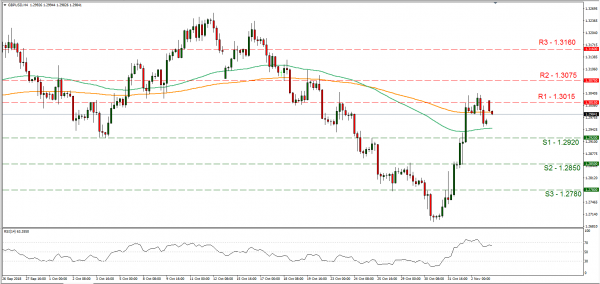

Cable opened with a positive gap on Monday morning as hopes for an orderly Brexit continued to grow. Sunday Times, reported that an all-UK customs deal is in the works between the UK and the EU. The report stated that UK PM Theresa May secured concessions from the EU to keep all of UK territories in a customs union, hence avoiding a hard border in Northern Ireland. Analysts point out that what we are seeing could be only a taste of what is to come should there be a deal between the EU and the UK about Brexit. Volatility is expected to continue for the pound as Brexit headlines could continue to reel in.

Cable opened with a positive gap of around 20 pips, on Monday surpassing briefly the 1.3015 (R1) resistance line, only to correct lower later on. The pair shows signs of stabilisation for now, however today’s financial releases as well as any Brexit headlines could move the pair. If the pair finds fresh buying orders along its path we could see it breaking the 1.3015 (R1) resistance line and aim for the 1.3075 (R2) resistance level. Should the pair come under the market’s selling interest, we could see it breaking the 1.2920 (S1) support line and aim for lower grounds.

USD strengthens on US employment report

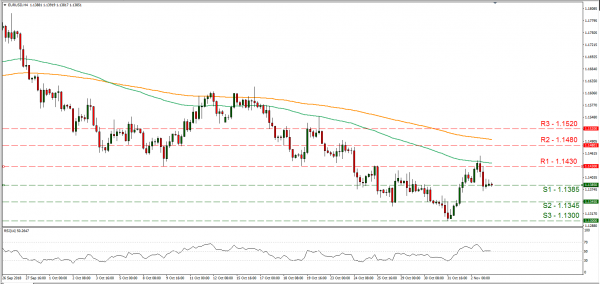

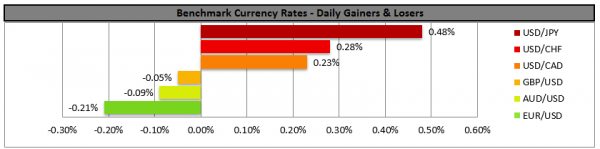

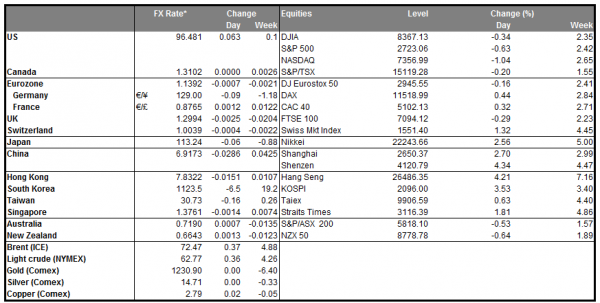

US Employment data for October released on Friday, supported the strengthening of the USD as it showed a tight labour market. Analysts consider that the dollar strength is to return as investors could be shifting attention to a tighter US monetary policy. Analysts also point out the risk factor of the Fed being more hawkish than expected. On the other hand, the USD’s role as a safe haven could be undermined by a softening in the US-Sino confrontation.

EUR/USD dropped on Friday testing the 1.1385 (S1) support line. The pair also showed some signs of stabilisation in the Asian session today. The pair may prove sensitive to the financial releases today, as well as any further headlines regarding the US-Sino trade war and the Eurogroup meeting today. Should the bulls dictate the pair’s direction we could see it breaking the 1.1430 (R1) resistance line. Should on the other hand, the bears take over the pair’s direction we could see it breaking the 1.1385 (S1) support line and aim, if not break the 1.1345 (S2) support barrier.

In today’s other economic highlights:

In the European session today, we get from Turkey the CPI rate for October and UK’s Services PMI for October. In the American session we get the US ISM Non-Manufacturing PMI for October. Please note that today, a Eurogroup meeting will take place and BoC governor Poloz speaks.

As for the rest of the week:

On Tuesday, we get RBA’s interest rate decision, Germany’s industrial orders for September, New Zealand’s employment data for Q3 and in the US the midterm elections will take place. On Wednesday, we get Germany’s industrial output for September, Eurozone’s retail sales for September, Canada’s Ivey PMI for October and RBNZ’s interest rate decision. On Thursday, we get China’s trade balance figure for October, Germany’s trade balance figure for September and FOMC’s interest rate decision. On Thursday, we get China’s trade balance figure for October, Germany’s trade balance figure for September and FOMC’s interest rate decision.

GBP/USD H4

Support: 1.2920(S1), 1.2850 (S2), 1.2780 (S3)

Resistance: 1.3015 (R1), 1.3075 (R2), 1.3160 (R3)

EUR/USD 4H

Support: 1.1385 (S1), 1.1345 (S2), 1.1300 (S3)

Resistance: 1.1430 (R1), 1.1480 (R2), 1.1520 (R3)