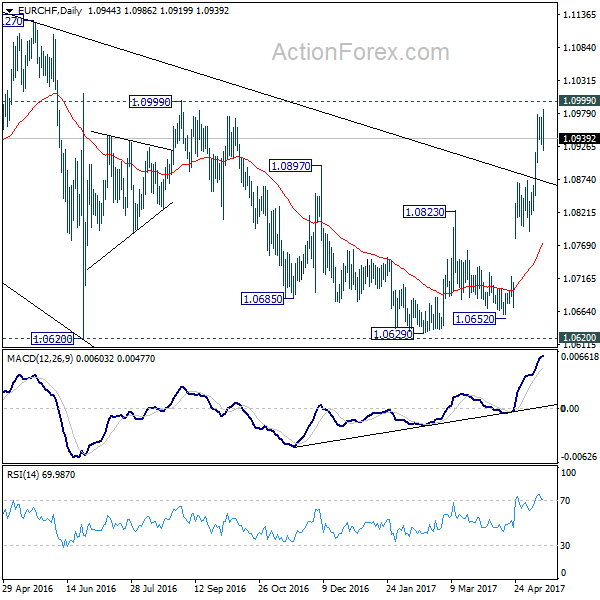

EUR/CHF’s strong rally last week affirmed our view of trend reversal. That is, corrective pattern from 1.1198 has completed already after defending 1.0653 fibonacci level. Nonetheless, as the cross lost momentum ahead of 1.0999 resistance, we’d expect some more consolidation in near term before another rally.

Initial bias in EUR/CHF stays neutral this week for consolidation. Deeper pull back could be seen but downside is expected to be contained by 1.0791/0872 support zone to bring rise resumption. As noted before, the consolidative pattern from 1.1198 should be completed. Firm break of 1.0999 resistance will pave the way for a retest on 1.1198 high.

In the bigger picture, the price actions from 1.1198 are seen as a corrective move. Current strong rebound is raising the chance that it’s completed after defending 38.2% retracement of 0.9771 to 1.1198 at 1.0653. Decisive break of 1.0999 resistance will target a test on 1.1198 high. For now, this will be the preferred case as long as 1.0791 support holds.