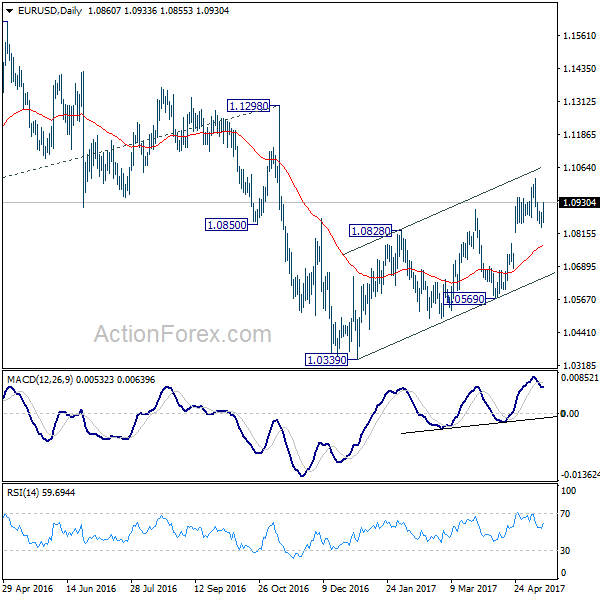

EUR/USD dipped to 1.0838 last week but rebounded strongly since then. Initial bias is neutral this week first. Overall, near term outlook is unchanged. Choppy rise from 1.0339 is seen as a corrective move. Bearish divergence condition in 4 hour MACD suggests short term topping at 1.1020 already. Hence, we’d favoring another fall. Break of 1.0838 will turn bias to the downside for 55 day EMA (now at 1.0770). Break there will argue that the corrective rise from 1.0339 is completed and target 1.0569 support for confirmation. Break of 1.1020 will extend the rise but we’ll look for reversal signal again.

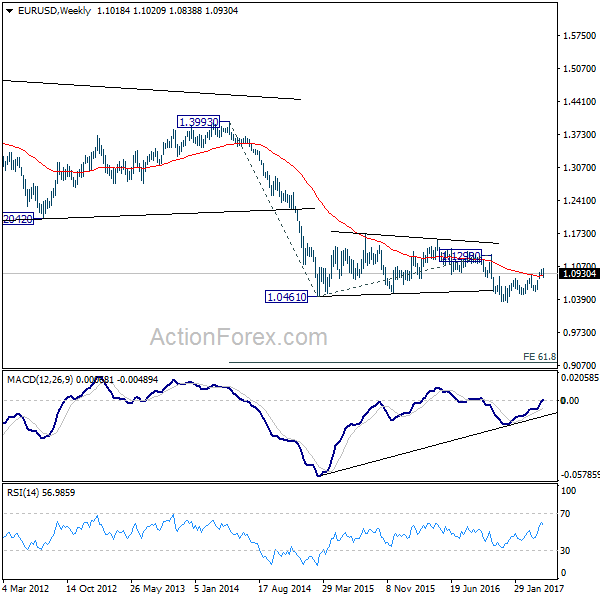

In the bigger picture, as long as 1.1298 key resistance holds, whole down trend from 1.6039 (2008 high) is still expected to continue. Break of 1.0339 low will send EUR/USD through parity to 61.8% projection of 1.3993 to 1.0461 from 1.1298 at 0.9115. However, considering bullish convergence condition in weekly MACD, break of 1.1298 will indicate long term reversal.

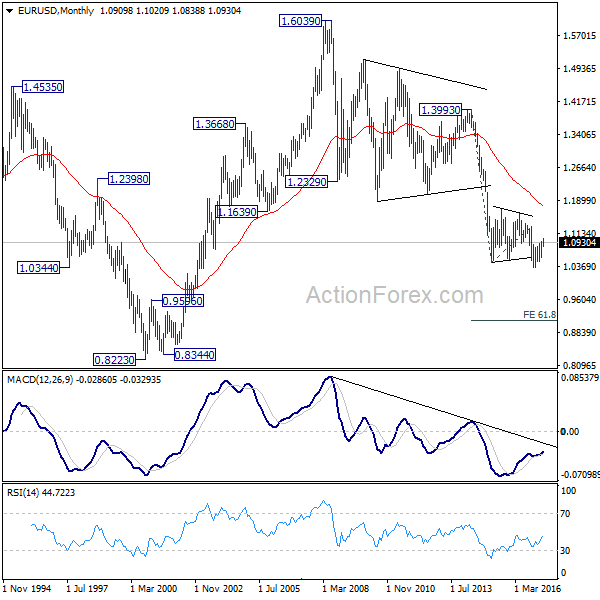

In the long term picture, the down trend from 1.6039 (2008 high) is still in progress and there is no clear sign of completion. We’d expect more downside towards 0.8223 (2000 low) as long as 1.1298 resistance holds. However, firm break of 1.1298 should now confirm long term reversal.