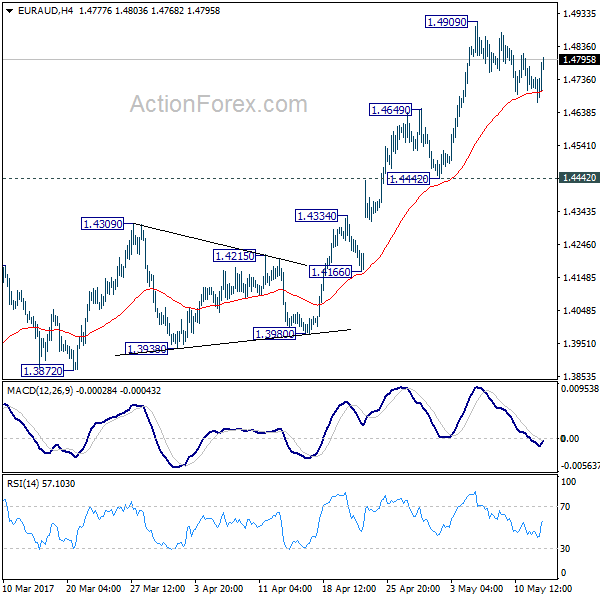

EUR/AUD stayed in consolidation below 1.4909 last week and recent rebound lost momentum. But overall outlook is unchanged. That is, whole correction from 1.6587 has completed at 1.3624 already after defending 1.3671 key support level. Further rise is expected to next fibonacci level at 1.5455 after consolidation completes.

Initial bias in EUR/AUD remains neutral this week first. Consolidation from 1.4909 could extend and deeper retreat cannot be ruled out. But downside should be contained by 1.4442/4649 support to bring rise resumption. Above 1.4909 will extend recent rally from 1.3624 to next medium term fibonacci level at 1.5455.

In the bigger picture, price actions from 1.6587 medium term top are viewed as a corrective pattern. Such correction should be completed after defending 1.3671 key support. Rise from 1.3642 is now expected to target 61.8% retracement of 1.6587 to 1.3624 at 1.5455 and above. In any case, outlook will now stay cautiously bullish as long as 1.4309 resistance turned support holds.

In the longer term picture, the rise from 1.1602 long term bottom isn’t over yet. We’ll keep monitoring the development but there is prospect of extending the rise to 61.8% retracement of 2.1127 to 1.1602 at 1.7488 and above. However, sustained trading below 1.3671 should confirm trend reversal and target 1.1602 long term bottom again.