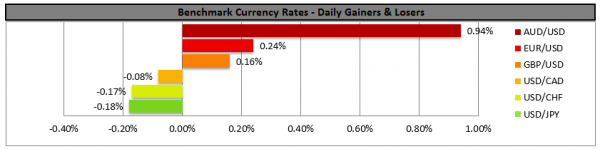

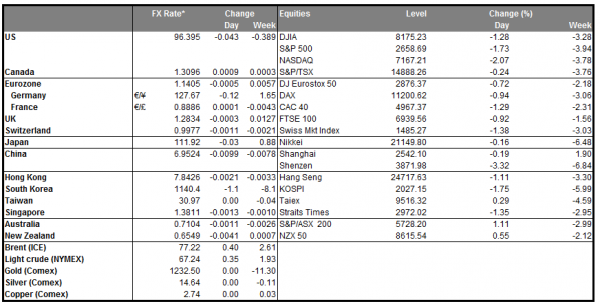

The greenback weakened against its major counterparts on a low US GDP growth rate on Friday, however the drop remained contained. On other news concerns seem to continue in the stock market especially about the earnings to be announced. Trade wars, rising wages and higher borrowing costs seem to be taking their toll slowly on the US economy. Currently, the USD could continue to serve as a safe haven and the Fed’s hawkish policy to strengthen it. As new developments are expected in the US-Sino relationships, volatility could rise for the USD.

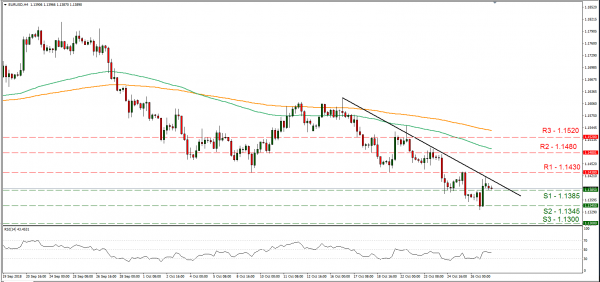

EUR/USD rose slightly on Friday after some choppy trading breaking the 1.1385 (S1) resistance line, now turned to support. The pair seems to continue to trade in a bearish market as its price action remains below the downward trendline, incepted since the 16th of October. Should the bears continue to dictate the pair’s direction, we could see the pair breaking the 1.1385 (S1) support line and aim for the 1.1345 (S2) support barrier. On the other hand if the bulls have the upper hand, we could see the pair breaking the 1.1430 (R1) resistance line.

UK Budget, dependent on Brexit developments

UK’s Chancellor of the Exchequers, Philip Hammond is due to give a speech in parliament, about the UK budget. The budget, should be terminating a 10 year austerity period of the government, however much of it may depend on Brexit developments. Mr. Hammond had stated that the UK would have to look at a different strategy and a new budget to set out a different strategy for the future. Today’s speech could provide further volatility for the UK pound.

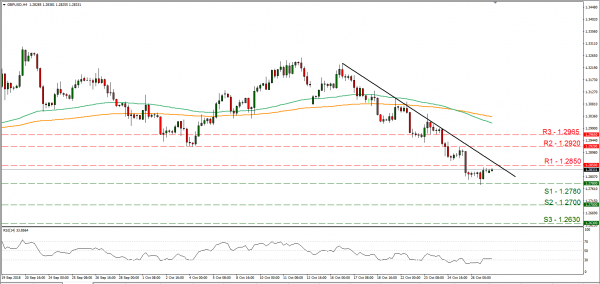

GBP/USD moved in a sideways motion on Friday, below the 1.2850 (R1) resistance line. We retain our bearish bias and for our opinion to change in favour of a sideways movement we would require a clear breaking of the downward trendline incepted since the 16th of October. Should the pair come under the market’s selling interest, we could see it breaking the 1.2780 (S1) support line and aim for the 1.2700 (S2) support zone. Should the market favour the pair’s long positions, we could see the pair breaking the prementioned downward trendline, the 1.2850 (R1) resistance line and aim for the 1.2920 (R2) resistance hurdle.

In today’s other economic highlights:

In the American session we get the US Personal consumption growth rate for September and the US Core PCE prices growth rate for September. Don’t forget that UK’s Finance minister Philip Hammond is to deliver the autumn budget statement.

As for the rest of the week:

On Tuesday, we get Eurozone’s preliminary GDP growth rate for Q3 and Germany’s preliminary HICP rate for October. On Wednesday, we get Australia’s CPI rate for Q3, China’s Manufacturing PMI for October, BoJ’s interest rate decision, France’s and Eurozone’s preliminary HICP rates for October and Canada’s GDP growth rate for August. On Thursday, we get BoE’s interest rate decision and the US ISM manufacturing PMI for October. On Friday, Australia’s Retail sales growth rate for September, the US Employment report for October as well as Canada’s unemployment data for October.

EUR/USD H4

Support: 1.1385 (S1), 1.1345 (S2), 1.1300 (S3)

Resistance: 1.1430 (R1), 1.1480 (R2), 1.1520 (R3)

GBP/USD 4H

Support: 1.2780 (S1), 1.2700 (S2), 1.2630 (S3)

Resistance: 1.2850 (R1), 1.2920 (R2), 1.2965 (R3)