Monday October 29: Five things the markets are talking about

Euro equities are small better bid, ignoring Asia’s mixed market overnight and slightly weaker U.S futures on concerns about corporate earnings and global growth.

U.S Treasuries remain well supported as a majority of the market rein in their expectations for tighter Fed policy. The EUR is steady despite Germany’s governing coalition falling to its worst regional election results in decades.

The ‘big’ dollar has found some support while gold prices ease. Oil trades below $68 a barrel as the market assesse “mixed supply signals.”

It’s a busy week on the data front. Two central banks – Bank of Japan (BoJ) and Bank of England (BoE) – meet and neither are expected to make any changes to their monetary policy.

Elsewhere, France, Italy and the Eurozone release flash estimates of Q3 GDP, while down-under, Australia reports Q3 consumer and producer price indexes.

In North America, the final U.S jobs report before the November mid-term elections is delivered on Friday along with Canada’s employment data.

1. Stocks mixed results

In Japan, stocks slipped overnight as further weakness in Chinese equities diminished investor sentiment, although some bargain hunting limited losses. The Nikkei ended the session down -0.16%, after posting their biggest weekly loss in more than eight-months, while the broader Topix was down -0.4%.

Down-under, Aussie shares outperformed, ending a six-session run lower, with gains across each sector of the market. Despite the S&P/ASX 200 climbing +1.1% overnight, the index is still on track for a loss of more than -7% this month. In S. Korea, the Kospi stock index fell -1.5% overnight, extending its decline into a fifth consecutive session and hitting its lowest in almost 23-months, on continued selling by foreign and local investors.

In China, stocks again saw red as weak profits for industrial and consumer firms added to concerns over a slowing economy. Another negative session highlights the markets doubt over the effectiveness of Beijing’s attempts to stabilize its own equity markets. The blue-chip CSI300 index closed -3.0% lower, while the Shanghai Composite Index ended down -2.2%. In Hong Kong, the Hang Seng closed up +0.38%.

In Europe, regional bourses trade higher across the board starting the week on a positive note.

U.S stocks are set to open in the ‘black’ (+0.3%).

Indices: Stoxx600 +0.9% at 355.6, FTSE +1.3% at 7030, DAX +1.1% at 11324, CAC-40 +0.3% at 4980, IBEX-35 +1.1% at 8826, FTSE MIB +2.2% at 19102, SMI +1.4% at 8790, S&P 500 Futures +0.3%

2. Oil prices fall as markets worry about trade slowdown, gold lower

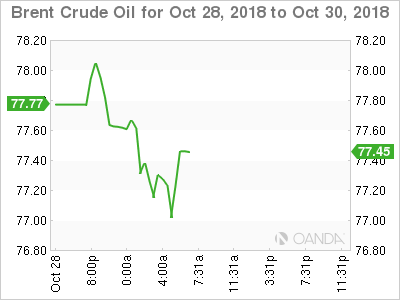

Oil prices have eased overnight amid a cautious market sentiment, coupled with a stronger U.S dollar underscores concerns that growth may be slowing, especially in Asia’s emerging economies.

Brent crude oil futures are trading down -46c, or -0.6%, at +$77.16 a barrel, while U.S West Texas Intermediate (WTI) crude futures are at +$67.19 a barrel, down -40 cents, or -0.6%.

CFTC data on Friday showed hedge funds slashed their “bullish” bets on U.S crude to the lowest level in more than a year – they cut their combined futures and options position in New York and London by -42,644 contracts to +216,733 in the week to Oct. 23.

There are also signs of a slowdown in global trade, with rates for dry-bulk and container ships – which carry most raw materials and manufactured goods – coming under pressure.

On the supply side, oil markets remain tense ahead of forthcoming U.S sanctions against Iran’s crude exports, which are set to start on Nov. 4 and are expected to tighten supply, especially to Asia, which takes most of Iran’s shipments.

According to Baker Hughes data last Friday, in North America there is no oil shortage. Production is set to rise further as U.S drillers added two oil rigs in the week to Oct. 26, bringing the total count to +875, the highest level since March 2015.

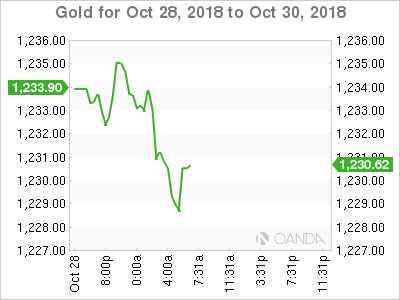

Ahead of the U.S open, gold prices have eased a tad, inching away from its three-month high print in Friday’s session, pressured as the ‘big’ dollar firms. Spot gold is down -0.1% at +$1,232.54 an ounce – on Friday, it touched its highest since July 17 at +$1,243.32. It climbed +0.6% last week in its fourth straight weekly gain, its longest such streak since January. U.S gold futures are down -0.1% at +$1,234.70 an ounce.

3. S&P ratings relief lifts Italy’s bond market

Italy’s 10-year BTP bond yield has fallen to a one-week low this morning, narrowing the gap to the German Bund, on relief that ratings agency Standard & Poor’s left the country’s credit rating unchanged.

Note: On Friday, S&P left Italy’s rating at BBB, two notches above junk, but lowered its outlook to negative from stable, saying that the “new government’s policy plans were weighing on the country’s growth and debt prospects.”

Yields along the Italian curve are down -6 to -16 bps – 10-year BTP are at +3.33%, while the BTP/Bund spread is at +299 bps from +306.

Elsewhere, the yield on U.S 10’s has eased -1 bps to +3.06%, the lowest in almost a month. In Germany, the 10-year Bund yield has increased less than +1 bps to +0.36%, the biggest increase in more than a week, while in the U.K, the 10-year Gilt yield has fallen -1 bps to +1.372%, hitting the lowest in two-months with its sixth straight decline.

4. U.S dollar stands tall

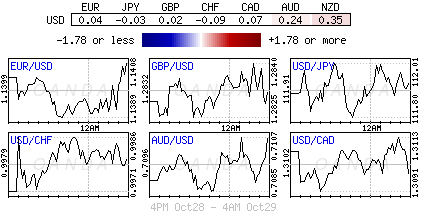

The ‘big’ dollar trades atop of its 10-week high against G7 currency pairs as concerns about global growth perseveres.

The safe haven yen (¥112.16) has benefited from the global sell-off in riskier assets as the market unwound its ‘carry’ trade exposures. Last week it gained +0.6% outright, this morning, with a stronger USD, its down -0.2%. The market will be watching the BoJ’s monetary policy announcement, due on Wednesday for short-term guidance.

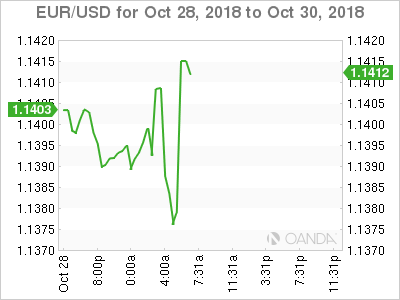

EUR (€1.1389) is trading atop its two-month low outright. Investors have seen some relief after German Chancellor Merkel’s junior coalition partners gave her conservatives until next year to deliver more policy results. However, there are concerns over her future after both parties suffered in a regional election on the weekend.

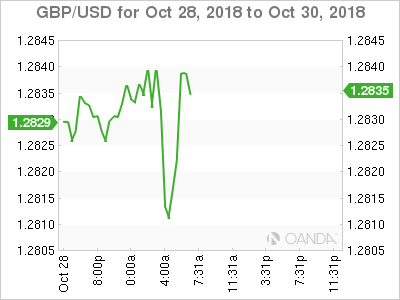

Sterling (£1.2821) is trading near its two-month low of £1.2775 before today’s annual budget presentation. Finance Minister Philip Hammond is likely to urge his Conservative Party to back the government’s plan for Brexit, or put at risk a long-awaited easing of austerity.

5. Chancellor Merkel may not run for re-election of CDU

In Germany yesterday, in the central state election in Hesse, it was another test for the Germany’s coalition partners.

Merkel’s Christian Democrats (CDU) came home first in Sunday’s election, but support fell and the disappointing outcome will certainly undermine her coalition, as well as her own political standing.

The ruling CDU lost -11.3% and SPD lost -10.9%, while the Green Party and AfD meanwhile gained +8.5% and +9.0% compared to the previous state election in 2013.

In the end, the old regional coalition of CDU and Green Party is likely to remain in office. But, despite the status quo, the CDU and SPD party leaders are under pressure, and the risk that the coalition will break up and that Germany will face new elections odd’s are now higher.