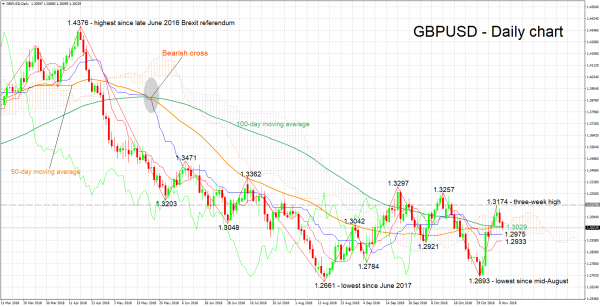

Technical Analysis: GBPUSD looks mostly neutral in short term

GBPUSD has retreated from the three-week high of 1.3174 hit earlier in the week. The Tenkan- and Kijun-sen lines are negatively aligned, though they have both flatlined, overall pointing to a mostly neutral short-term picture for the pair.

Stronger-than-projected GDP growth out of the UK is likely to boost the pair. Initial resistance to gains may occur around 1.3055, the Ichimoku cloud top. Further above and given a break of the 1.31 handle, Wednesday’s three-week high of 1.3174 would come back into view.

In the event of a more decisive move below the 50- and 100-day moving average lines at 1.3029 (the two have converged) coming on the back of downbeat numbers out of the UK, support could occur from the zone around the Kijun-sen. The region around this also includes the 1.30 mark and the Ichimoku cloud bottom. Steeper losses would turn the attention to the Tenkan-sen at 1.2933; the area around this captures a previous bottom at 1.2921. Lower still, early September’s trough of 1.2784 would increasingly come within scope.

Brexit headlines and US data out on Friday can also move the pair.