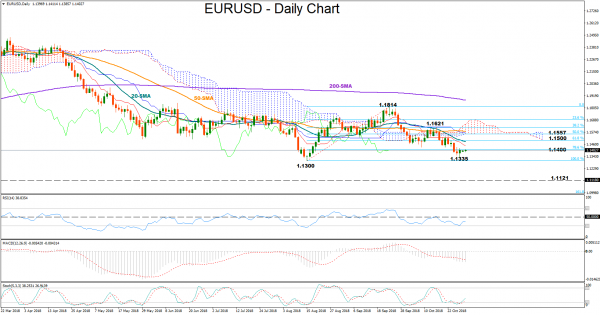

EURUSD unlocked fresh two-month lows at 1.1335 on Friday and is currently struggling to overcome the 1.1400 level. The RSI and the MACD though suggest that negative risks remain high in the short-term as the former is weakening below its 50 neutral mark while the latter continues to hold in negative zone and below its red signal line. Yet, in the very short-term upside corrections are not unlikely as the stochastics reverse higher after the bullish rebound in the overbought area (below 20).

Should the price move south, traders would be interested to see whether the price can bridge the 1.1335 trough with scope to revisit the 1.130 bottom, which is the lowest level reached since July 2017. A significant decline below the latter would probably push the price towards 1.1120 where the price found support several times during 2016, while prior to that, bears need to break the 1.1200 psychological mark.

On the alternative scenario, if the price gains momentum to the upside, resistance is expected to come at 1.1500, the 61.8% Fibonacci of the upleg from 1.1300 to 1.1814. Slightly above, the 50% Fibonacci of 1.1557 may be of greater importance given that the bottom of the Ichimoku cloud is also placed around that area and hence any decisive rally above that level could signal additional gains in the coming sessions. However, traders might wait for a close above the previous high of 1.1621 for a confirmation.

Turning to the medium-term picture, the pair is neutral as long as the 1.1300-1.1814 range is active.

To sum up, EURUSD maintains bearish bias in the short-term, while in the medium-term the outlook is neutral.