Key Highlights

- The US Dollar traded higher towards the 113.40 level recently against the Japanese Yen.

- There was a break above a declining channel with resistance at 112.40 on the 4-hours chart of USD/JPY.

- The US Initial Jobless Claims for the week ending Oct 27, 2018 declined from 216K to 214K.

- Today, the US nonfarm payrolls figure for Oct 2018 will be released, which is forecasted to rise from 134K to 190K.

USDJPY Technical Analysis

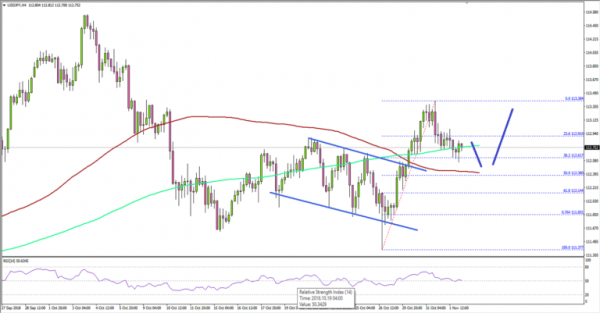

The US Dollar formed a decent support around the 111.35-40 zone and recovered recently against the Japanese Yen. The USD/JPY pair traded above the 112.00 and 112.60 resistance levels to move into a positive zone.

Looking at the 4-hours chart, the pair traded with a bullish bias and broke the 112.80 resistance as well along with the 100 simple moving average (4-hours).

More importantly, there was a break above a declining channel with resistance at 112.40 on the same chart. The pair traded towards the 113.35-40 zone and formed a high at 113.38. Later, the pair started a downside correction and traded below 113.00.

There was a break below the 23.6% Fib retracement level of the last wave from the 111.37 low to 113.38 high. However, there is a strong support formed near the 112.40 level and the 100 SMA.

Moreover, the 50% Fib retracement level of the last wave from the 111.37 low to 113.38 high is at 112.38. Therefore, if the pair declines further, it could find support near the 112.35-40 zone. On the upside, an initial resistance is near 113.35, above which the pair could rise towards 113.80.

Fundamentally, the US Initial Jobless Claims figure for the week ending Oct 27, 2018 was released by the US Department of Labor. The market was looking for a decline from the last reading of 215K to 213K.

The actual result was neutral as there was a decline from the last revised reading of 216K to 214K, similar to the 2K decline forecast. The report added:

The 4-week moving average was 213,750, an increase of 1,750 from the previous week’s revised average. The previous week’s average was revised up by 250 from 211,750 to 212,000.

Recently, EUR/USD recovered from lows and GBP/USD moved above the 1.2850 resistance. However, the next move depends on today’s nonfarm payrolls release in the US for Oct 2018.

Economic Releases to Watch Today

- Germany’s Manufacturing PMI for Oct 2018 – Forecast 52.3, versus 52.3 previous.

- Euro Zone Manufacturing PMI Oct 2018 – Forecast 52.1, versus 52.1 previous.

- UK Construction PMI for Oct 2018 – Forecast 55.0, versus 52.1 previous.

- US nonfarm payrolls Oct 2018 – Forecast 190K, versus 134K previous.

- US Unemployment Rate Oct 2018 – Forecast 3.7%, versus 3.7% previous.

- Canada’s employment Change Oct 2018 – Forecast 10K, versus 63.3K previous.

- Canada’s Unemployment Rate Oct 2018 – Forecast 5.9%, versus 5.9% previous.