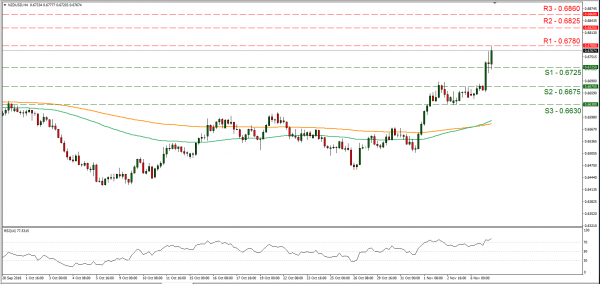

RBNZ is to release its interest rate decision in the American session (20:00, GMT) today and is widely expected to remain on hold at +1.75%. Currently NZD OIS imply a probability of 98.45% for the bank to remain on hold and the bank’s past guidance also supports such a notion. Market focus could turn to the accompanying statement and following press conference (21:00, GMT), if RBNZ keeps interest rates at the same level. The recent acceleration of the inflation rate for Q3, along with one of the lowest unemployment rates in a number of years, could provide arguments for the existence of more hawkish elements in the accompanying statement. We could see the Kiwi strengthening ahead of RBNZ’s interest rate decision, as expectations were boosted by yesterday’s release of the employment data for Q3 and as the RBNZ has a dual mandate for inflation and unemployment.

NZD/USD rallied yesterday and during today’s Asian session by breaking the 0.6675 (S2), the 0.6725 (S1) resistance levels (now turned to support) and tested the 0.6780 (R1) resistance line. We could see the pair continuing to trade in a bullish market ahead of RBNZ’s interest rate decision, however it should be noted that the RSI indicator in the 4 hour chart has surpassed the reading of 70, implying a rather overcrowded long position. Should the pair find fresh buying orders along its path we could see it breaking the 0.6780 (R1) resistance line and aim for the 0.6825 (R2) resistance hurdle. Should it on the other hand, come under the selling interest of the market, we could see it breaking the 0.6725 (S1) support line and aim for the 0.6675 (S2) support barrier.

Choppy trading for USD upon results of midterms

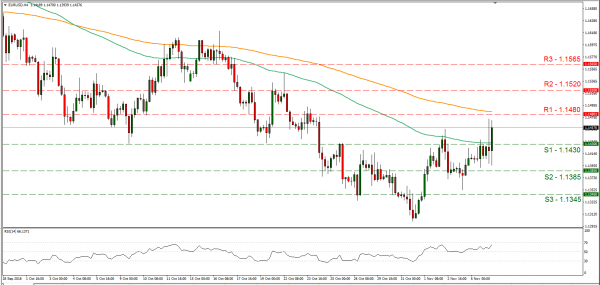

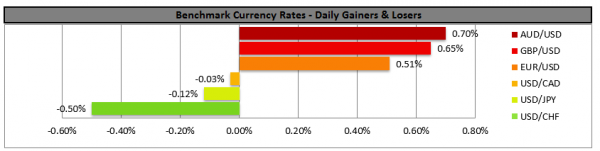

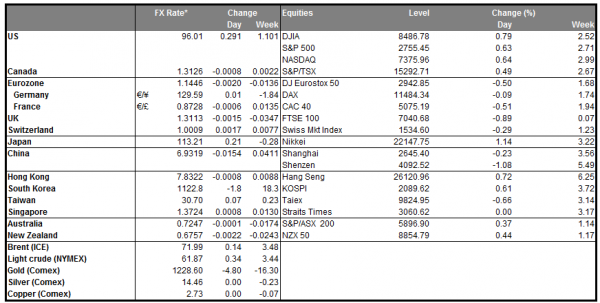

The USD experienced some choppy trading against the EUR and the JPY yesterday as the early results of the midterms pointed to a gridlock in the US Congress. The Democrats are expected to win majority in the House of Representatives while the Republicans seem to keep the seat majority in the Senate. Analysts point out that if Congress is split, it will be difficult for new policies of the US President to pass in order to boost the economy and such a scenario, could prove negative for the US Dollar. Volatility for USD pairs is expected to continue in the aftermath of the elections and ahead of the FOMC interest rate decision on Thursday.

EUR/USD rose during the Asian session, clearly breaking the 1.1430 (S1) resistance line (now turned to support).We could see the pair continuing to trade in a bullish market as the financial releases could favour it, while the aftermath of the US midterm elections may weaken the USD somewhat further. Should the pair’s direction be dictated by the bulls, we could see it breaking the 1.1480 (R1) resistance line and aim for the 1.1520 (R2) resistance level. Should the bears take over, we could see it breaking the 1.1430 (S1) support line and aim for the 1.1385 (S2) support zone.

In today’s other economic highlights:

In the European session today we get Germany’s industrial output growth rate for September, UK’s Halifax house price growth rate for October and Eurozone’s retail sales growth rate for September. In the American session, Canada’s Ivey PMI for October and from the US the EIA weekly crude oil inventories figure will be released. Please be advised that the ECB will be holding a non-monetary meeting today and some comments for Italy’s budget could slip out.

NZD/USD H4

Support: 0.0.6725 (S1), 0.6675 (S2), 0.6630 (S3)

Resistance: 0.6780 (R1), 0.6825 (R2), 0.6860 (R3)

EUR/USD 4H

Support: 1.1430 (S1), 1.1385 (S2), 1.1345 (S3)

Resistance: 1.1480 (R1), 1.1520 (R2), 1.1565 (R3)